Personal Lending Solution

Although loan services are now accessible via many channels, obtaining a best-fit loan can still be a complex and time-consuming process. The easiest way to get started is to take a few moments to establish exactly how your loan will improve your cash flow and enrich your life. Below are some tips to help you choose the right plan.

As the year approaches its end, major banks are grasping the opportunity to launch tax loan. However, do you know the differences between tax loan and personal loan in general? What should we look for before applying for tax loan? Have a look now.

As its name suggests, the main purpose of tax loan is for paying tax. In earlier times, some banks even paid tax bills directly on behalf of the applicants. But now, most banks do not have any strict requirements of loan purpose. It can be used for tax payment as well as funds for other plans, like home renovation, marriage, continuing education, cash flow, etc.

Previously, banks competed fiercely with ever lower tax loan interest rates to attract more customers. It might be different this year. In the midst of the rate hike cycle, the interest rates charged to tax loan this year would probably be higher than last year. Nonetheless, tax loan is still the loan product with the lowest rates of the year. Many consumers are closely waiting for the launch of tax loan in order to “borrow cheap money” for handling financial affairs.

In general, tax loans come with a shorter repayment period, but most of them offer at least 24 months. Similarly, loan amounts are comparable to other personal loans. Tax loan amounts could be over 10 times your monthly salary and not limited to the tax payable.

Similar to other personal loans, consumers should pay particular attention to APR when choosing tax loan and make sure not to be attracted simply by a low rate. The calculation of APR includes all applicable interest rates, handling fees, other charges, rebates and rewards. It is an indicator that allows applicants to understand the exact borrowing cost with ease. Consumers should “shop around” and compare relevant information provided by banks before applications. For the same loan amount and same repayment period, the lowest APR represents the best deal.

Interest charges of tax loans are lower than other personal loan products, and loan amounts were raised substantially and are enough for paying tax several times. However, consumers should be pragmatic when deciding how much to borrow. Of course, extra loan amounts could be used as a cash reserve, but beware of the additional interest expenses involved. In order to minimize lending cost, you may opt for loans that can be withdrawn in two instalments. In this way, you can drawdown loans according to tax payment due date so that interest expenses are saved.

Tax loan application procedure is the same as other loan products. Consumers can apply for tax loan through bank branches, websites or mobile apps. Some banks even provide a 24-hour application hotline service to suit your needs around the clock. If you need money for tax payment or cash flow, please feel free to call HSBC’s 24-hour tax loan application hotline 2748 8080 or visit the official website.

To borrow or not to borrow? Borrow only if you can repay!

If you’ve been looking at loan ads recently, you’ve probably seen the message “Borrow only if you can repay!”. This is, no doubt, wise advice. Not only should you assess your ability to repay your loans, an understanding of which loans you should apply for is just as important too. Let’s start with two common loan types in the market - installment loans and revolving loans.

If you’re all about playing it safe with a certain budget, then this is the loan for you. An installment loan has a fixed repayment period as well as a fixed monthly repayment amount. Generally speaking, these loans offer up to 60 months of repayment period. But, you have to be mindful about the loan tenor as longer repayment period will incur extra interest and you may also require to pay an additional handling fee for early repayment. What if your financial circumstances change and need extra cash flow? Some installment loans allow customers to redraw the repaid amount without the need to reapply.

If you were only looking for emergency cash, or a loan that you’re confident to repay in a short period of time, then the revolving loans would be a better option for you. Without any fixed repayment amount or period, you can withdraw cash or repay whenever you prefer; simply repay the minimum amount of 2% to 3% of the outstanding balance each month and you’ll be good to go. As oppose to an installment loan, you can settle the whole amount in one go without incurring any extra charges as the interest is calculated on a daily basis. Better still, your credit limit will be restored automatically after each repayment. However, interest rates for revolving loans are often higher than installment loans, and you’ll need to pay an annual fee for the facility.

There is no definite answer as it depends on your situation. Let’s take a look at Roy and Mat’s examples:

Both are about to get married and need extra cash for their wedding expenses.

