Smart Tips on Cash-out Refinancing

Home owners can take advantage of property value appreciation to cash out money. This article provides some tips on how to cash out wisely using lower interest rates.

Home owners who want to cash out the value appreciation of their properties can apply for additional home loan financing with their mortgage banks. Depending on the market's prevailing mortgage interest rate, owners can take on different strategies to cash out more on top of their current mortgage plan. Let's take a look at Kelly and Perry's cases.

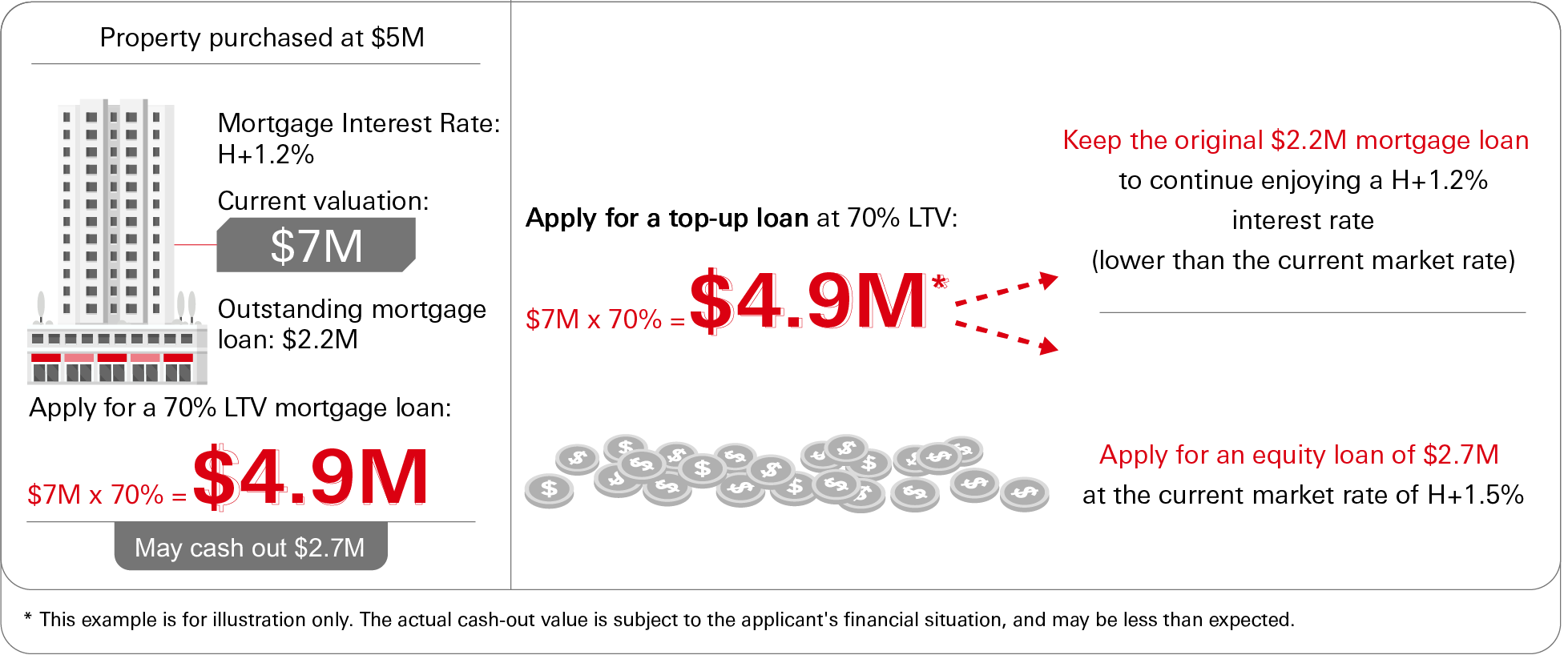

Kelly and Perry each purchased an apartment for $5M. Both have had their property value appreciated to $7M, with an outstanding balance of $2.2M left on their respective mortgages. How can Kelly and Perry arrange to cash out from the appreciated property and minimize their interest expenses? To answer this, we need to compare the interest rates of their original mortgage plans with the prevailing market rates.

Case 1: With the rise of interest rate

Kelly set up her mortgage plan at a time when the interest rate was low. Since the market interest rate has now increased, she could consider keeping the original mortgage plan to continue enjoying a lower interest rate on her $2.2M outstanding mortgage loan, and applying for an equity loan to borrow a further $2.7M.

Case 2: With the fall of interest rate

Perry's situation is the exact opposite. Since the current market interest rate is lower than the one charged under the original mortgage plan, he could consider applying for a top-up loan with the mortgage bank for $4.9M. He can still cash out $2.7M after paying off the existing loan of $2.2M and enjoy a lower interest rate for the total amount of the new loan.

Save interest with a deposit-linked mortgage:

Save interest with a deposit-linked mortgage:

If you have no special use in mind for the cashed-out funds, consider placing them into the linked bank account of a deposit-linked mortgage repayment plan to enjoy a preferential savings interest rate equivalent to your mortgage interest rate. You can use the interest gained in the linked account to offset part of your mortgage interest payment. As it is a savings account, you can enjoy the flexibility of being able to withdraw funds at any time. Generally, banks set a cap on the deposit balance for preferential interest rate, usually at half of the outstanding balance of the mortgage loan.

Further reading: Interest Saving Tips: Earn High Interest with Your Mortgage and Offset Interest Expense

Tips:

Tips:

- A mortgage loan application is subject to the bank's approval. The bank will conduct a stress test for applicants who are seeking to refinance, and will check the applicant's previous repayment records.

Note: Mortgage loan approval is subject to the applicant's personal circumstances and the applicable terms and conditions and policies at the time. Approval is subject to credit assessment and the bank reserves the right of final decision.

To borrow or not to borrow? Borrow only if you can repay!

All information is for reference only. All services provided by The Hongkong and Shanghai Banking Corporation Limited ("HSBC") are subject to the prevailing terms and conditions and the applicable terms and conditions shall prevail if there are any inconsistencies or discrepancies with the content. HSBC is not responsible for any liabilities, costs, damages, or any consequences stemming from reliance on the information provided. Content provided should not be treated as any investment or legal advice or professional opinion, and is not solicitation or advice of any products or services. HSBC does not guarantee the accuracy, timeliness or completeness of this information, and information may be subject to change without prior notice.

Issued by The Hongkong and Shanghai Banking Corporation Limited