VHIS insights – Tax Season

Filling in your tax return form is not always easy, but if you do it right, you could enjoy tax savings. The annual premium for each VHIS policy is good for up to HKD8,000 in taxable income deduction per person per year. There are just a few things to keep in mind when you’re applying for tax deduction.

Policies for family members are tax-deductible

Unlimited number of life insureds and policies

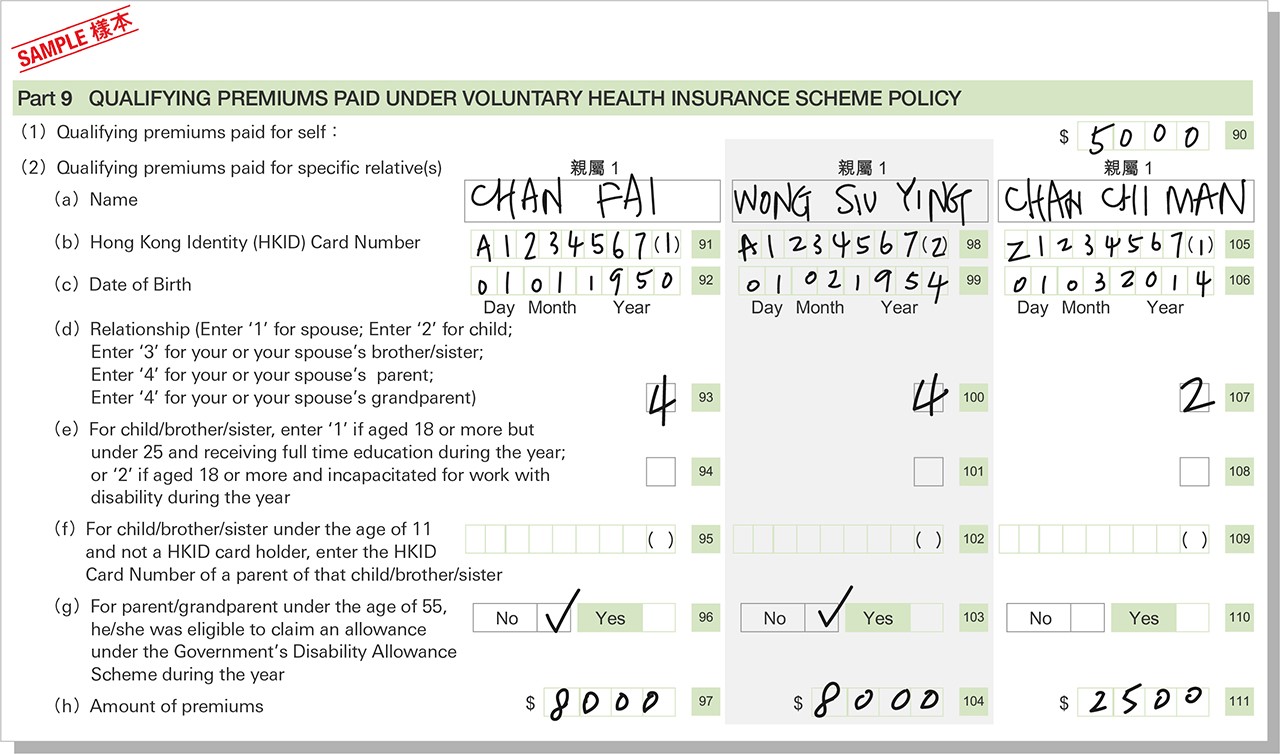

When you’re filling in the VHIS premium amounts in Section 9 of the tax return form, remember that there’s no limit to the number of family members and policies supported by you. The tax-deductible premium amount, however, is subject to a maximum of HKD8,000 per life insured per tax assessment year. Designated family members can include the taxpayer’s spouse and children, and the paternal and maternal grandparents, parents and siblings of the taxpayer and their spouse. A tax deduction quota of up to HKD8,000 applies to each of these family members. So the more eligible family members you purchase VHIS policies for, the more you’ll be able to claim for tax deduction.

A reminder: only the policyholder can claim the tax-deductible amount but not the life insured of the VHIS policy (unless they are the same person). In other words, different taxpayers who have purchased a VHIS policy for the same family member can each apply for a tax deduction of up to HKD8,000. Check out the following examples to see how it works.

