Want an easier way to manage your annuity policy?

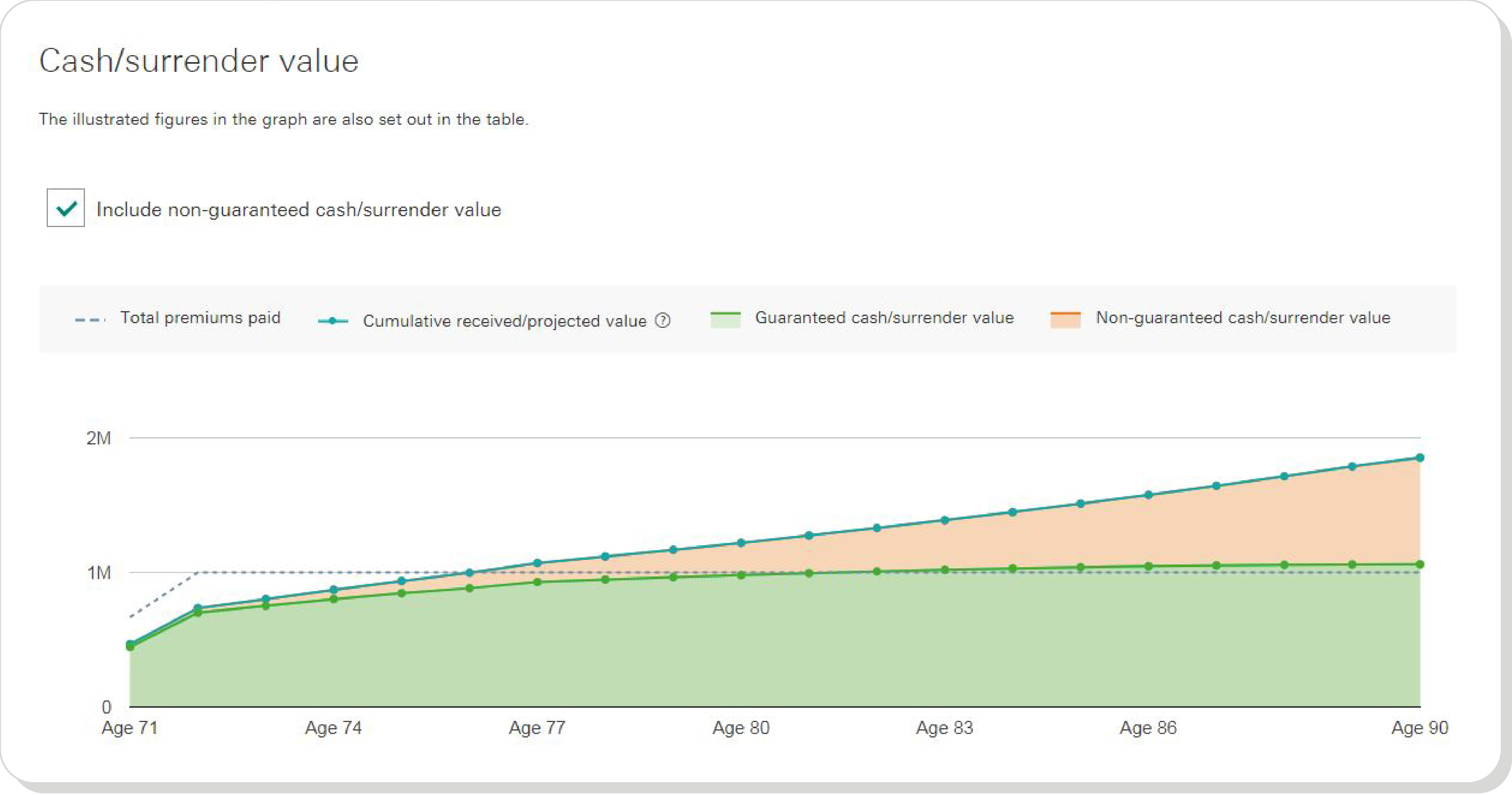

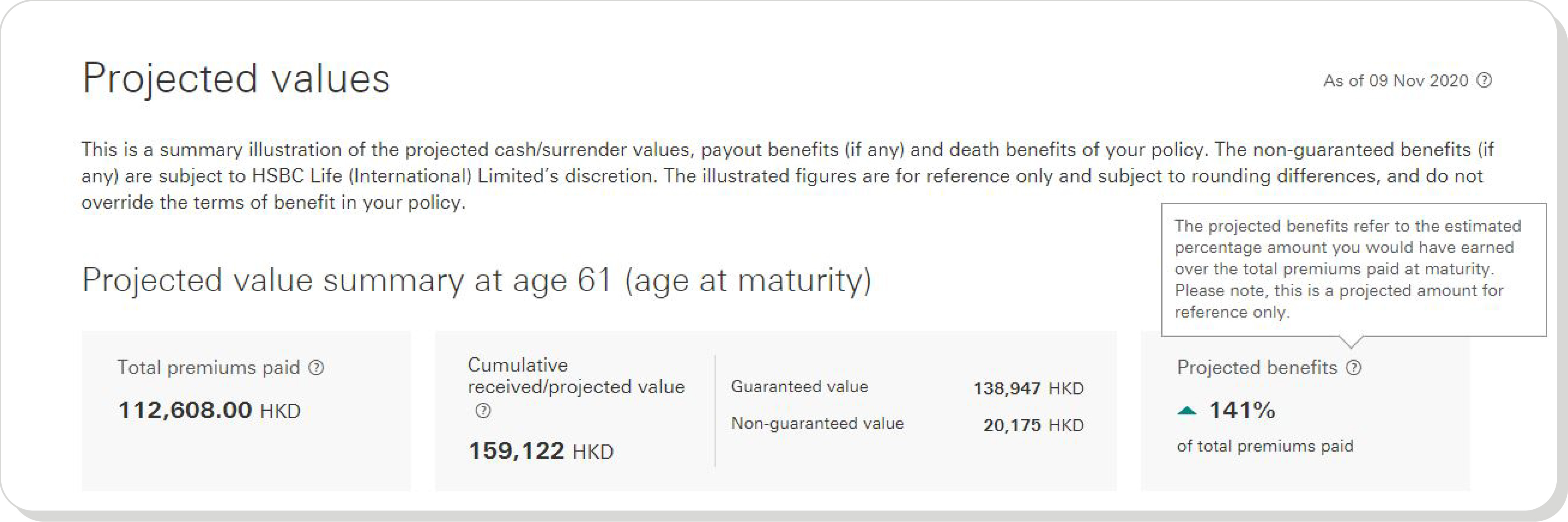

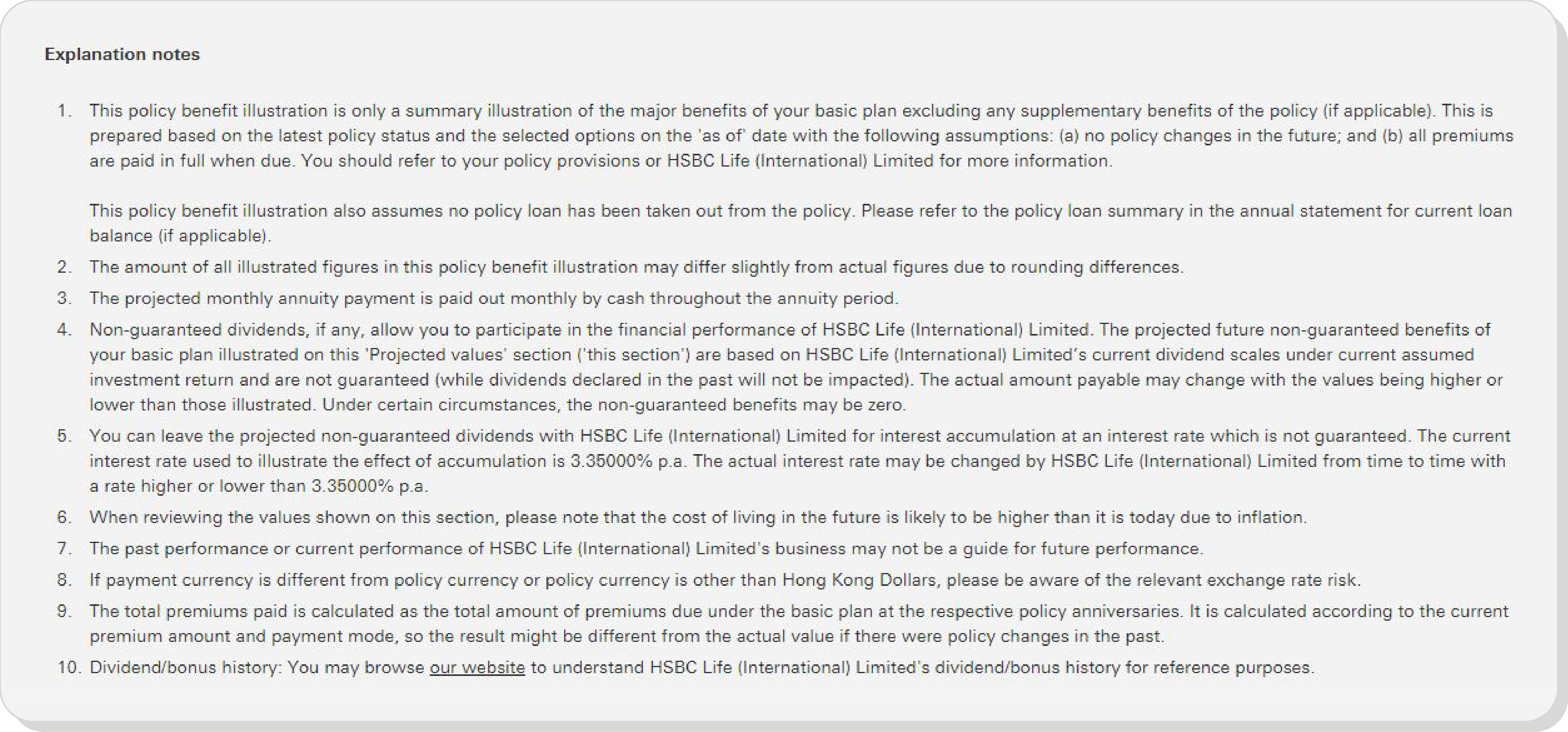

HSBC Life’s Digital Policy Value Projection not only allows you to check the projected values of your life insurance policies * anytime, but gives you more functionalities to manage your annuity plan as well. You can choose to receive annuity payments after the accumulation period or retain them in the policy to accumulate and earn potential interest. Digital Policy Value Projection makes that decision easier by increasing transparency with real-time policy updates. Even managing your policy in general becomes more convenient with a number of interactive features. There are two main pages for your review – Cash/Surrender Value and Death Benefit. If you have chosen to receive the annuities, a Payout Benefits page will also be accessible. The examples below will show you how to get the most out of Digital Policy Value Projection.

*Applicable only to selected annuity, whole of life and endowment products.

