Interest Saving Tips: Earn High Interest with Your Mortgage and Offset Interest Expenses

With a deposit-linked mortgage repayment plan, home owners can earn higher deposit interest to offset part of their mortgage interest expense. Do you know that, along with borrowers, other related parties can be qualified to enjoy a higher deposit as well?

For mortgaged property owners with idle funds, or who have recently remortgaged and cashed out the appreciated property value with no specific use in mind, how can they make best use of those funds to reduce their mortgage interest expense while maintaining financial flexibility? The answer is a deposit-linked mortgage repayment plan.

|

|

Through a deposit-linked mortgage repayment plan, your designated savings account can enjoy the same preferential interest rate as your linked mortgage loan account interest rate. In general, banks will set a cap on the deposit amount eligible for such preferential interest rates, usually up to 50% of the outstanding mortgage loan. The interest return earned monthly in this account can help offset the mortgage interest expense, while funds can be flexibly withdrawn at any time to maintain cash flow. |

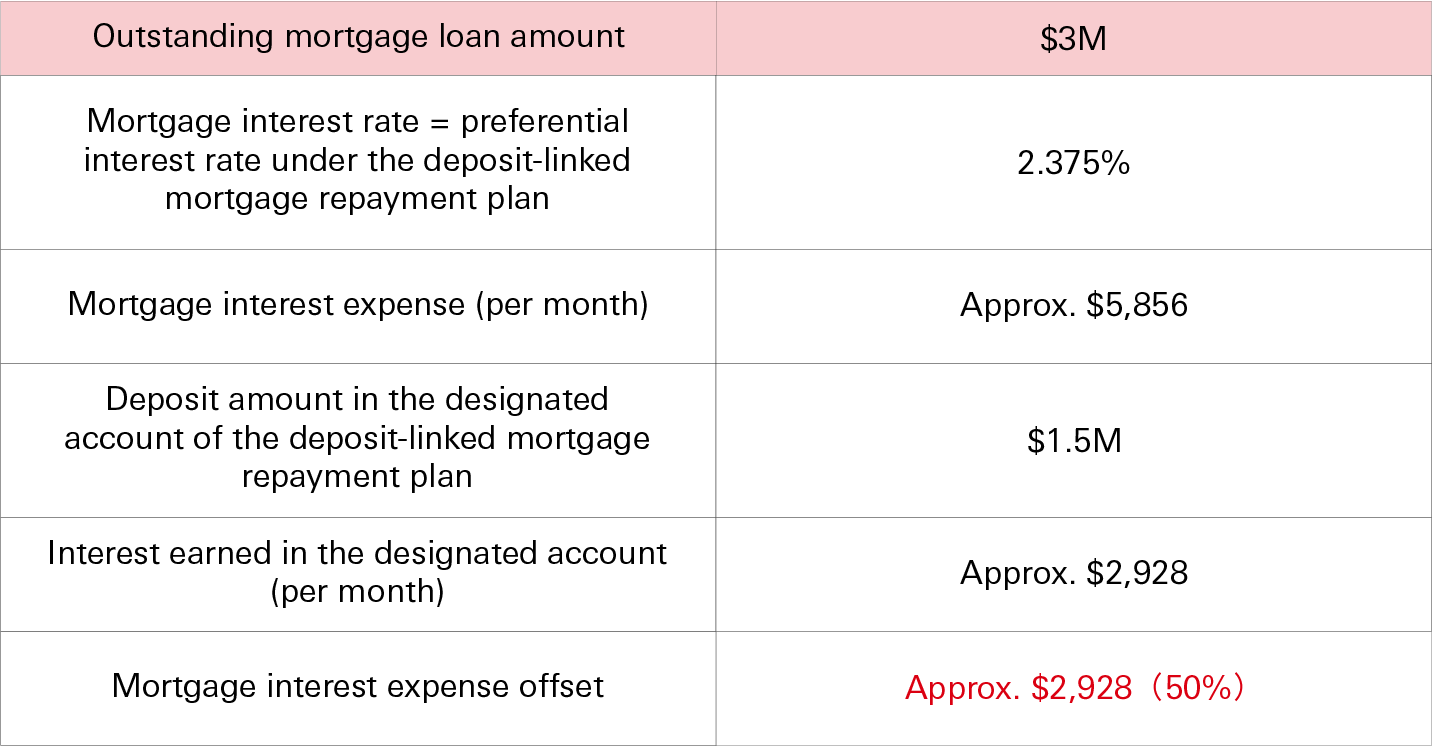

For example, if a property owner's outstanding mortgage balance is $3M and the interest rate is 2.375%, he/she can save about half of the mortgage interest expense by depositing $1.5M into the linked account.

Note: This example is for illustration only. The actual interest expense and income should be determined in accordance with the bank's calculation.

Tips:

Tips:

- It is worth noting that while deposit-linked repayment plans in the market are generally limited to the borrower's deposit account, HSBC's Deposit-Linked Mortgage Repayment Plan is open to borrowers or spouses of borrowers and mortgagors, allowing them to link up their Hong Kong Dollar savings accounts with the mortgage plan. Up to three Hong Kong Dollar savings accounts can be linked to earn preferential interest rates, giving families a convenient and flexible way to manage finances. The linked mortgage account and savings account remain independent of each other to maintain a clear picture of your finances.

-

HSBC's Deposit-Linked Mortgage Repayment Plan deposits interest directly into the savings account, and is not deducted from the mortgage principal or interest. Therefore, it does not affect the mortgage interest expense that can be deducted for taxation.

Remarks:

- HSBC's Deposit-Linked Mortgage Payment Plan is subject to minimum loan amount requirements, and is only available for HSBC Premier, HSBC One or Personal Integrated Account customers. It can be linked to a maximum of three Hong Kong Dollar savings accounts (deposit-linked account). For an individual borrower, only the deposit-linked account(s) held by the borrower or spouse of the borrower, or their joint account(s) or mortgagor, is/are eligible. For a company borrower, only the deposit-linked account(s) held by the guarantor or spouse of the guarantor, or their joint account, is/are eligible. In the case of two deposit-linked accounts, the deposit balance eligible for a preferential interest rate (available threshold) for each account is up to 50% of the outstanding principal amount of the mortgage loan divided by two. In the case of three deposit-linked accounts, the available threshold for each account is up to 50% of the outstanding principal amount of the mortgage loan divided by three.

- Mortgage loan approval is subject to the applicant's personal circumstances and the applicable terms and conditions and policies at the time. Approval is subject to credit assessment and the bank reserves the right of final decision.

To borrow or not to borrow? Borrow only if you can repay!

All information is for reference only. All services provided by The Hongkong and Shanghai Banking Corporation Limited ("HSBC") are subject to the prevailing terms and conditions and the applicable terms and conditions shall prevail if there are any inconsistencies or discrepancies with the content. HSBC is not responsible for any liabilities, costs, damages, or any consequences stemming from reliance on the information provided. Content provided should not be treated as any investment or legal advice or professional opinion, and is not solicitation or advice of any products or services. HSBC does not guarantee the accuracy, timeliness or completeness of this information, and information may be subject to change without prior notice.

Issued by The Hongkong and Shanghai Banking Corporation Limited