First-time Home Buyer Exclusive: Basic Stamp Duty and High Loan-to-Value Ratio Mortgage

First-time home buyers are only required to pay the basic stamp duty, they are also eligible to apply for a mortgage loan of up to 90% loan-to-value ratio with mortgage insurance. This article explains the eligibility and entitlements for first-time home buyers to help you plan your budget and get ready for home ownership.

To encourage wider home ownership, the government has introduced mortgage insurance policies that allow home buyers to purchase properties with a lower down payment, and enable first-time home buyers who are permanent Hong Kong residents to pay less stamp duty. Are you eligible as a first-time home buyer?

First-Time Home Buyer Eligibility

According to the requirements, there are no age or asset restrictions for first-time home buyers, provided that they do not own any other residential property at the time of transaction. In fact, even if a person previously owned a residence but has since sold it, or jointly owned a property with others but had his/her name removed from the title deeds, as long as they do not own any other residential property at the time of transaction, they are still eligible as a "first-time home buyer".

Highlight 1 for First-time Home Buyers: Only pay the basic ad valorem stamp duty (AVD)

|

|

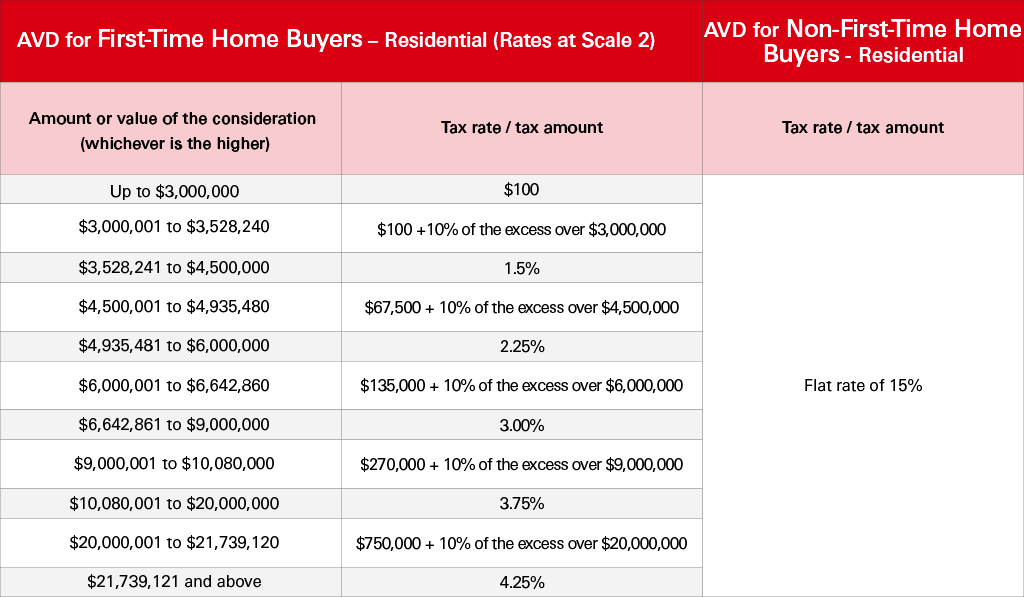

Property stamp duties in Hong Kong include the ad valorem stamp duty (AVD), special stamp duty (SSD) and buyer's stamp duty (BSD). Generally speaking, first-time home buyers just have to pay the AVD, whereas SSD will be payable by short-term speculators, and BSD by home buyers who are non-Hong Kong permanent residents or companies. |

For example, when purchasing a $8M residential property, eligible first-time home buyers are only required to pay 3% AVD, or $240,000, while non-first-time home buyers have to pay 15% AVD, or $1.2M.

Tips:

Tips:

-

Non-Hong Kong permanent residents are required to pay an additional buyer's stamp duty (BSD) of 15% on the property stated consideration or market value (whichever is higher).

-

If the buyer is a permanent resident and successfully sells out his/her previous one and only residence within 12 months from completing the new transaction, and meeting the requirements of the Inland Revenue Department, he will be eligible for a refund of the excess initially paid as a non-first-time home buyer at 15% over the basic tax applicable for him/her as a first-time home buyer.

- For eligible incoming talents who have purchased residential property in Hong Kong on or after 19 October 2022 and at the time of acquisition of the property concerned did not own any other residential property in Hong Kong, and subsequently become Hong Kong permanent residents, they will be eligible for the same stamp duty rates as first time home buyers who are Hong Kong permanent residents, and (if they still hold the property) may apply for a refund of the extra stamp duty for purchasing residential property in Hong Kong. Eligible incoming talents include those who enter Hong Kong under designated talents admission schemes, including General Employment Policy (GEP), Admission Scheme for Mainland Talents and Professionals (ASMTP), Quality Migrant Admission Scheme (QMAS), Technology Talent Admission Scheme (TechTAS), Immigration Arrangements for Non-local Graduates (IANG), Admission Scheme for the Second Generation of Chinese Hong Kong Permanent Residents (ASSG) and Top Talent Pass Scheme (TTPS).

Note: For details of stamp duty, please refer to the official website of Inland Revenue.

Highlight 2 for First-time Home Buyers: Higher loan-to-value ratio mortgage

|

|

Home buyers can apply for a higher loan-to-value (LTV) ratio mortgage when purchasing a property for self-occupancy. First-time home buyers who satisfy certain requirements may apply for a mortgage loan of up to 90% loan-to-value ratio with mortgage insurance, so that they can purchase a property with as low as 10% down payment. |

Tips:

Tips:

-

In order to be eligible for an 80%-90% LTV mortgage for property valued above $4M to below $11.25M, he/she must be a first-time home buyer with a regular income, and satisfy specific requirements.

Note: Mortgage loan approval is subject to the applicant's personal circumstances and the applicable terms and conditions and policies at the time. Approval is subject to credit assessment and the bank reserves the right of final decision.

To borrow or not to borrow? Borrow only if you can repay!

All information is for reference only. All services provided by The Hongkong and Shanghai Banking Corporation Limited ("HSBC") are subject to the prevailing terms and conditions and the applicable terms and conditions shall prevail if there are any inconsistencies or discrepancies with the content. HSBC is not responsible for any liabilities, costs, damages, or any consequences stemming from reliance on the information provided. Content provided should not be treated as any investment or legal advice or professional opinion, and is not solicitation or advice of any products or services. HSBC does not guarantee the accuracy, timeliness or completeness of this information, and information may be subject to change without prior notice.

Issued by The Hongkong and Shanghai Banking Corporation Limited