Annuity Plan Case Study

Withdrawing annuity income

Case Study 2 –

Accumulating annuity

Case Study 3 –

Changing annuity status from payout to accumulation

Study 4 –

Changing annuity arrangement from accumulation to withdrawal Case Study 5 –

Withdrawing dividends

Annuity Plan Case Study 1 – Withdrawing annuity income

Annuity Plan Case Study 1 – Withdrawing annuity income

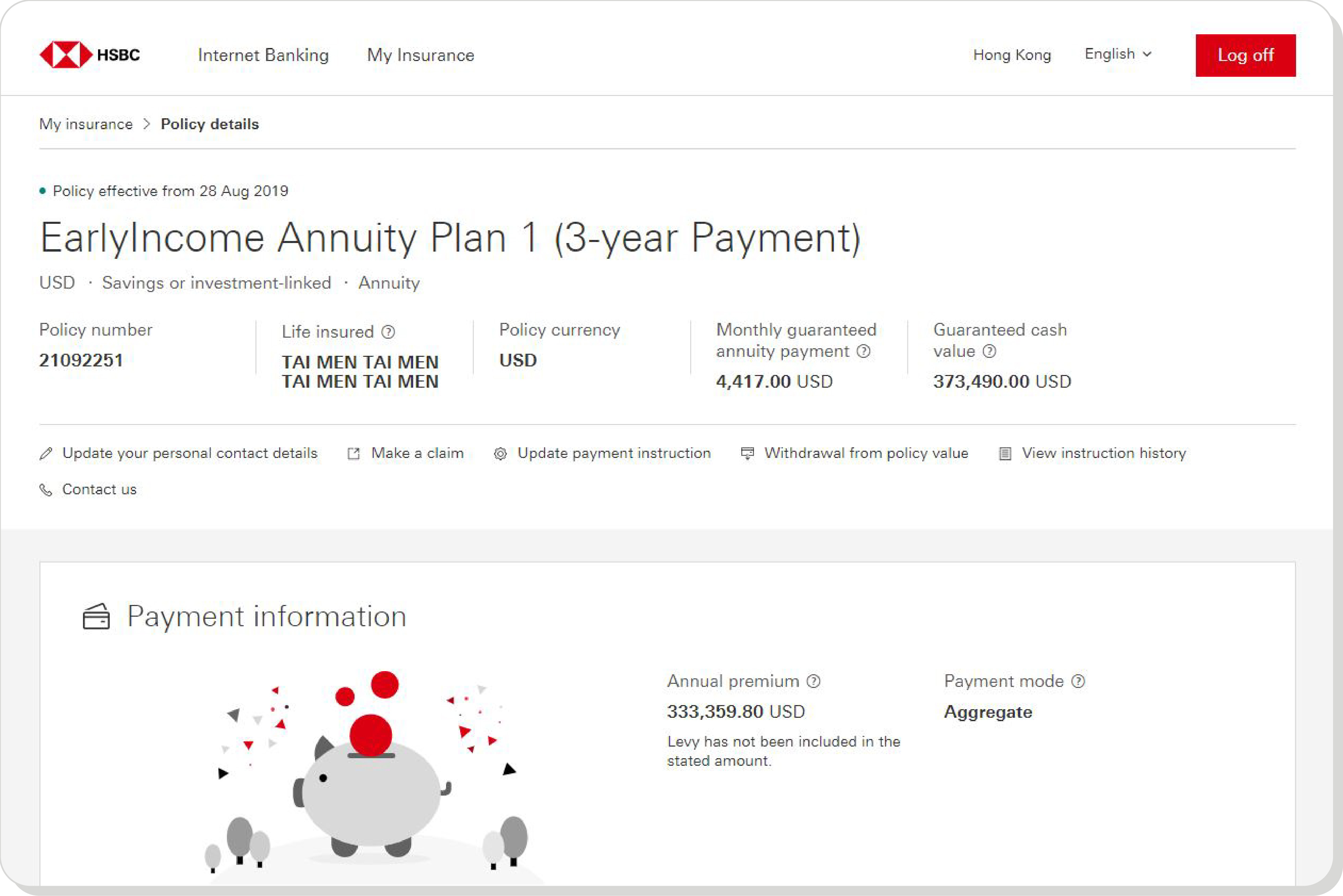

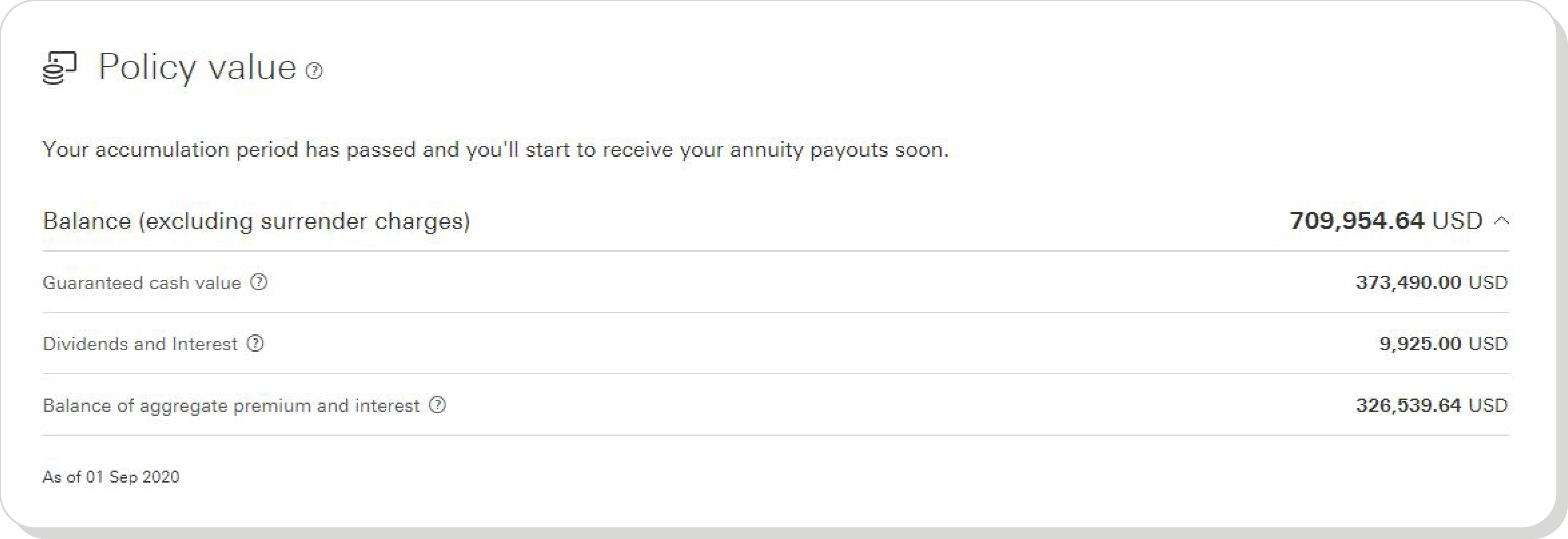

Kate is a retiree who has an annuity plan that has reached the annuity period. Each month, she receives an annuity payment from the policy to cover her living expenses.

