Decoding Mortgage Interest Rates: "H-based", "P-based" and Fixed Rate Plans

When applying for a mortgage loan, you may notice there are HIBOR-based, prime-based and fixed-rate plans. What are the differences, and how do you choose between them to suit your budget and save interest? What are the key points to consider in a changing economic environment?

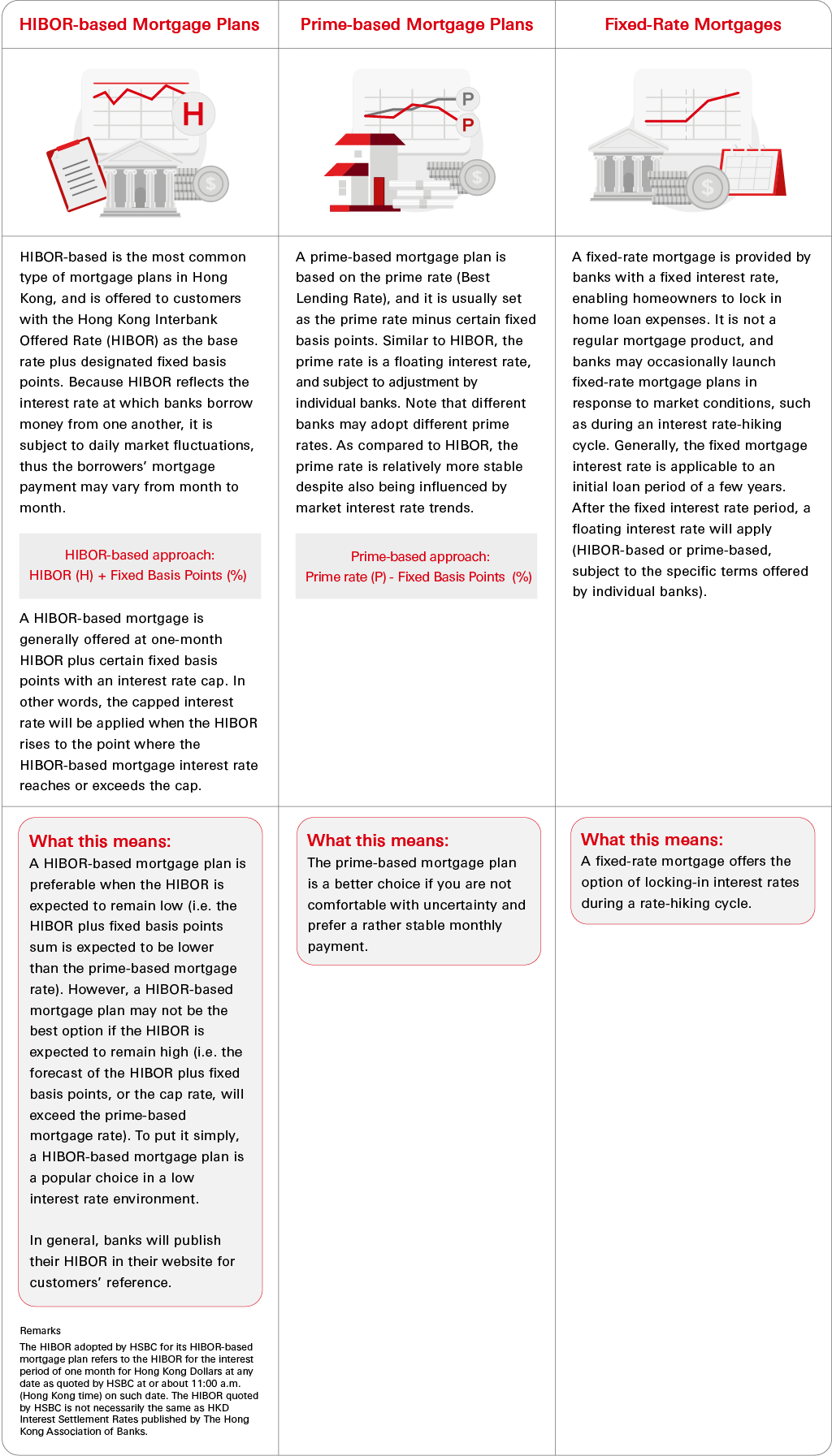

In Hong Kong, the two major types of mortgage plans are floating rate and fixed rate, with two different floating-rate mortgage plans, namely HIBOR-based and prime-based mortgages. This article explains the differences between these mortgage plans, and illustrates how interest rate trends impact mortgage loan repayment and the implications under different interest rate trends.

Reference:

HSBC HKD Hong Kong Interbank Offered Rate (HIBOR)

HSBC HKD Best Lending Rate (BLR)

Tips:

Tips:

- For both HIBOR-based and prime-based mortgage plans, the basis points are fixed from the time you set up the mortgage contract with the bank. However, be mindful that the prime rate and HIBOR are both floating rates. Banks may raise their prime rates, and the HIBOR may also fluctuate. Homeowners should pay attention to market interest rate trends.

Note: Mortgage loan approval is subject to the applicant's personal circumstances and the applicable terms and conditions and policies at the time. Approval is subject to credit assessment and the bank reserves the right of final decision.

To borrow or not to borrow? Borrow only if you can repay!

All information is for reference only. All services provided by The Hongkong and Shanghai Banking Corporation Limited ("HSBC") are subject to the prevailing terms and conditions and the applicable terms and conditions shall prevail if there are any inconsistencies or discrepancies with the content. HSBC is not responsible for any liabilities, costs, damages, or any consequences stemming from reliance on the information provided. Content provided should not be treated as any investment or legal advice or professional opinion, and is not solicitation or advice of any products or services. HSBC does not guarantee the accuracy, timeliness or completeness of this information, and information may be subject to change without prior notice.

Issued by The Hongkong and Shanghai Banking Corporation Limited