Quick cash withdrawals at your fingertips

Withdraw cash with our HSBC HK App, no ATM card is needed¹.

-

Set up cash withdrawal instructions in advance and shorten time spent at the ATM²

Set up cash withdrawal instructions in advance and shorten time spent at the ATM²

-

Withdraw cash at any local HSBC and Hang Seng ATM³

Withdraw cash at any local HSBC and Hang Seng ATM³

-

Withdraw easily at non-HSBC Group ATMs that support UnionPay QR Code Withdrawal in Hong Kong and mainland China⁴

Withdraw easily at non-HSBC Group ATMs that support UnionPay QR Code Withdrawal in Hong Kong and mainland China⁴

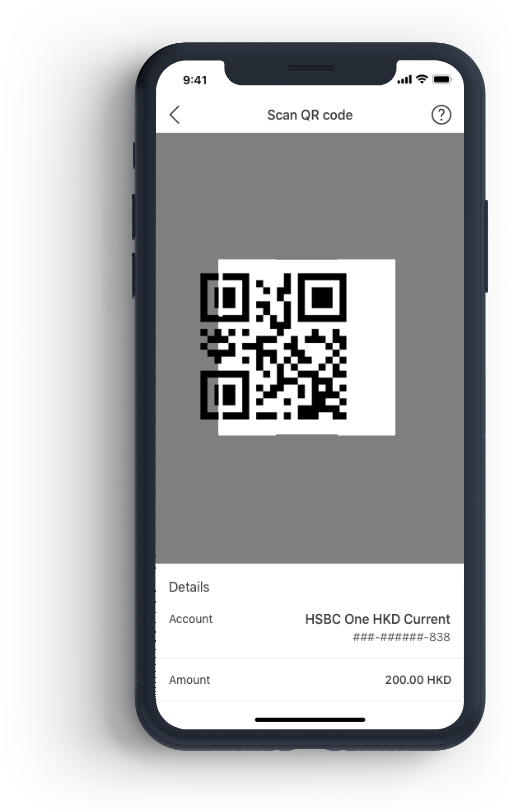

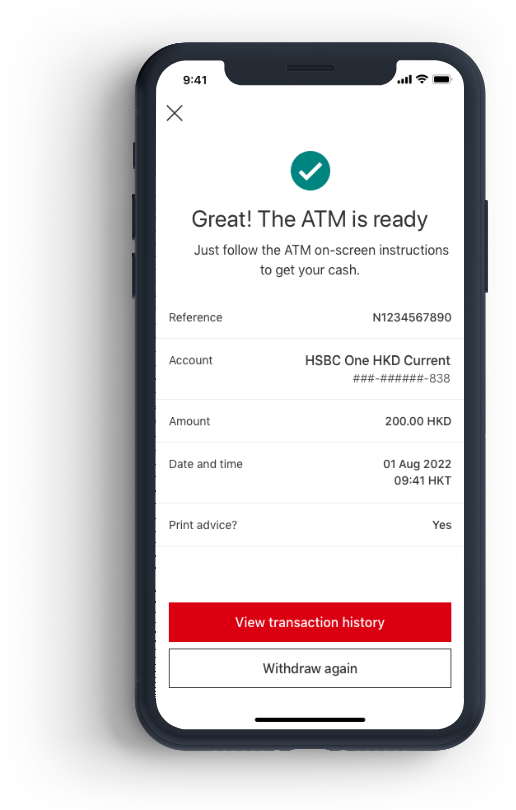

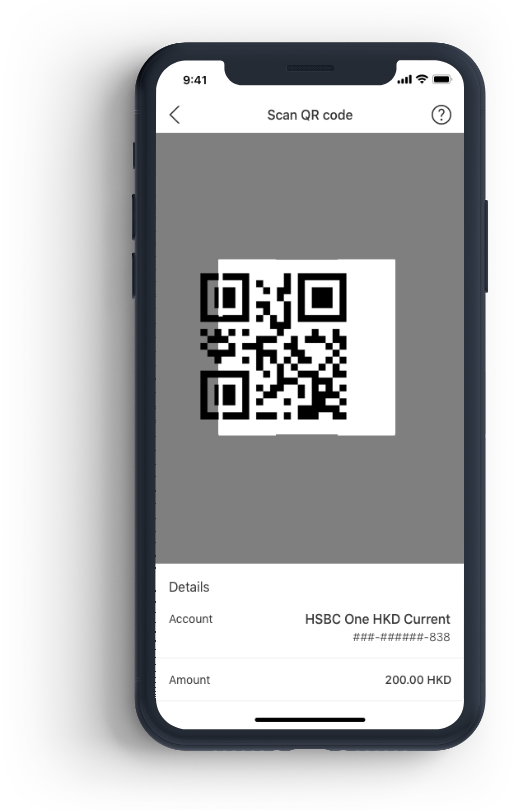

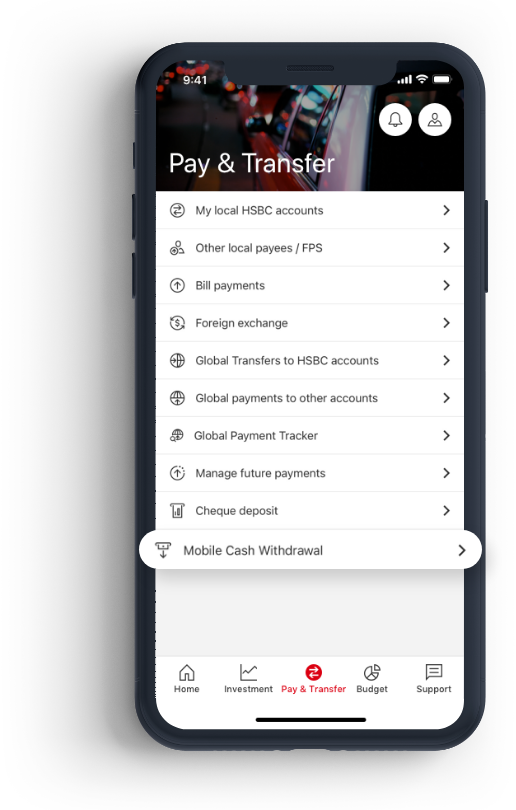

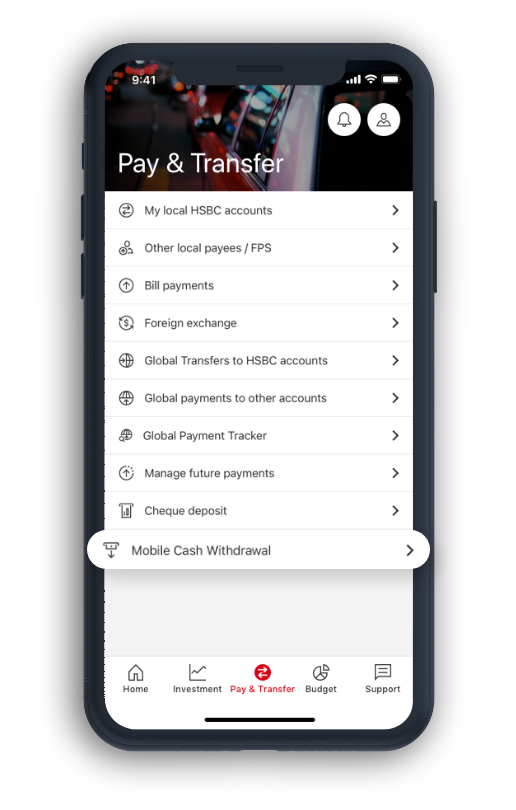

How to use Mobile Cash Withdrawal – via HSBC Group ATMs

How to use Mobile Cash Withdrawal – via non-HSBC Group ATMs

Banking tips

Popular topics

Remarks

- You can use Mobile Cash Withdrawal if you hold any of the following accounts:

(a) HSBC Integrated account

(b) HKD Current account

(c) HKD Savings account

(d) HKD Statement Savings account

(e) Cash Card account

(f) Super Ease account

(g) University Student account

(h) Revolving credit facility

You must hold an HSBC UnionPay ATM Card to make withdrawals from non-HSBC Group ATMs. - Once you have entered your Mobile Cash Withdrawal instructions on the HSBC HK Mobile Banking app, they will be valid for 10 minutes only. You will need to scan the QR code on the ATM within these 10 minutes or start a new set of instructions.

- Mobile Cash Withdrawal is available at all HSBC and Hang Seng ATMs and multi-function machines (MFMs) in Hong Kong, for HKD cash withdrawals.

- For Mobile Cash Withdrawals conducted at non-HSBC Group ATMs that support UnionPay QR Code Withdrawal, only HKD cash withdrawals are available in Hong Kong, and RMB in mainland China.