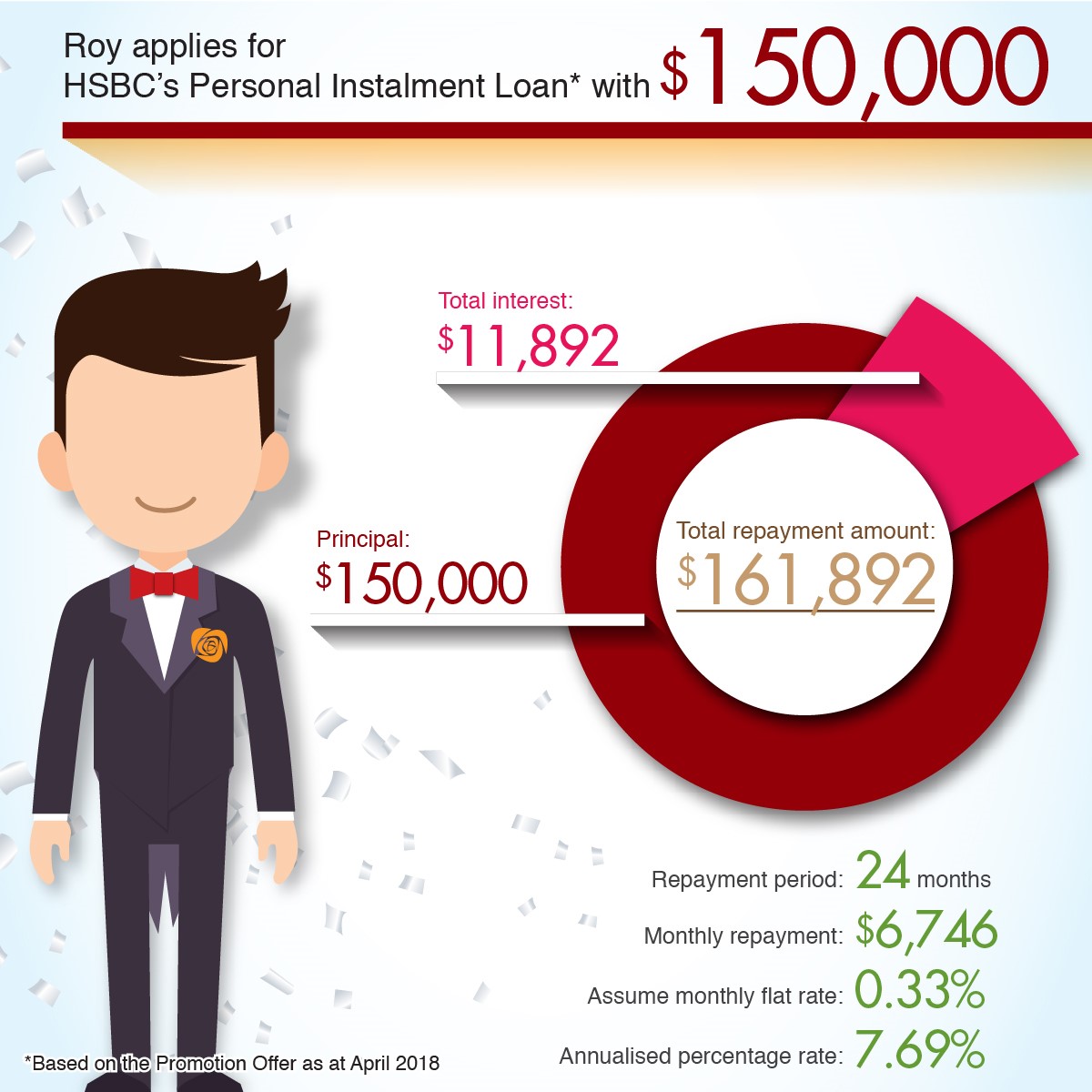

Roy and his fiancée decided to have their wedding overseas. They estimate the total cost of airline tickets, photography, wedding decorations and outfits will be around $300,000. As the wedding will not take place in Hong Kong, they are only inviting their closest friends and relatives, and hence not expecting to receive much cash subsidies from their wedding gifts. Roy has around $150,000 of savings and can afford to pay back around $7,000 a month for a loan.

