Premium financing decoded

You probably know what “premiums” are, and have a working knowledge of the concept of “financing”. But what is “premium financing”? When do you need it? What is it for?

Premium financing – Concept

Generally speaking, there are two types of life insurance: pure protection products1 (seldom used as security), and protection products offering value appreciation and cash value1.

Through premium financing, you purchase a life policy offering value appreciation and cash value by taking out a bank loan2. The bank loan is used to pay part of the premiums, and typically, your newly acquired life insurance policy is then assigned to the bank as security. Different banks, though, support different arrangements.

The requirements for premium financing vary according to the insurance company and bank. Some banks only approve applications for loan amounts that range several hundred thousand to several million HK dollars. The concept of premium financing, therefore, can be one of the useful tools for middle-class or high net worth individuals.

There are three parties involved in a premium financing arrangement: the policyholder, the insurance company and the lending bank:

A life insurance policy is a product underwritten by an insurance company, while premium financing is a loan service provided by a bank. Insurance companies do not provide premium financing services themselves; however, certain policy terms and provisions may allow some insurance companies that have a working relationship with a bank to consider accepting customers’ life insurance policies as security for premium financing.

| Note: | Whether the rights under a policy can be transferred to a lending bank depends on how advantageous the terms, conditions and policies governing such transferal are to the bank. Before policy rights can be transferred as security, the insurance company may require the policyholder to obtain the written agreement of policy’s irrevocable beneficiary regarding any such arrangement. |

Why premium financing?

|

The relationship between interest rates and borrowing costs Since life insurance policies offering value appreciation and cash value typically include annual dividends and a surrender value, they are considered by some banks to have value as security. In a market environment where interest rates are relatively low, the interest cost3 of a bank loan will be lower and more attractive. For customers who can afford to bare the interest payment, lower interest rates thus often become the key motivation for using their insurance policies as security in a premium financing arrangement. |

|

Increased flexibility Premium financing provides more flexibility when it comes to paying premiums. As the policyholder, you’d be able to maintain better cash flow, thus minimising the need to liquidate your assets to fund premium payments. |

|

Enhancing cash flow for added flexibility and control Using premium financing to cover premium payments frees up your own cash reserves. You can thus divert your surplus cash flow to other uses, such as making business investments or paying for your children’s education. |

What are the things to keep in mind4?

