A life policy can turned into an enduring legacy

Your achievements deserve to be safeguarded and turned into an enduring legacy. When it comes to passing your wealth to the next generation, life insurance solutions offer significant advantages that make the process of legacy planning and wealth succession much smoother and easier.

Life insurance plans can facilitate all aspects of legacy planning, from wealth protection, family protection, wealth transfer to estate equalisation. This may help you safeguard not only your legacy but the financial prospects of those who matter most to you. What’s more, a life insurance policy can be owned by a trust as part of your legacy planning.

Wealth Protection

Wealth Protection

Life insurance policies with a savings element give you a lifetime of protection and can serve as a tool to help accumulate wealth for the long term. While you are growing the cash value of your policy with the premiums you pay, you may receive regular cash bonuses and dividends under the policy, subject to market conditions, which you can use to further build on your wealth foundation. Some life insurance policies come with a policy value management lock-in feature to give you more financial certainty.

Applicable products: Whole Life, Universal Life

Family Protection

Family Protection

Life can be unpredictable, and the lack of adequate protection could leave your family exposed financially in the wake of unfortunate events. That is why a life policy typically protects the insured person’s family with a sizeable death benefit in the unfortunate event of his/ her untimely passing. Some jurisdictions outside Hong Kong may impose estate duty. The death benefit from your life insurance policy may be exempt from estate duty or inheritance tax in some jurisdictions under the right circumstances. So, your insurance policy may help you pass on assets to your child in full. You are advised to seek the opinion of a professional tax advisor.

Applicable products: Whole Life, Term Life, Universal Life

Wealth and Protection Transfer

Wealth and Protection Transfer

Some life policies allow you to change the life insured1 (Subject to the approval of insurance company), which gives you the option to pass on your wealth and life protection to the next generation at an earlier time if you wish. A life policy also allows you to change your designated beneficiary (ies), so you always have the flexibility to allocate your insurance proceeds by making corresponding arrangements with regard to your insurance policy.

Applicable products: Whole Life, Universal Life

Estate Equalisation

Estate Equalisation

Sometimes people want to divide their assets evenly but not all assets and holdings can be easily divided into equal or defined portions. Purchasing a life insurance policy can be a good way to ensure effective distribution, so that, if you wish, all your beneficiaries would receive nearly equal shares of your estate.

Applicable products: Whole Life, Universal Life

The Beauty of Legacy Planning

![]() Mr. and Mrs. Chan’s estate is worth a total of HKD20 million, including a HKD8 million property. They plan to keep a portion of it for their retirement and divide the rest equally between their two children as inheritance.