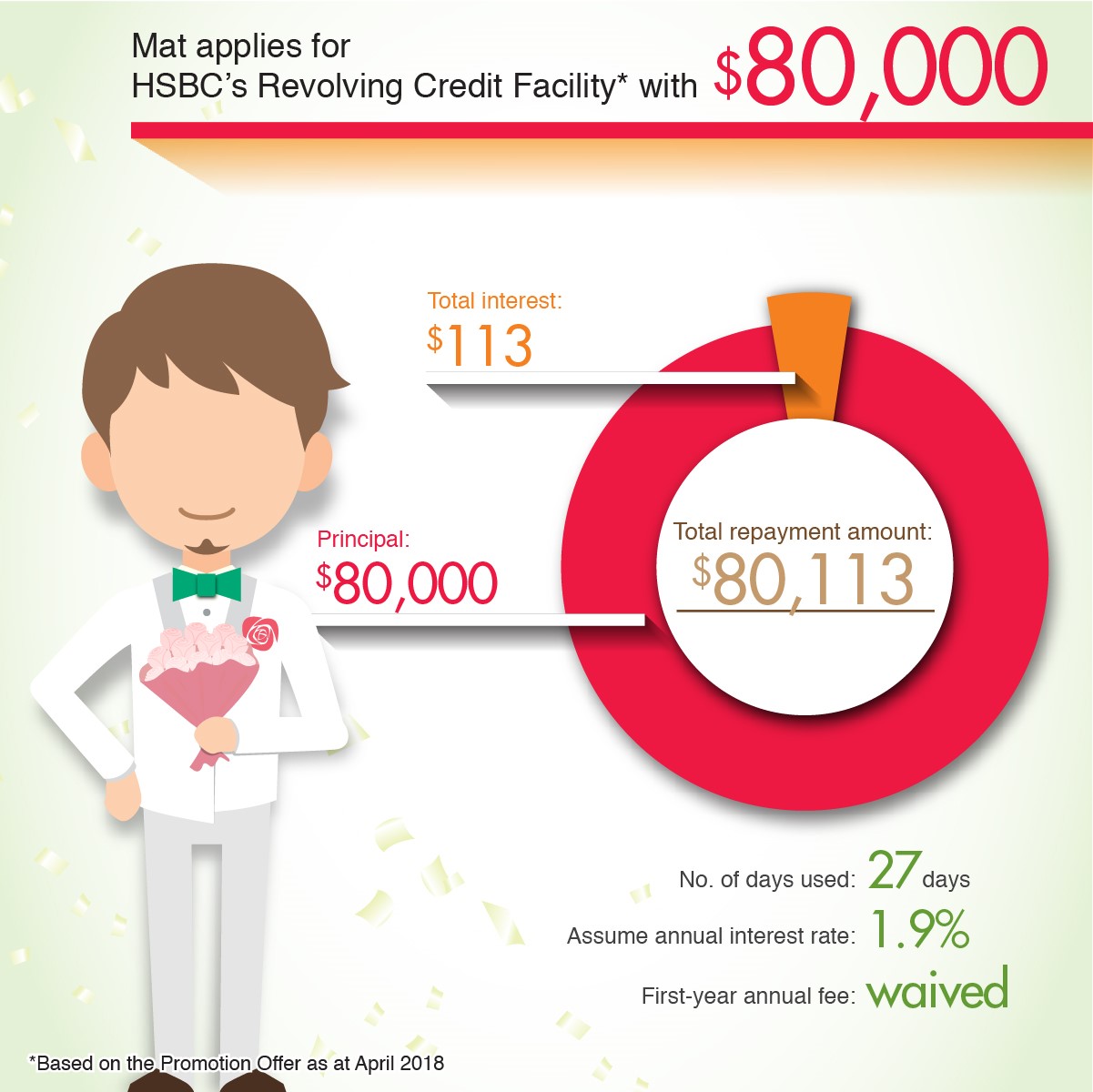

As for Mat and his future bride, they prefer to throw a massive wedding banquet in Hong Kong, with the same price tag as Roy’s of $300,000. As Mat has more savings, he only needed to loan an extra $80,000, and since the cash subsidies from the wedding gifts could also ease some of his monetary worries, he expects to repay everything within a short period.

