A) General

Why does HSBC Insurance expand the beneficiary definition?

HSBC Insurance is expanding the beneficiary definitions of its life insurance policies to reflect a broader range of committed and familial relationships as the society is evolving. This is part of HSBC Insurance’s customer-centric initiative to enhance overall customer experience and accessibility to life insurance products.

Is it applicable to online applications of life insurance policies as well?

Yes the expansion of beneficiary definitions applies to all new and existing HSBC life insurance policies applied through different distribution channels.

We expanded the beneficiary definition as we see new and varied family dynamics and relationships are redefining who make up the people we are closest to and thus, the nature of financial dependency.

Our aim is for our insurance solutions to be as clear, inclusive and accessible as possible.

Can I nominate my friend as beneficiary?

No. We would only cover people in committed and familial relationships.

As an example, for de-facto partners, there is a requirement that a declaration has to be made to confirm that the domestic partner and the life insured are both at least 18 years old and have been publicly represented in a committed relationship for a minimum period of 6 months on the date of making the nomination. In addition, the policy beneficiary has an interest in the survival of the policyholder/life insured and that payment of the insurance proceeds upon death of the life insured is of benefit to the life insured i.e. it would bring financial loss and hardship to the beneficiary.

If I plan to take out a life policy with HSBC Insurance and wish to nominate one of the allowable relationships shown in the table below as my beneficiary, are there any specific directions I must follow?

Yes, the policyholder and the life insured must be the same individual.

If I have an existing life insurance policy with HSBC Insurance can I nominate one of the allowable relationships shown in the table below as my beneficiary?

Yes, after a life insurance policy has been issued, the policyholder can nominate another person as a beneficiary, unless the existing policy beneficiary has been designated as an irrevocable beneficiary i.e. one that cannot be changed without agreement of the beneficiary.

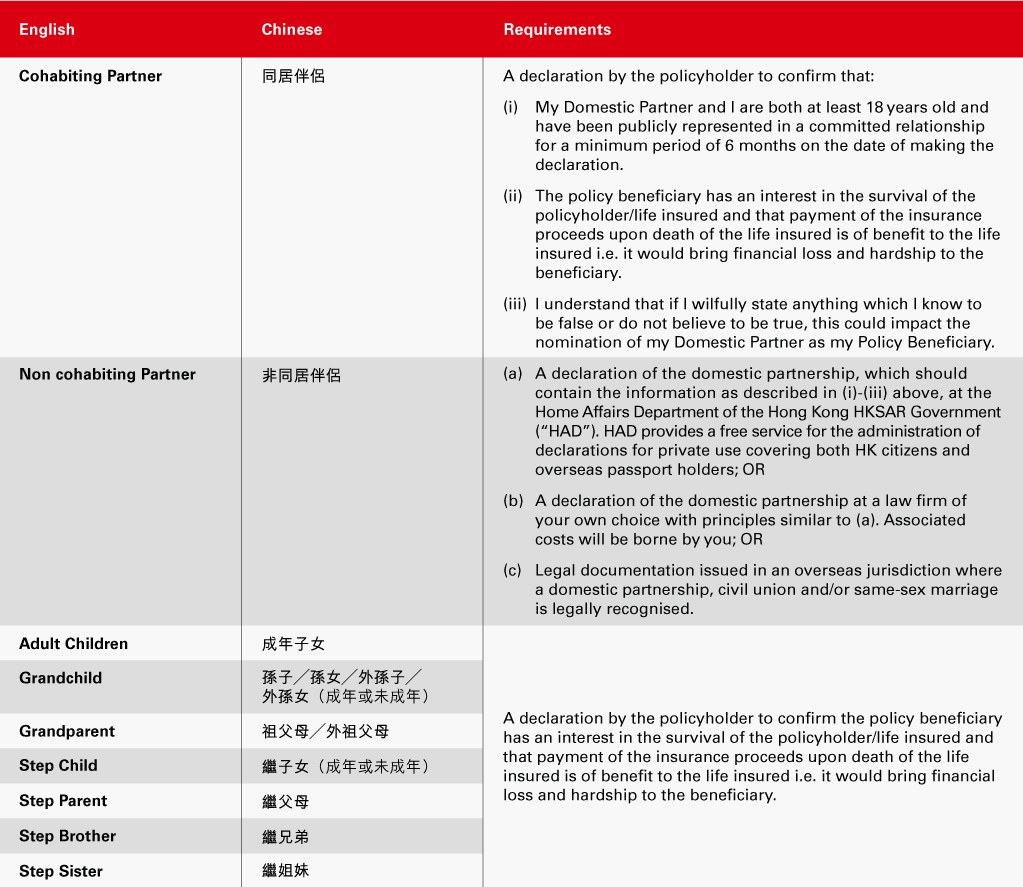

Summary of documents required to be submitted with a life insurance application form when nominating one of the following relationships as a policy beneficiary:

B) Nomination of a domestic partner as a beneficiary

What needs to be provided to verify the domestic partner status if my partner and I are cohabitating i.e. living together in a committed relationship in Hong Kong?