Example 1: Single man

Jasper holds a VHIS policy, for which he pays an annual premium of HKD12,000. Since this exceeds the upper limit, the tax-deductible amount he is eligible to claim HKD8,000.

|

Annual premium paid: HKD12,000 |

Exceeds upper limit of HKD8,000 |

Total tax deduction claimable: HKD8,000 |

Example 2: Married woman, supporting her parents-in-law and a son

Lenny is the policyholder of 4 VHIS policies, with herself, her father-in-law, mother-in-law and son as the life insured respectively. The annual premiums she pays are HKD5,000, HKD16,000, HKD12,000 and HKD2,500 respectively. That means the premiums for two of her policies exceed the HKD8,000 limit.

|

Annual premium paid:

HKD5,000  |

Does not exceed the limit of HKD8,000 |

Tax deduction claimable: HKD5,000 |

|

Annual premium paid:

HKD16,000  |

Exceeds the limit of HKD8,000 |

Tax deduction claimable: HKD8,000 |

|

|

Annual premium paid:

HKD12,000  |

Tax deduction claimable: HKD8,000 |

||

|

Annual premium paid:

HKD2,500  |

Does not exceed the limit of HKD8,000 |

Tax deduction claimable: HKD2,500 |

The total tax-deductible amount Lenny can claim is thus: HKD5,000 + HKD8,000 + HKD8,000 + HKD2,500 = HKD23,500

Below is a sample tax return form for your reference

*Reference: Section 9 of Tax Return - Individuals

Example 3: Each sibling purchasing VHIS policies for their mother

Cammy has bought 2 VHIS policies for her mother, for which she pays annual premiums of HKD4,000 and HKD6,000 respectively. Since the total has gone over the limit, she can only claim a tax deductible amount of HKD8,000.

|

Annual premium paid:

HKD10,000  |

Exceeds the limit of HKD8,000 |

Tax deduction claimable: HKD8,000 |

At the same time, her brother Joseph has also bought a VHIS policy for his mother, paying an annual premium of HKD6,000. Since this premium amount is below the limit, Joseph can claim the full HKD6,000 tax-deductible amount.

|

Annual premium paid:

HKD6,000  |

Does not exceed the limit of HKD8,000 |

Tax deduction claimable: HKD6,000 |

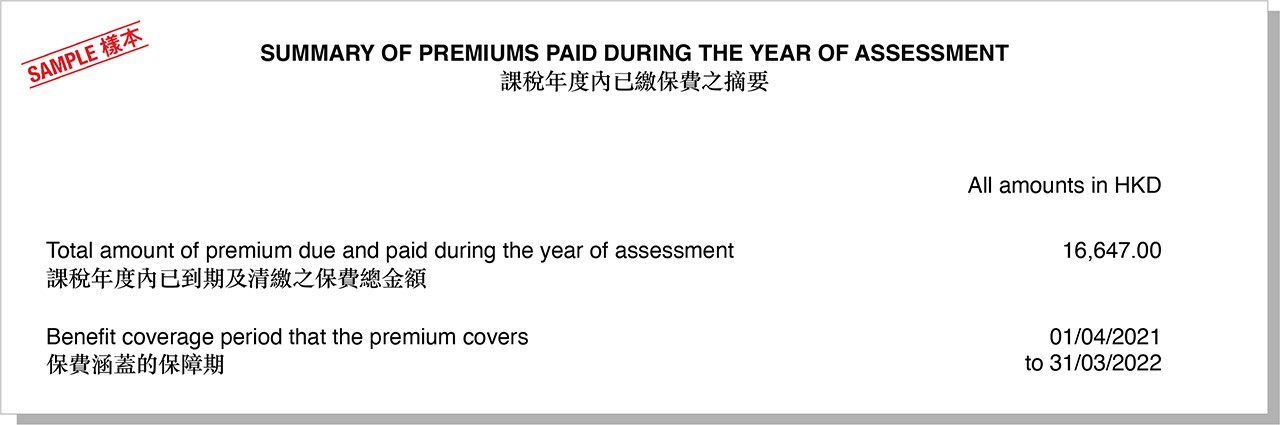

Where do I find information about the premiums I’ve paid?

You’ll find what you need to complete your tax return form in the Summary of Premiums Paid for the Current Tax Assessment Year or other related documents. Keep this information at hand when you’re doing your tax return to save yourself the trouble of doing all that adding and subtracting.

Should I keep the documents?

Even though you don’t have to include your annual VHIS summary with your completed tax return form, it is advisable to keep it for 6 years for possible selected reviews by the Inland Revenue Department.

The Hong Kong SAR government introduced a trio of tax-saving schemes. In addition to eligible VHIS policies, certified Qualifying Deferred Annuity Plans and Tax-deductible Voluntary Contributions plans will also allow you to avail yourself of potential tax benefits.

Sources:

- VHIS tax deduction: https://www.vhis.gov.hk/en/consumer_corner/tax-deduction.html

- Tax Deduction for Qualifying Premiums Paid under the Voluntary Health Insurance Scheme (VHIS) Policy: https://www.gov.hk/en/residents/taxes/salaries/allowances/deductions/vhis.htm

- How much tax can you save with VHIS? https://www.ifec.org.hk/web/en/financial-products/insurance/product-types/vhis/tax-savings-vhis.page

- Completion and Filing of Tax Return - Individuals: https://www.ird.gov.hk/eng/tax/ind_ctr.htm

- [Tax return 2021] Handy guide to tax return and tax deduction https://wealth.hket.com/article/2960206/【報稅2021】報稅、扣稅攻略懶人包