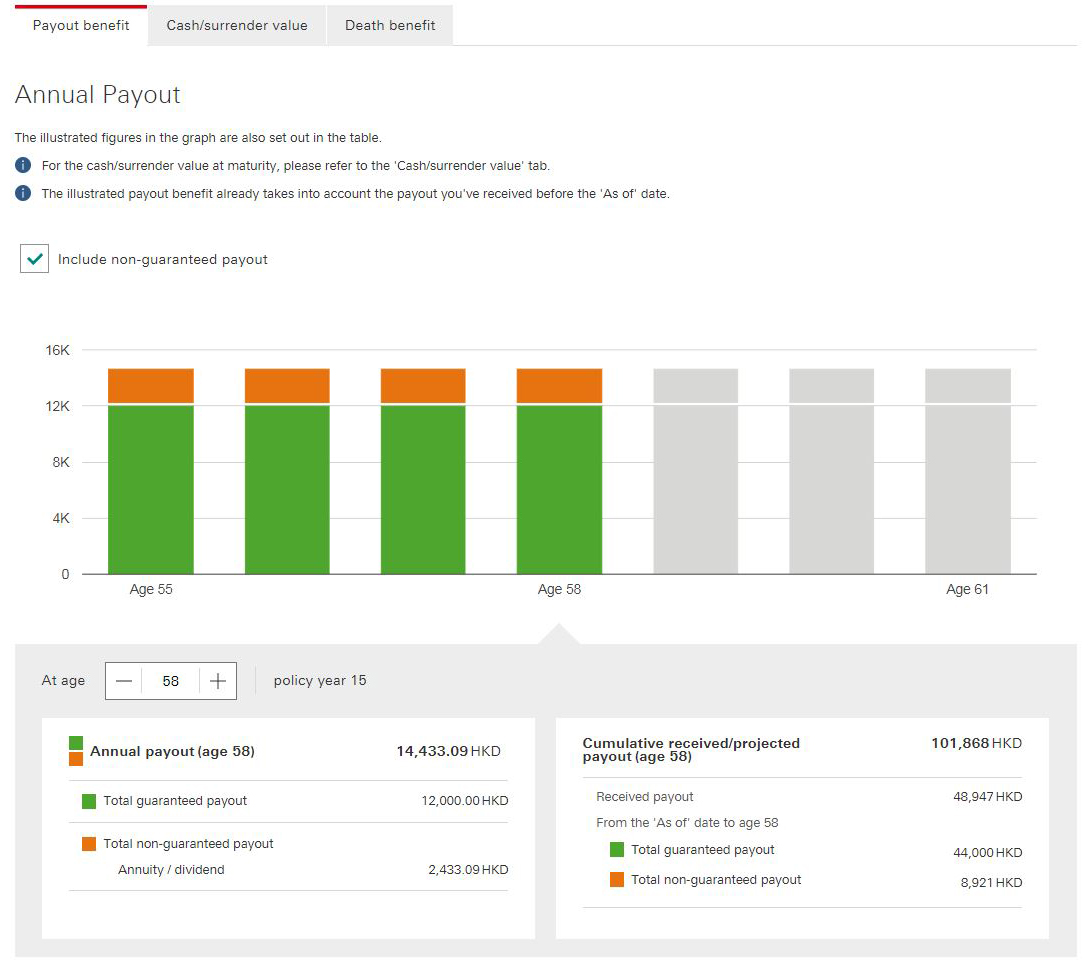

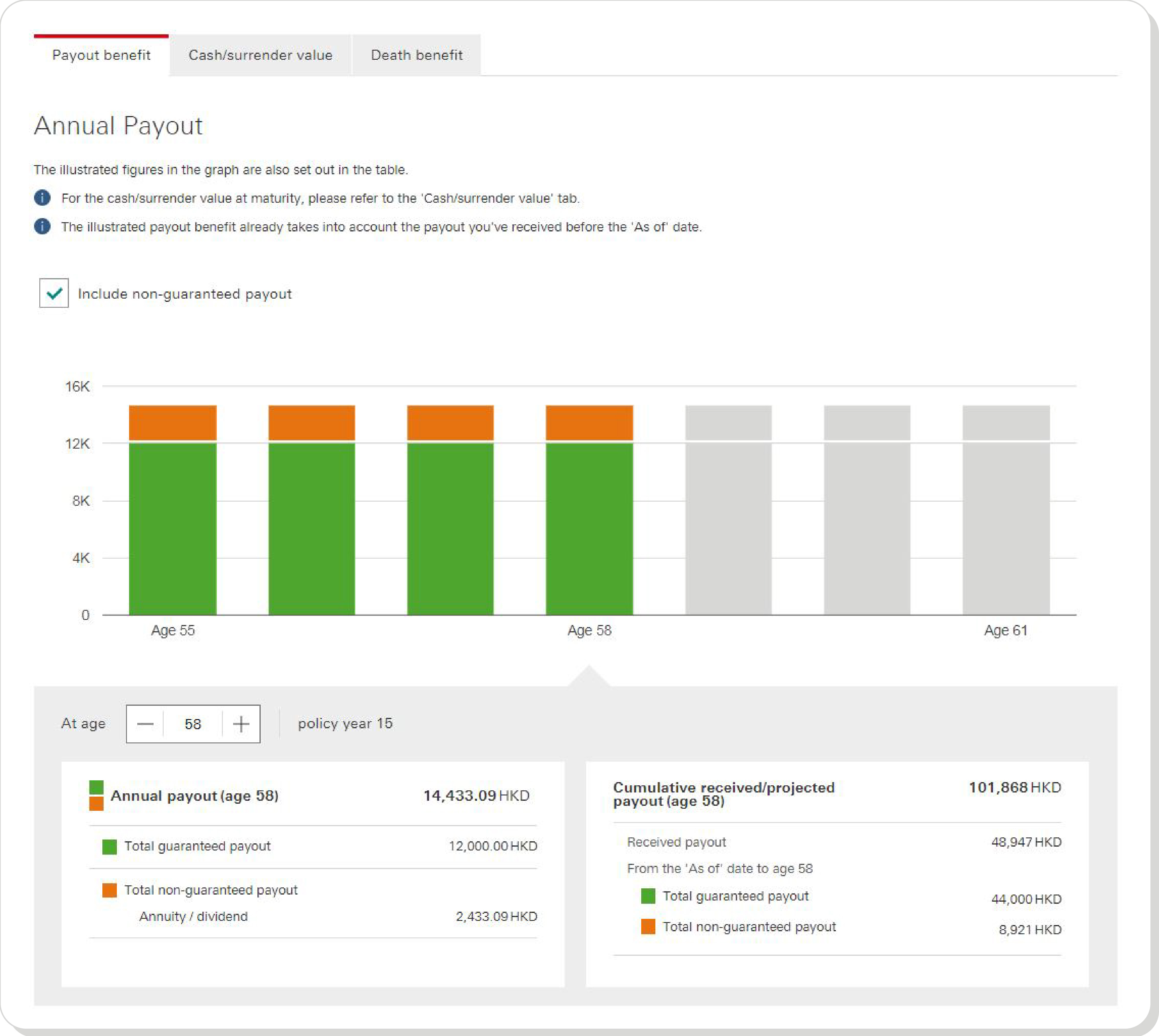

By clicking the Payout Benefits tab, Kate can view her projected annual annuity payouts. With the “Include non-guaranteed payout” option selected by default, the bar chart will display the annual guaranteed and non-guaranteed annuity amounts in green and orange respectively. If Kate wants to know the annuity income she’ll receive when she’s 58, for example, all she has to do is to click the Age 58 bar on the chart to see more detailed information on her annuity for that year.