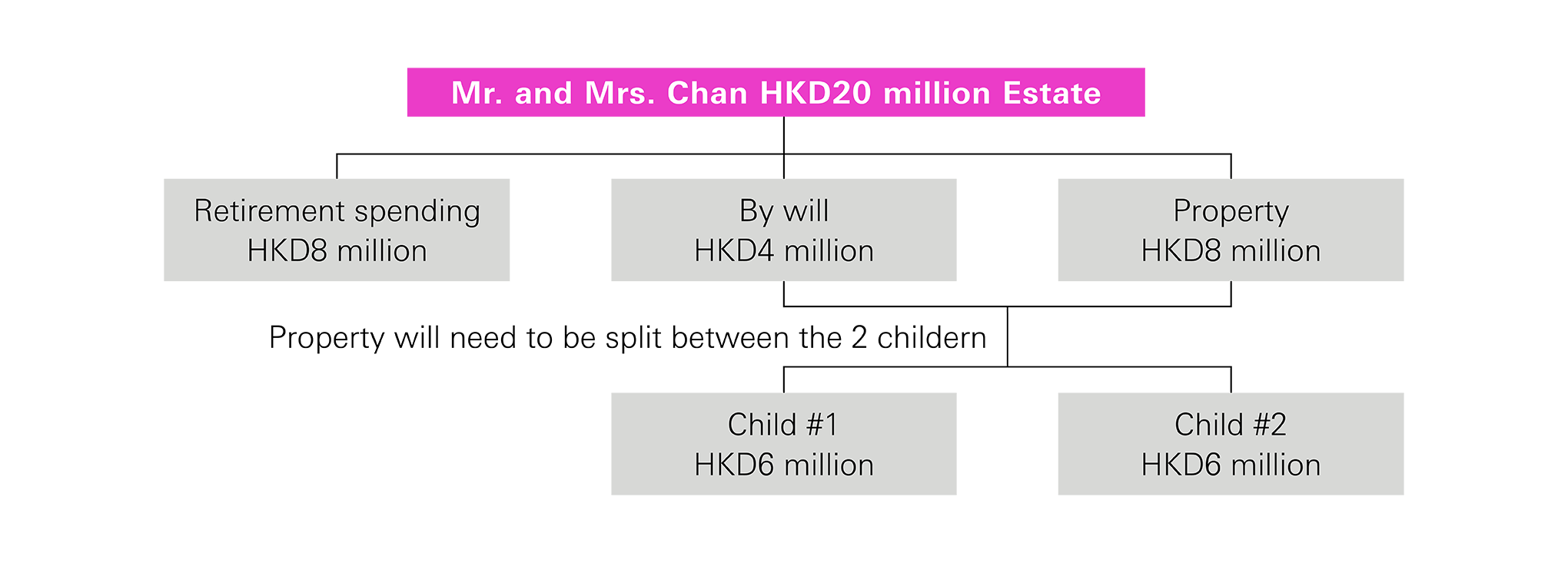

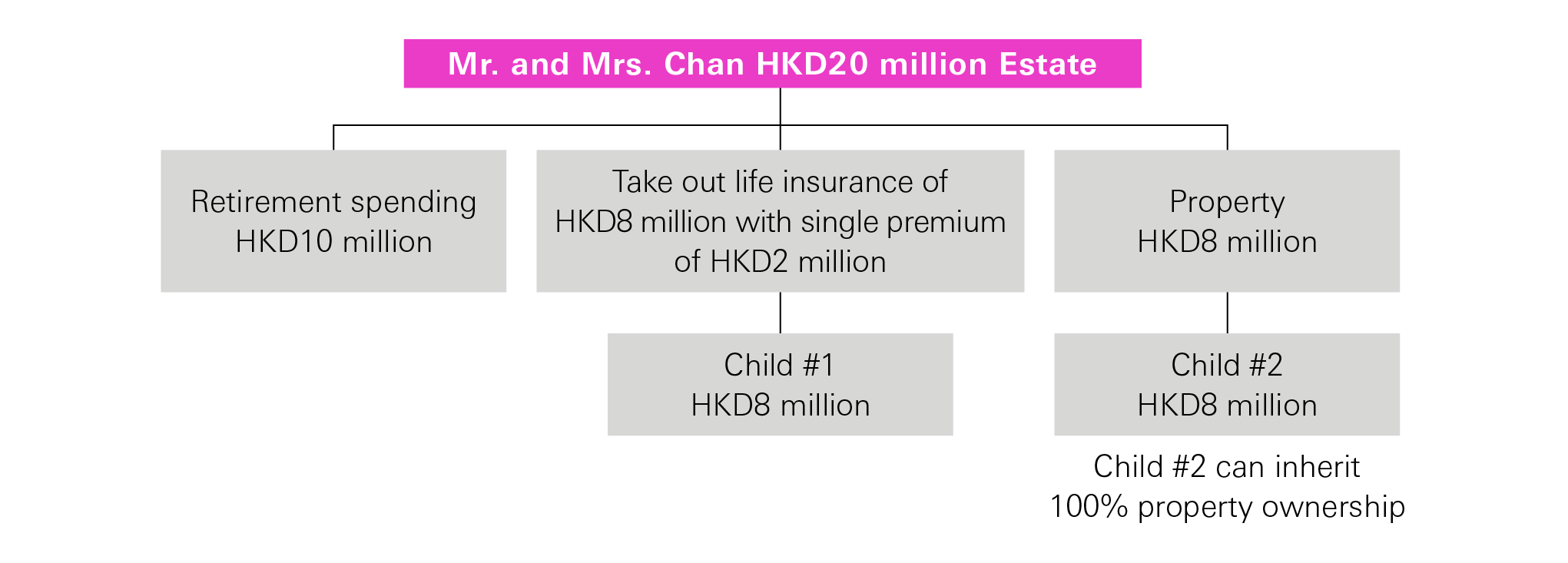

Mr. and Mrs. Chan’s estate is worth a total of HKD20 million, including a HKD8 million property. They plan to keep a portion of it for their retirement and divide the rest equally between their two children as inheritance.

Without using insurance in legacy planning

In this hypothetical scenario, Mr. and Mrs. Chan may have to ensure they spend no more than HKD8 million during their retirement, so that HKD12million in assets, including their property, will be left for their children’s inheritance.

Using insurance in legacy planning

As an alternative scenario , either Mr. or Mrs. Chan can purchase a life insurance policy with a sum insured of HKD8 million by paying HKD2 million2 as a single premium(subject to the insurance company’s quotation), which would leave HKD10 million for their retirement reserve. As for the rest of their estate, they can, without having to split the property, leave two equal shares of HKD8 million each for their children’s inheritance.

HSBC Life (International) Limited (incorporated in Bermuda with limited liability) (“HSBC Life”) offers a full range of life insurance products to help you further your priorities at every life stage. For more details on how they can meet your wealth growth and legacy planning needs, please visit any HSBC branch.

Remarks

- Change of life insured is subject to evidence of insurability and approval by the Company which is based on the underwriting conditions of the life insured. Any such request will be assessed on case-by-case basis and is at company discretion, with consideration of multiple factors, including but not limited to the change in underlying claim risk, change in policy term, latest economic outlook; and is at o company discretion.

- The sum insured, which will be available upon the death of the life insured during the policy term, varies from product to product based on a given premium amount, and the premium amount is based on the life insured’s gender, age, smoking habit, sum insured and other underwriting considerations. Please refer to relevant product materials for details. The numbers described in the above examples are hypothetical and are for illustrative purposes only.

HSBC Life is authorised and regulated by the Insurance Authority (“IA”) of the Hong Kong Special Administrative Region ("HKSAR") to carry on long-term insurance business in the HKSAR. The Hongkong and Shanghai Banking Corporation Limited ("HSBC") is an insurance agent authorised by HSBC Life for the distribution of life insurance products.