- For Mobile Cash Withdrawals at HSBC Group ATMs in Hong Kong, you can use Mobile Cash Withdrawal to withdraw up to your small-value payment limit, which is capped at HKD10,000 per day and shared by small value transfers such as FPS and non-registered payee transfers. If you need to withdraw a higher amount or use other services that are subject to your small-value payment limit, you can consider using other means of withdrawal or transfer instead, such as your physical cards. You will need to set up your small-value payment limit to use Mobile Cash Withdrawal at HSBC Group ATMs in Hong Kong if you are using the feature for the first time, if you have not set your limit yet or if your limit is set to zero.

- For Mobile Cash Withdrawals at non-HSBC Group ATMs in Hong Kong/mainland China, you can use Mobile Cash Withdrawal to withdraw up to HKD80,000 per day or as high as the daily withdrawal limit on your HSBC UnionPay ATM Card. This is also subject to the operating bank’s ATM daily/per transaction withdrawal limit. Withdrawal charges will apply.

- • For security purposes, you need to log on to the HSBC HK Mobile Banking app with your Mobile Security Key or biometric authentication.

- • Mobile Cash Withdrawal transactions are governed by our Online and Mobile Banking Terms, the General Terms and Conditions, and Integrated Account Terms and Conditions. Mobile Cash Withdrawal transactions completed at non-HSBC Group ATMs that support UnionPay QR Code Withdrawal service will be governed by ATM card terms and conditions as well. By using this feature, you confirm that you agree to be bound by them.

Note:

- • The screen displays are for reference and illustration purposes only.

- • Apple, the Apple logo, iPhone, iPad, iPod touch, Touch ID and Face ID are trademarks of Apple Inc., registered in the US and other countries. App Store is a service mark of Apple Inc.

- • Google Play and the Google Play logo are trademarks of Google LLC. Android is a trademark of Google LLC.

- • QR Code is a registered trademark of Denso Wave Incorporated.

Your feedback is important to us – Did you find this website useful?