Six things to know before buying a VHIS plan

There is a wide variety of medical insurance products in Hong Kong with many similarities and differences, yet some VHIS plan features are not found in traditional plans. Learn more and be a smart consumer.

The law of insurance: Buy early and be worry-freeInsurance companies set underwriting requirements based on an applicant’s age, smoking habits, health and medical history. Generally speaking, younger and healthier applicants pay lower premiums. If an application is made only after a health problem has appeared, premiums may increase, exclusions may be added to the plan or the application may be turned down altogether. Approval and plan renewal are also subject to age restrictions. Parents should apply for VHIS plans for their kids as early as possible. Since children have lower resistance to disease, they are more likely to become ill and require hospitalisation. For parents, a VHIS plan would lighten any potential financial burden. |

|

Waiting periodSome medical insurance plans include a waiting period, i.e., the period (usually 30 days after the application is approved) during which the insurance company will not reimburse the life insured’s medical expenses. Assuming you’re currently healthy, the earlier you apply, the lower your chances of becoming ill during the waiting period and and not being eligible for reimbursement. With HSBC VHIS plans, there is no waiting period, which means the life insured is protected immediately. |

|

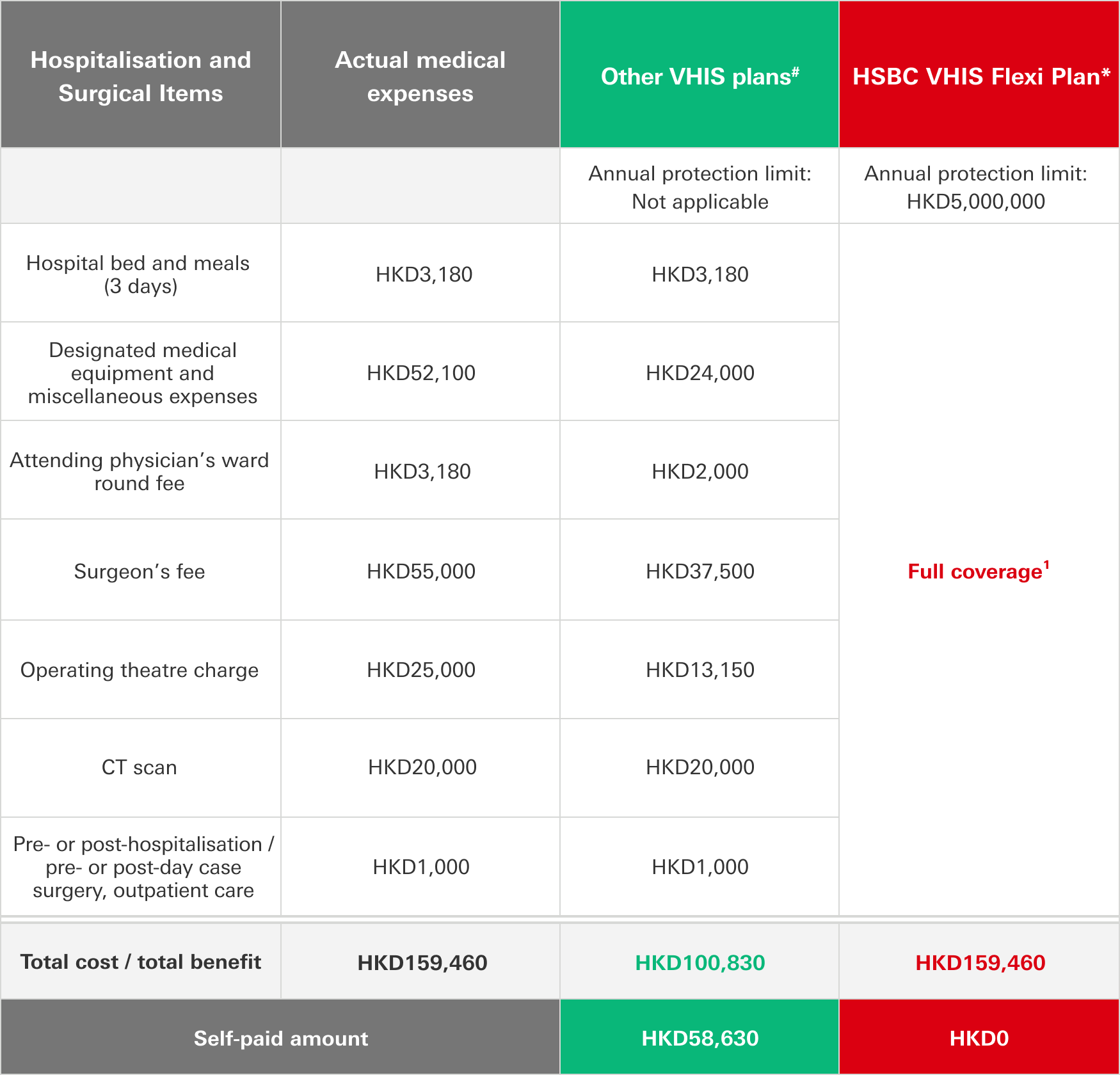

Full coverage1 for medical sub-itemsSome VHIS plans have itemised sub-limits. For your reference, the comparisons below illustrate the differences between a plan with itemised sub-limits and one offering full coverage1. Assumption: A 30-year-old male has a cardiovascular blockage during the term of a medical plan and requires bypass surgery plus a 3-day hospital stay.

*Example based on HSBC Life Flexi Plan – Bronze. Monthly premium around HKD 682. From these comparisons, it is clear that a full coverage1 plan provides more comprehensive protection. In fact, the planholder will not have to pay extra even when faced with major medical expenses, which makes it much easier to stay within one’s budget. |

|

Tax DeductionWhat sets a VHIS plan apart from other medical insurance products is its tax deduction eligibility. Taxpayers can buy VHIS plans for themselves and their family members. In addition to being entitled to medical reimbursements, they can also apply for a tax deduction of HKD 8,000 per life insured, per year. And there’s no limit to how many plans they can purchase. |

|

Unknown pre-existing conditions – Covered!A VHIS plan covers unknown pre-existing conditions, i.e., medical conditions the plan buyer is not aware of at the time of applying or which have not shown obvious signs or symptoms. |

|

Geographic coverage – Global vs Hong KongPatients battling a serious illness may consider going overseas for treatment. Further, people who plan to emigrate or those who have children who may study aboard also need to consider the regions covered by their plans. With some VHIS products, even the lowest-tiered plans cover the Greater China Area. The typical top-tiered plan even offers global coverage2, which gives the life insured many more options when considering where to receive treatment. Medical insurance is a risk-transfer tool. Through a medical plan, the insurance company undertakes to share the responsibility for the life insured’s medical expenses, thus giving the latter more medication and treatment options. |

There is a wide variety of VHIS products on the market. As long as you know the differences, then take time to shop and compare; you’re sure to find a comprehensive protection plan that meets your needs and budget.

- Full coverage shall mean the actual amount of eligible expenses and other expenses charged and payable in accordance to the terms and benefits of HSBC VHIS Flexi Plan.

- Global coverage may subject to the product launched by different insurance companies. For details, please refer to the Terms and Conditions of the respective plan.