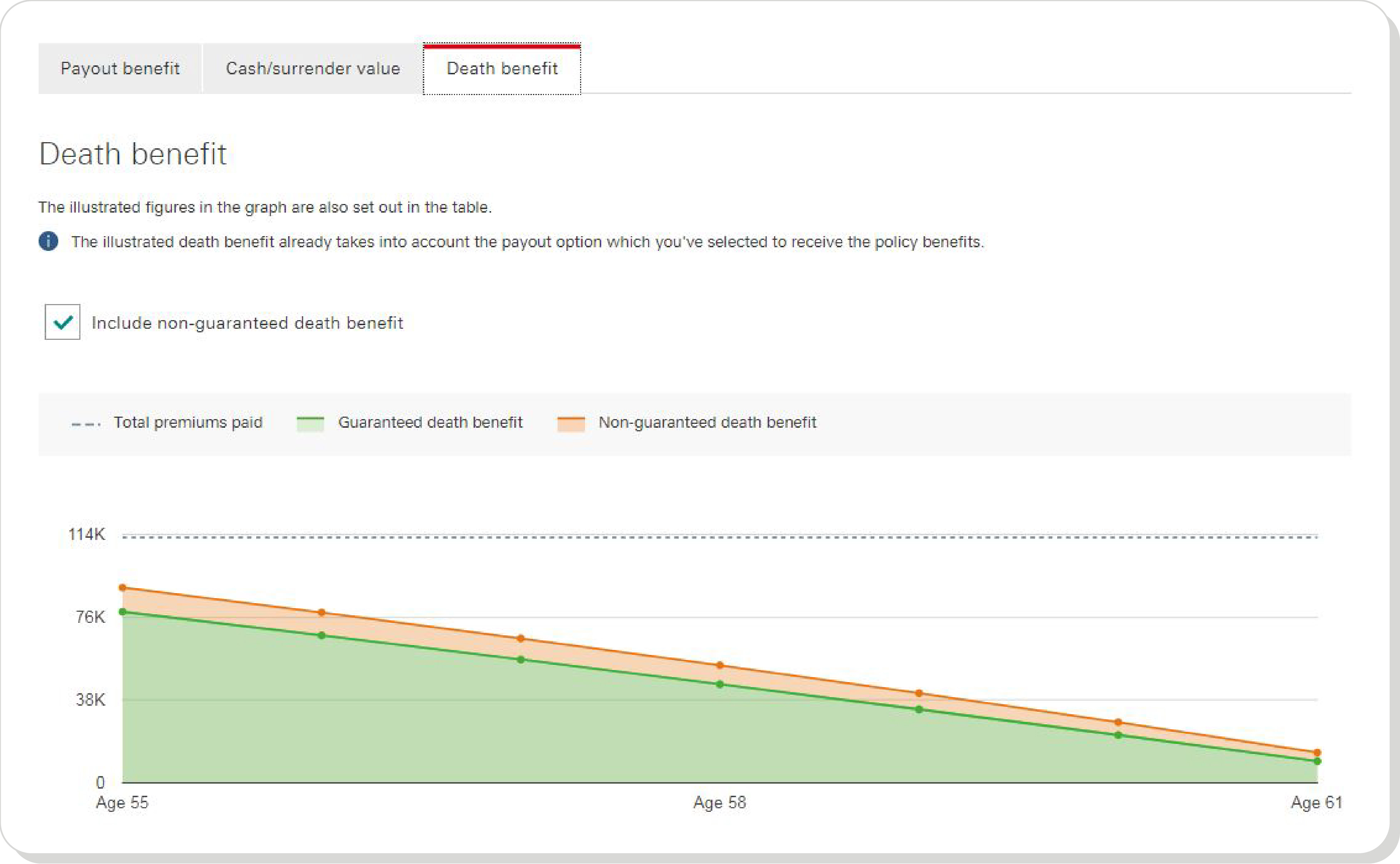

Kate is a mother of two, and wants to protect her children from financial difficulties in case anything happens to her. On the Policy Value Projection main page, she can click the Death Benefit tab to view the relevant chart, a handy feature that lets her stay up-to-date on the total Death Benefit amount including non-guaranteed benefits. Since she has chosen to receive regular payouts, and the guaranteed death benefit is calculated using a designated percentage (eg 101%) of the guaranteed cash value or total premium paid less any monthly guaranteed annuity paid, the death benefit amount will gradually decrease as more monthly guaranteed annuities are paid out, and the line on the chart will be on a downward trend. In addition, the service can display year-by-year policy value projections for her easy reference.

Annuity Plan Case Study 2 – Accumulating annuity

Annuity Plan Case Study 2 – Accumulating annuity

Unlike Kate, Tom has chosen to accumulate his annuity payments in his policy for higher potential returns. As a result, the projected death benefit comprising the guaranteed death benefit plus the accumulated monthly annuity amount may be on an upward trend.

Annuity Plan Case Study 3 – Changing annuity status from payout to accumulation

Annuity Plan Case Study 3 – Changing annuity status from payout to accumulation

Jess took up an annuity policy some years ago in order to pay for her master’s degree studies with monthly annuities. Since she has now completed the programme, she wants to stop the annuity payments and start accumulating in the hope of earning more potential interest.

After the annuity has changed from payout mode to accumulation mode, the lines for cash value/surrender value/death benefit may start trending in a different direction.

Note:

If a customer wants to change their payout/accumulation option, they need to complete 'Change of Policy Payment Option' on https://www.hsbc.com.hk/insurance/forms/.

Since the information update requires some time, the Payout Benefits display on the page will be temporarily hidden after the customer’s new instruction has been received. Once the update is complete, the relevant display will indicate the new annuity arrangement.

Annuity Plan Case Study 4 – Changing annuity arrangement from accumulation to withdrawal