|

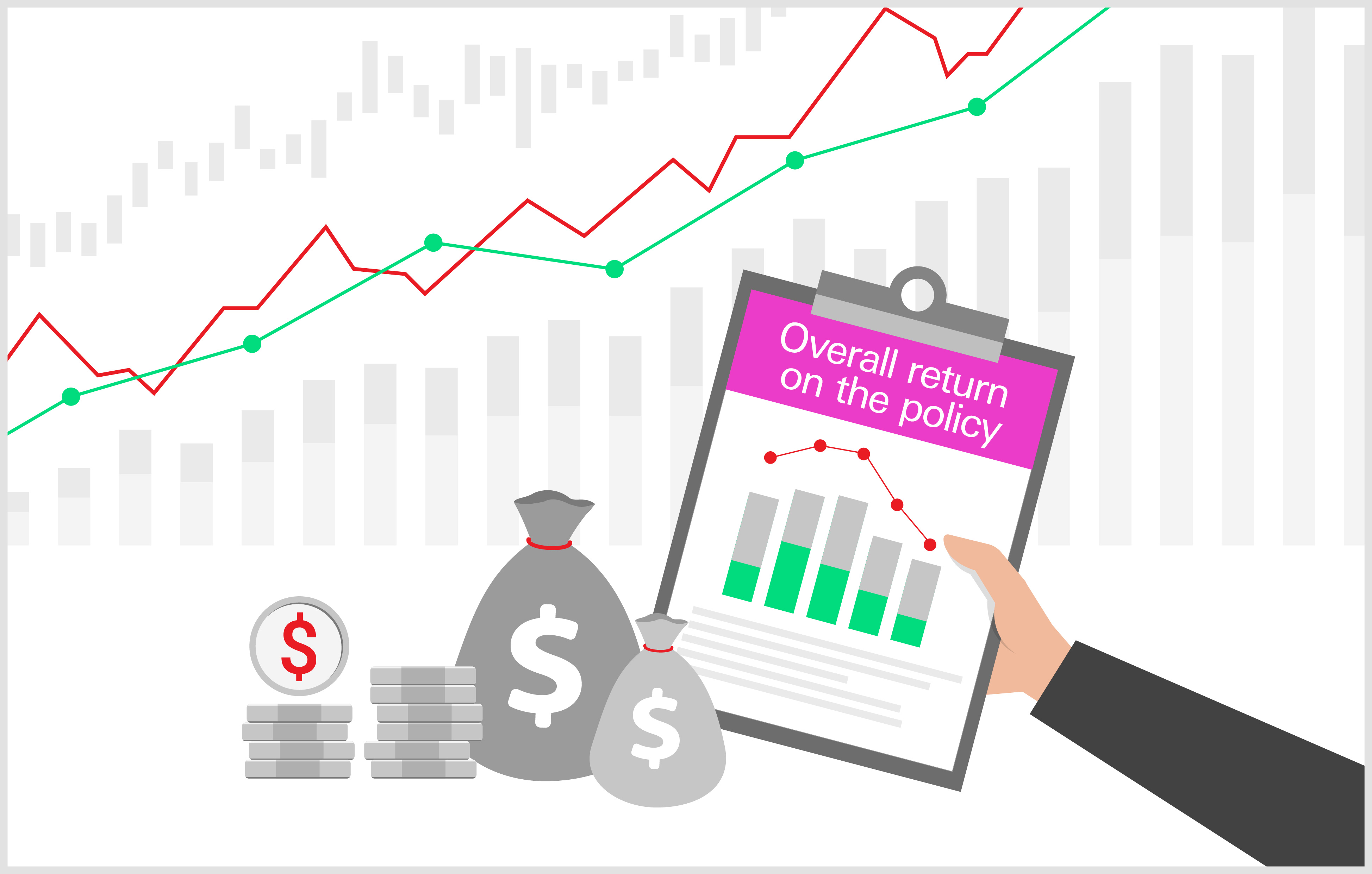

Changes in interest rates The interest rate for a premium financing loan is not fixed, and can rise or fall in response to market movements. A significant increase in this interest rate would be accompanied by a corresponding hike in the interest you have to pay. If the loan’s interest rate exceeds the policy’s interest rate, the overall return on the policy could suffer or even be cancelled out. |

