Never miss eStatements and eAdvices

Easily check up to 7 years of transactions anytime, anywhere, free of charge.

-

Eco-friendly – fewer printouts mean less paper ending up in landfills

Eco-friendly – fewer printouts mean less paper ending up in landfills

-

Convenient - check your financial records anytime via the HSBC HK App. Free from possible postal delay and save annual fee for paper statements

Convenient - check your financial records anytime via the HSBC HK App. Free from possible postal delay and save annual fee for paper statements

-

Up to the minute - get SMS or email notifications when your eStatement or eAdvice is ready, and receive push notifications for new statements of banking accounts on the HSBC HK App

Up to the minute - get SMS or email notifications when your eStatement or eAdvice is ready, and receive push notifications for new statements of banking accounts on the HSBC HK App

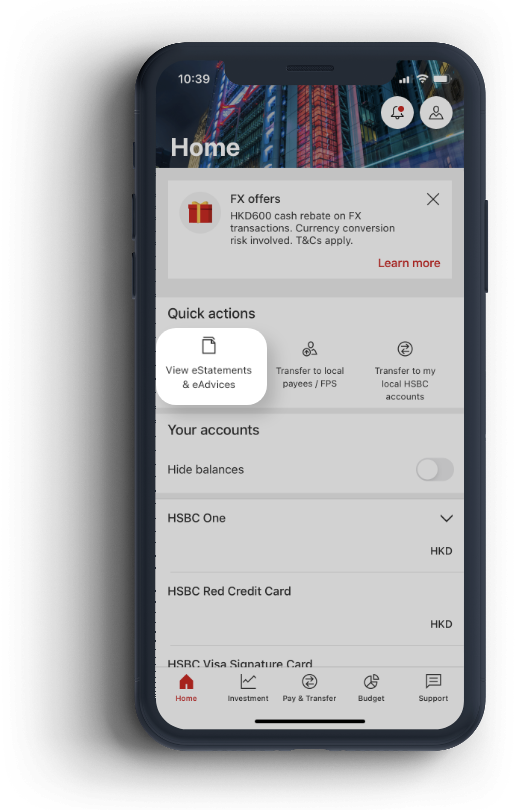

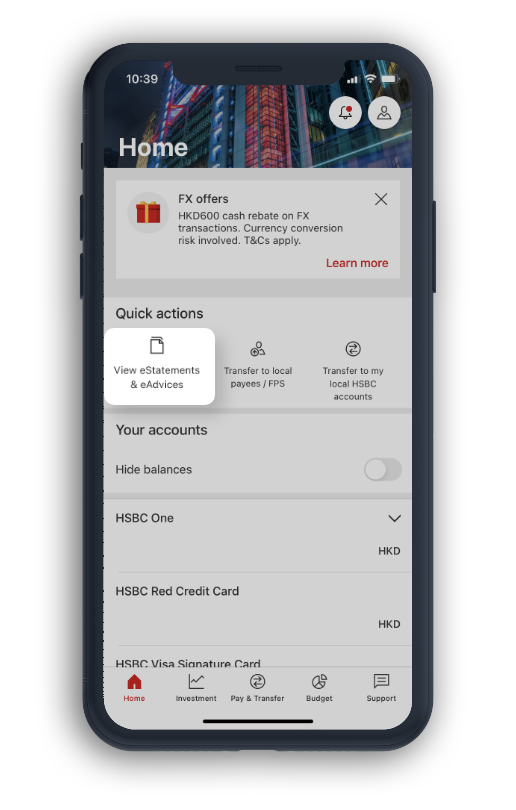

How to view and download your eStatements / eAdvices on iOS devices

How to view and download your eStatements / eAdvices on Android devices

Banking tips

Popular topics

Remarks

- • Your eAdvice are retained up to 3 months. Monthly HIBOR-based Mortgage Plan Repayment eAdvice are retained up to 12 months.

- • Your eStatements for other accounts (including investment services and securities accounts) are retained up to 24 months.

Your eStatements for integrated accounts, HKD current accounts and HKD savings accounts are retained up to 84 months.

We will accumulate your eStatements for credit card accounts up to 84 months. If an eStatement within the past 84 months is not displayed, you can request a paper statement and the fee will be waived. - • Once you’ve registered for Personal Internet Banking, you’ll no longer receive banking and credit card statements by email. Instead, you’ll be able to view your eStatements in the HSBC HK App or Online Banking. If you’re a green cardholder with a Personal Internet Banking profile, you can view your eStatements using the app or Online Banking. They’ll also be sent to your designated email address, protected by a password. For customers who newly opened mortgage or other loan accounts, you may opt for eStatement and eAdvices services via Online Banking.

- • If account holders choose to receive any paper statement in a full calendar year, account holders will be subject to a Paper Statement Service Annual Fee of HKD60. This standard charge applies to Personal Banking HK Dollar Current, SuperEase, HSBC Jade, HSBC Premier, HSBC One, Personal Integrated Account, University Student Account, Cash Card, Renminbi Savings, HK Dollar Statement Savings, CombiNations Statement Savings, Foreign Currency Current or any Credit Card accounts. The following group of customers will be exempt from the annual fee: aged below 18 or aged 65 and above, recipients of Government's Comprehensive Social Security Allowance, recipients of Government’s Disability Allowance and the physically disabled or visually impaired.

- • You should ensure that your mobile phone and other telecommunications equipment and related services are capable of receiving Push Notification Alerts through push notifications. Push notification runs on the service provided by Apple Inc. ("Apple") or Google LLC ("Google"), as applicable. Any delay or failure in delivering push notification messages due to Apple's or Google's service is beyond our control.

- • Once customers enroll the Push Notifications service, SMS as a statement ready notification will not be issued.

Note:

- • The screen displays are for reference and illustration purposes only.

- • Apple, the Apple logo, iPhone, iPad, iPod touch, Touch ID and Face ID are trademarks of Apple Inc., registered in the US and other countries. App Store is a service mark of Apple Inc.

- • Google Play and the Google Play logo are trademarks of Google LLC. Android is a trademark of Google LLC.

Your feedback is important to us – Did you find this website useful?