Annuity Plan Case Study 4 – Changing annuity arrangement from accumulation to withdrawal

Jack has been accumulating the payments from his annuity policy for years. This year, his son is entering a private secondary school, so he decides to switch from accumulation to payout.

After the change has taken effect, Jack’s projected policy value will reflect the new annuity arrangement, and Payout Benefits will be included in the interface. In his case, even though the policy anniversary falls on February 1, payouts will not start until the commencement of his son’s new school year in September. That means he will only receive 5 months’ worth of annuity in the first year after the change (September to January), and the column for that first year will show a lower amount than for subsequent years.

Note:

If customer wants to change their payout/accumulation option, they need to complete 'Change of Policy Payment Option' on https://www.hsbc.com.hk/insurance/forms/.

Annuity Plan Case Study 5 – Withdrawing dividends

Annuity Plan Case Study 5 – Withdrawing dividends

The building Bob lives in will soon undergo renovation, and each household needs to pay HKD 100,000 for the project. He plans to withdraw the dividends that have accumulated in his annuity policy for that purpose. All he has to do is log on to online banking and request to withdraw by clicking the link on his policy details page.

After the withdrawal has been processed, the figures in Digital Policy Value Projection will be refreshed accordingly.

Extra tools - more help, more answers

If you encounter insurance terms which you don’t understand, just click the “?” icon to learn more.

The page also includes illustrations that explain in detail what you need to know:

If you need to get in touch with us, you can do so anytime by using Chat with us in the HSBC HK Mobile Banking App or Live Chat on the HSBC Personal Internet Banking.

Monday to Friday (except public holidays)

General insurance: 9:00am to 10:00pm

Life insurance: 9:00am to 8:00pm

Adjusting your financial strategy to suit different life stages is an important part of your protection planning. If your insurance company can offer services to help you manage your policy, your wealth management journey will be that much smoother and easier.