HSBC Insurance expands beneficiary definitions for life insurance policies

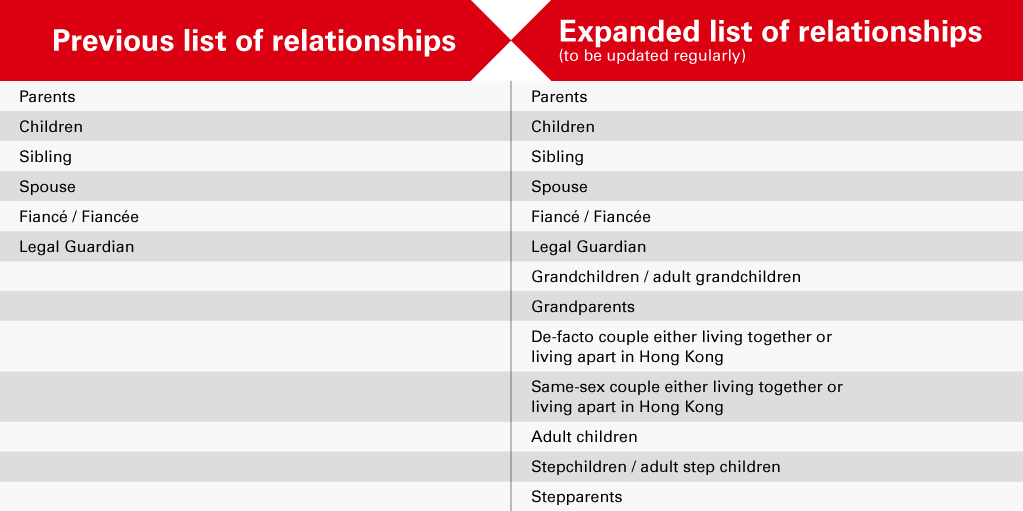

HSBC Insurance recently expanded the beneficiary definitions of its life insurance policies to include grandchildren, grandparents, stepchildren, de-facto couples and same-sex couples, among other relationships.

Customers who take out a life insurance policy from HSBC can use the expanded list of relationships to name their beneficiary at application stage, enhancing overall customer experience and accessibility to life insurance products. Currently, life insurance industry practice limits beneficiaries to relationships by law or blood upon application, with a change in beneficiary only allowed at a later stage, after a policy has been issued.

These changes reflect a need for greater clarity and transparency in addressing new customer needs as a result of a broader range of committed and familial relationships in society today.

Ed Moncreiffe, CEO of HSBC Insurance in Hong Kong, said: “HSBC Insurance understands that our customers have different needs and preferences and we are committed to providing more individuals and families in Hong Kong with greater access to protection solutions. This is an important part of HSBC’s efforts to provide inclusive solutions that reflect the increasing diversity of our customer base.

“Insurance is about protecting our loved ones in case of unexpected events and in a society that’s evolving, new and varied family dynamics and relationships are redefining who make up the people we are closest to and the nature of financial dependency. Grandparents may wish to leave their grandchildren a legacy. Couples in modern living relationships will naturally want to protect those with whom they share their financial burdens. Our aim is for our insurance solutions to be as clear, inclusive and accessible as possible.”

Insurance is an effective legacy planning tool given it can designate a beneficiary, providing a faster way for beneficiaries to access life insurance proceeds to offer immediate financial security in the event of unexpected loss.

Applicants for all HSBC life insurance policies can name the following parties as beneficiary(ies) upon application:

* applicants need to provide necessary supporting documents as requested by HSBC; declare that the policy beneficiary has an interest in the survival of the policyholder/life insured and that payment of the insurance proceeds upon death of the life insured is of benefit to the life insured i.e. it would bring financial loss and hardship to the beneficiary.