If you wish to nominate your domestic partner (as defined in Q3 below) as a beneficiary under your life insurance policy and you are cohabitating with your partner, the following supporting document has to be provided to HSBC Life (International) Limited for consideration during the beneficiary nomination process:

A declaration by the policyholder to confirm that:

(a) My domestic partner and I are both at least 18 years old and have been publicly represented in a committed relationship for a minimum period of 6 months on the date of making this statement.

(b) The policy beneficiary has an interest in the survival of the policyholder/life insured and that payment of the insurance proceeds upon death of the life insured is of benefit to the life insured i.e. it would bring financial loss and hardship to the beneficiary.

(c) I understand that if I wilfully state anything which I know to be false or do not believe to be true, this could impact the nomination of my domestic partner as my policy beneficiary.

What needs to be provided to verify the domestic partner status if my partner and I are not cohabitating i.e. in a committed relationship, but living apart?

If you wish to nominate your domestic partner (as defined in Q3 below) as a beneficiary under your life insurance policy and you are not cohabitating, ONE of the following supporting documents has to be provided to HSBC Life (International) Limited for consideration during the beneficiary nomination process:

(a) A declaration of the domestic partnership, which should contain the information as described in B1 above, at the Home Affairs Department of the Hong Kong HKSAR Government (“HAD”). HAD provides a free service for the administration of declarations for private use covering both HK citizens and overseas passport holders; OR

(b) A declaration of the domestic partnership at a law firm of your own choice with principles similar to (a). Associated costs will be borne by you; OR

(c) Legal documentation issued in an overseas jurisdiction where a domestic partnership, civil union and/or same-sex marriage is legally recognised.

For (a) and (b), the declaration is made by virtue of the Oaths and Declarations Ordinance (Cap. 11) in Hong Kong. In the event that an individual knowingly and wilfully makes a false declaration, this would be a criminal offence.

What is a domestic partner?

We recognise unmarried domestic partners the same way as married spouses in respect of life insurance provided that it is legally permissible and that your partner satisfies the following requirement:

“A domestic partner is defined as a person (of the same or opposite gender) who has been in a continuous relationship with you, during which period, neither you nor your partner were or are still married to or partnered with any other person. Furthermore, your partner and you have been publicly represented in a committed relationship for a minimum period of 6 months at the date of notifying HSBC Life (International) Limited.”

Are my parents and siblings considered as my domestic partners?

A domestic partnership as defined in point 3 above in essence means a de facto marital relationship. As such, parents and siblings would not count as your domestic partners.

How to make a declaration for nominating non-cohabiting partner as beneficiary and what kind of documents should I bring along to HAD or a law firm?

To make a declaration, you can approach any of the Home Affairs Enquiry Centres of HAD in person or engage a law firm.

You will need to fill in the “Non-cohabiting Partner as Beneficiary” Form as provided by HSBC Life (International) Limited and read out the declaration in front of the Commissioner for Oaths, and sign the declaration. You will need to bring along your Identity Card/Passport to identify yourself.

Where can I find the declaration service time slots and the addresses of the Home Affairs Enquiry Centres?

Please visit the Home Affairs public website for details of service time slots in the District most convenient to you. https://www.had.gov.hk/en/public_services/public_enquiry_services/provided.htm

Consequence management for making false declarations?

If you wilfully make a false declaration regarding your domestic partnership, the validity of your beneficiary nomination may not be able to be legally recognised and any insurance proceeds payable will only be made to your estate.

What if I have queries relating to the definition of domestic partner?

Should you have queries relating to the definition of domestic partner under point 3 above, please contact HSBC Life (International) Limited.

C) Nomination of other family members as a beneficiary

What needs to be provided to HSBC Life (International) Limited if a policyholder nominate other family members as a beneficiary, including grandparents, grandchildren or step children?

The policyholder needs to fill in a “Nominating Grandchild/Grandparent/Step Child/Step Parent/Step Brother/Step Sister as Beneficiary” Form as provided by HSBC Life (International) Limited to confirm the policy beneficiary has an interest in the survival of the policyholder/life insured and that payment of the insurance proceeds upon death of the life insured is of benefit to the life insured i.e. it would bring financial loss and hardship to the beneficiary.

Do you cover adopted children?

Yes we cover all children, by blood or adopted.