If your situation is similar to Mat’s, whereby the loan amount is not particularly high, and you’ll be able to repay within a short period, then the revolving loan may be your preferred choice as the interest is calculated on a daily basis. Unlike the installment loan, you can definitely save on interest. But bear in mind, most revolving loans only provide low interest rates for the first 3 to 6 months, therefore you have to ensure that you can pay back within that period, or else interest expense may end up considerably higher than an installment loan.

On the other hand, if you find yourself in more of Roy’s situation, where your loan amount is quite large, and you would prefer a fixed repayment amount and period, an installment loan may be a better option for you.

To find out more and understand which type of loan is best for you, feel free to contact us at 2748 8080, or you can apply directly online. It's easy and convenient.

To borrow or not to borrow? Borrow only if you can repay!

Imagine if Jack Ma was still an English teacher and hadn’t taken the leap to start his own company? Nowadays, more people are willing to get out of their comfort zones and start a business; is this something you’ve been pondering as well?

Obviously a good idea is paramount when starting a business. If you think your idea has potential, take the leap and do something about it before it becomes dated. In this day and age, being an entrepreneur is not as difficult as it used to be; running an online shop is considered to be a good start. Though it’s not a physical store, expenses such as business registration, imports, website production, shipping, promotion and design fees, billing and more do tend to creep in. If you don’t have enough cash flow, you might need to spend time to save up, hence missing a window of opportunity for your brilliant idea coming into fruition, or worse, others who are more prepared succeeding first on that same concept.

There are choices of startup loans in the market but their application procedures tend to be more complex and require a longer time for approval. If you have to go through taxing and time-wasting procedures, the situation could have been changed by the time you get your business fund. A great idea can only succeed if the timing is right, so a personal loan could be an alternative.

By comparing with startup loans, application procedures of a personal loan used to be little simpler and the threshold may be lower as well, so it may be a relatively preferable solution. Furthermore, there are banks that can even approve loans in a few minutes if you have a payroll account, or have a proof of income with them. As long as you make up your mind, there’s really no excuse to delay starting your business.

To find out more about personal loans, feel free to call us on 2748 8080, or apply online now.

To borrow or not to borrow? Borrow only if you can repay!

Applying for loans nowadays is straightforward; a few clicks on your mobile, or place a quick call is all you need. In spite of this, there are important matters you need to double check before applying, as they might stall the procedure or even affect your chances of approval!

To find out more about personal loans, feel free to call us on 2748 8080, or apply online now.

To borrow or not to borrow? Borrow only if you can repay!

Whether it’s a fairy-tale wedding, garden party, or an overseas nuptial ceremony, we are certain you have a pretty solid idea in mind. You let your imaginations run wild, and envision the perfect setting for your perfect day, however once you start calculating the expenses, your dream wedding is suddenly not so feasible especially when you’ve insufficient fund.

There are those who decided not to go forward with a wedding because of budget issue, however getting married is one of life’s major events, the risk of regretting for not following through is always high. Why not consider to solve with a loan, rather than missing out on this big day in your life?

Your most important expense is undoubtedly booking the wedding venue. It’s no secret a decent venue costs a fortune, and even if you opt for the ‘lunch wedding banquet’ in a hotel, it could still set you back at least 100k, and we have yet to include the budget for suits, gowns, photography, decoration, hair, makeup and other expenses! You might consider some of these items redundant, however how would you feel if you keep seeing subpar wedding photos of yourself forever looping on social media platform? Quality photography and decorations accentuate the colour of a wedding, making it more memorable and, ‘instagrammable’. Furthermore, let’s not forget the costs of the deposit for all the service required, as well as setting aside an amount for honeymoon! Having said that, two people’s lifelong happiness is priceless, and no amount of money trouble should come between that.