|

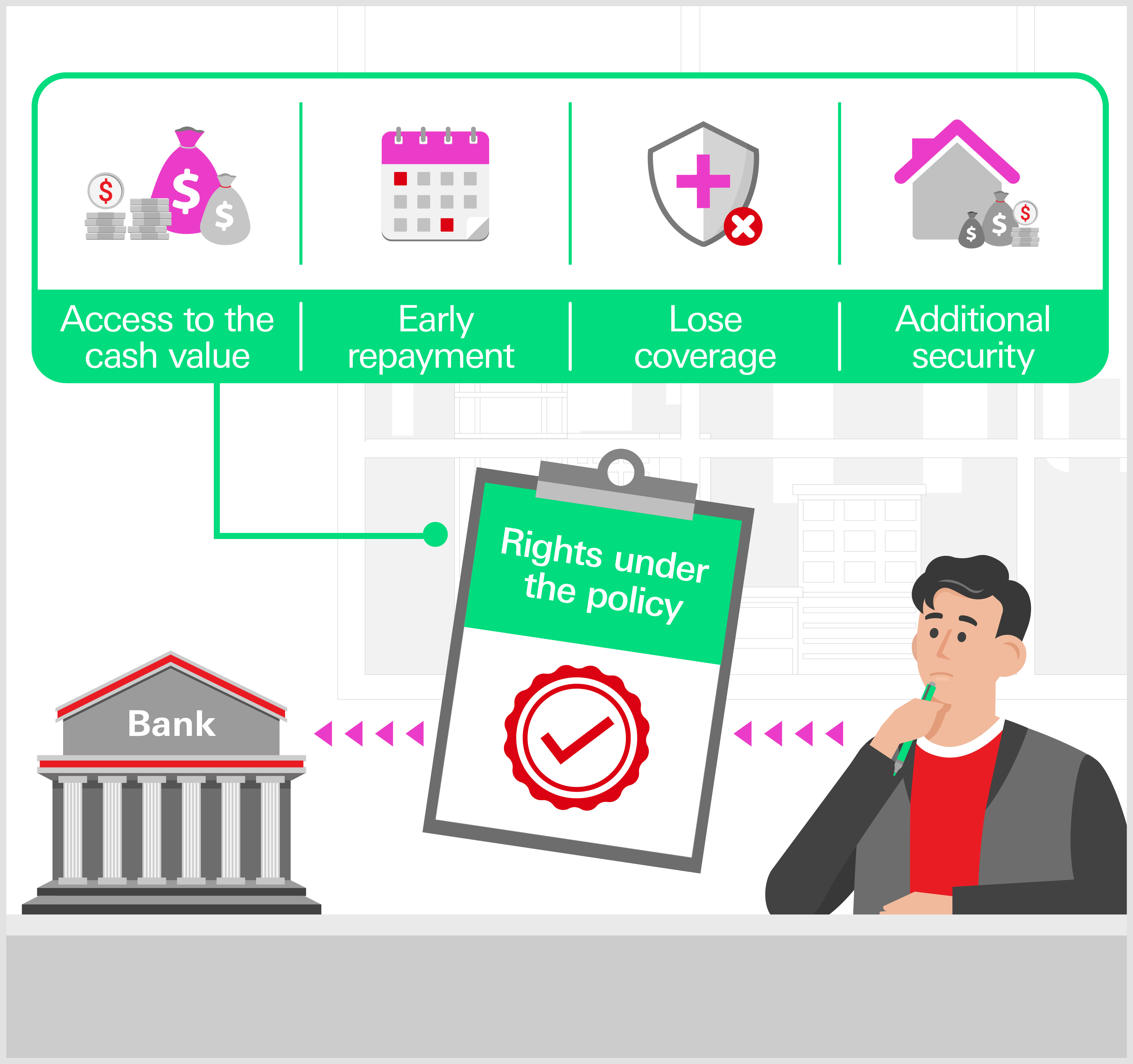

Policy rights after assignment In a premium financing arrangement, you are in effect consenting to the transfer of the rights under the policy to the lending bank, which would have a major effect on your rights as the original policyholder. Whether you or the bank have priority access to the policy’s cash value or death benefit in the event of the death of the life insured will in large part be determined by the amount of the outstanding loan balance. When the loan principal exceeds a certain percentage of the policy’s cash value, the bank can demand early repayment of part of the loan as a way to lower the proportion of the loan principal balance. If you are unable to do so, the bank has the right to surrender your policy and use the surrender value to settle the balance on your loan. In this scenario, you would lose your coverage and other rights under the policy. Some banks might also require you to provide additional security. |

To borrow or not to borrow?

Borrow only if you can repay!

Before applying for premium financing, consider the questions below:

- What are you purchasing the insurance for?

- Is the policy you’re applying for suited to premium financing?

- Have you talked to your insurance and wealth management consultants about your protection needs, financial status and risk exposure?

- Do you really need to pay your insurance premiums with a bank loan?

- Are you willing to give the bank priority access to the rights under the policy?

- Is the market in a cash-rich, low-interest phase right now?

- Do you have to mobilise other assets to fund the purchase of the policy?

- Is the loan’s interest rate lower than the policy’s guaranteed interest rate?

- Can you afford to make the interest payments incurred as a result of premium financing?

- Do you know that, under a premium financing agreement, the policy’s death benefit will first be used to repay the bank loan, thus reducing the benefit payable to the life insured’s benefit?