Loaning is not an excuse for you to splurge. In fact, it might be a viable option to solve the cash flow problem. All you need to do is choose a loan that can provide the required funds for your wedding and suit your repayment ability. Banks are now incredibly flexible with repayment periods up to 60 months. Some can even be approved in a minute, and will provide you a 30-day cooling-off period without any early repayment penalty, therefore allowing you to remain in total control of your own financial management in case you change your mind.

To find out more about personal loans, feel free to call us on 2748 8080, or apply online now.

To borrow or not to borrow? Borrow only if you can repay!

No matter how old is your child, a parent’s list of worries are endless and child’s education is always on list. Besides local universities, many parents are preparing to send their children to study abroad. This will offer them the exposure of a western education and culture, further developing their independence and skillsets. However, what does that preparation actually mean? What is the annual tuition and living expenses? What else does one need to consider?

It is important to understand your children’s aspirations and interests, and place them in an environment that complements their abilities. Aligning these items will allow your child to have a happy start for studying abroad.

Admission requirements for universities vary from country to country. Some will recognize the results of the Hong Kong public examinations, while others will require a designation from public examinations such as IELTS, TOEFL, SAT, ACT, etc. Supplementary documents such as letters of recommendation or proof of financial ability may also be needed.

In terms of scores, some colleges or disciplines require DSE average scores of "4" or above, or IELTS scores of 6.0 or above. Prestigious universities such as Oxford, Cambridge will even require IELTS scores of 7.0. Should your children’s public test results fail to meet these standards, they can alternatively enroll in a community college or university prerequisite class for a period of two years, and then progress to year one of undergraduate degree if certain requirement is met.

It is important to note that certain Universities require application a year before the school term commences. This can be completed via post or the Internet. Enrolling in a bachelor's degree at a UK university can be applied through UCAS. Student visa application begins with the immigration office once you receive the confirmation of admission.

Actual expenses will vary depending on the cities and universities that you choose. Cost of living will also fluctuate depending on the proximity to the campus.

| Average annual expenditure for overseas bachelor degree programs | |||

| Country | Tuition | Living expenses (Housing, Meals, Transportation) |

Total |

| USA | HK$196,200 (USD25,000) |

HK$117,700 (USD15,000) |

HK$313,900 (USD40,000) |

| UK | HK$210,000 (GBP20,000) |

HK$126,000 (GBP12,000) |

HK$336,000 (GBP32,000) |

| Canada | HK$102,600 (CAD17,000) |

HK$72,400 (CAD12,000) |

HK$175,000 (CAD29,000) |

| Australia | HK$143,400 (AUD24,000) |

HK$121,900 (AUD20,400) |

HK$265,300 (AUD44,400) |

Needless to say, studying abroad involves a big investment. A three to four year program will require close to a million dollars. If financing does prove to be difficult, it is possible to consider other means for education funding. For example, HSBC's Personal Instalment Loan provides loan amount up to 12 times the monthly salary or HK$1,500,000 (whichever is lower). The maximum 60-month repayment period offers you a comfortable repayment schedule while covering tuition costs and living expenses. Redraw the repaid loan any time without re-applying is also available in case additional funds is needed.

Studying abroad is not a simple decision, other than visiting universities official websites for more details, you can get additional information from some of the public and private resources, like Education Bureau and Hong Kong Education & Career Expo.

To find out more about personal loans, feel free to call us on 2748 8080, or apply online now.

To borrow or not to borrow? Borrow only if you can repay!

Useful Links

If you wish to know more about the lending product details...

Personal Instalment Loan

Revolving Credit Facility

Cash Instalment Plan

Spending Instalment Plan

If you want to make application...

Personal Instalment Plan

Revolving Credit Facility

Cash Instalment Plan

Spending Instalment Plan

If you want to know more about the monthly repayment amount...

Personal Instalment Loan

Cash Instalment Plan

Spending Instalment Plan

If you need help, please call...

Personal Instalment Loan/Revolving Credit Facility: (852) 2748 8080

Cash Instalment Plan: (852) 2233 3051

Spending Instalment Plan: (852) 2233 3052

To borrow or not to borrow? Borrow only if you cay repay!