Premium financing is not for everyone. Whether you’re looking to provide your family with sufficient protection or use the policy as a legacy planning tool, buying insurance through a premium financing arrangement can give your funds added mobility and help you realise your protection and wealth goals. But it also involves borrowing, incurring interest payments, losing your rights under the policy and other risks. So before you decide to apply for premium financing, be sure to assess your financial needs and stay up-to-date on market conditions to ensure it will bring you the intended benefits.

- Pure protection insurance products, such as term life insurance policies, do not offer value appreciation or withdrawable cash value. There are, however, many insurance products on the market designed to provide value appreciation, including annuity plans, universal life insurance plans, whole life insurance plans, etc.

- To borrow or not to borrow? Borrow only if you can repay!

- Loan interest rates are affected by the supply and demand of currencies, and could rise significantly due to prevailing market conditions. Banks can also adjust loan interest rates at their discretion.

- In addition to interest rate movements and changes in ownership rights after a policy has been reassigned, you should also pay particular attention to the following in considering whether premium financing is suited to your needs:

- Collateral top-up risk - If the value of the loan reaches or exceeds a certain percentage of the cash value of the Policy (as determined by the relevant policy provisions), you will be required to reduce the loan principal through early repayment within the time period specified by any notice or call made by the bank to that effect. Failure to do so will result in the bank surrendering the policy to repay the outstanding loan balance, with any remaining amount (if any) to be paid to you. You will also lose the life insurance coverage and other benefits under the Policy.

- Loan repayment default risk - If any repayment of monthly interest is overdue (not made within the time period specified by the bank), or the repayment of the total outstanding loan balance is not made within the specified time period after the expiry of the loan tenor, the bank may proactively surrender your Policy, which will result in your loss of life insurance coverage and other benefits under the Policy.

- Loan recall risk – The lending bank reserves the right to review a loan or the maximum limit of an Insurance Premium Financing amount annually or from time to time, and may at any time request full repayment of the loan without advance notice. Failure to meet such a demand may result in the surrender of the Policy by the bank to pay off the outstanding loan balance.

Examples of a situation that may trigger such request(s) include but are not limited to: - the maximum Loan-To-Value ratio is exceeded (e.g. a decrease in the cash value of the Policy or a decrease in the required Loan-To-Value ratio);

- default of payment under the Insurance Premium Financing agreement;

- an adverse change in the credit rating or default of the Policy Issuer.

- Loss of insurance coverage risk - If you pass away during the Insurance Premium Financing loan period, the death benefit amount will be used to repay any outstanding loan balance before the remaining amount, if any, is paid to your beneficiary(ies). The beneficiary(ies) may not receive any money if no amount remains.

- Exchange rate risk - Exchange rate exposure arises when your income or assets are in a currency other than the Loan currency -- USD. If your income or assets are not in USD, you are required to convert them into USD for settlement of the loan principal and interests. Exchange controls imposed by the relevant authorities may apply to certain currencies (e.g. RMB), the exchange rates of which may be adversely affected as a result. Such currencies may not be freely convertible.

- Counterparty risk – The lending bank has the right to review the amount of loan advanced to you and/or the Loan-to-Value ratio and request immediate settlement of part or all of the outstanding loan amount and interest if the bank has any reason to doubt the financial standing or credibility of the Policy Issuer, which may be caused by a number of factors including a downgrade of the Policy Issuer’s credit rating, its insolvency or default on its obligations. The deterioration of the creditworthiness of the Policy Issuer and its inability to make payments under the Policy will not affect or discharge you from your responsibility to repay in full the loan and accrued interest to the bank.

The Loan-To-Value ratio may change depending on, among other factors, the credit rating of the Policy Issuer.

In exceptional circumstances, such as when the Policy Issuer is unable to issue the Policy due to insolvency or other reasons, it may fail to refund the premium amount paid by the Bank for issuing the Policy. In the event that the Policy Issuer fails to refund the Bank, you will still be liable for repaying the outstanding Insurance Premium Financing loan balance to the bank.