At a Glance: Understanding the Different Obligations of Mortgagor, Borrower and Guarantor

When applying for a mortgage, in addition to the owner, other parties can take up the role of borrowers or guarantors. This article covers the different obligations of each role and the impact on their future borrowing capacity.

Buying property can be a personal decision, or part of a family's wealth strategy. Do you know that, when applying for a mortgage loan, apart from the mortgagor (property owner), you may introduce other people to take part as borrower or guarantor? The following cases illustrate the obligations and differences of each of these roles:

Mortgagor = Property Owner

|

|

Example:

Mike is a civil servant with a stable income who just bought a property in his own name, and he can afford the mortgage repayment without anyone else's contributions. He can apply for a mortgage by himself, and that makes him both a mortgagor and a borrower. What this means:

|

Borrower = The person responsible for the loan debt and for making payments

|

|

Example:

Anson is getting married next year and wants to buy a new apartment in joint names with his fiancée. They will both be the owners (mortgagors) while Anson (also as borrower) will be responsible for repaying the mortgage. What this means:

|

||

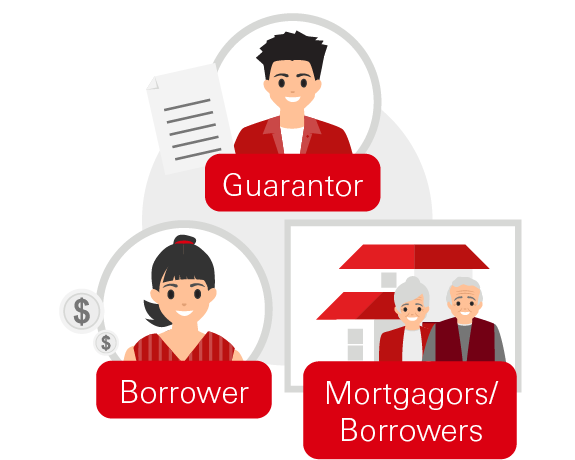

Guarantor = The person who provides a guarantee for a mortgage

|

|

Example:

Gigi's parents wanted to enjoy their retirement in a new home, but it is difficult to apply for a mortgage without sufficient income. Gigi listed herself as additional borrower and her parents as the property owners (mortgagors + borrowers). However, her repayment ability was still insufficient to take out the mortgage, so her brother signed on as a guarantor. What this means:

|

Tips:

Tips:

-

Whether you are thinking of becoming a mortgagor, borrower or guarantor, you must consider the impact on your future borrowing capacity, and plan carefully, especially if you intend to buy other properties in future.

Note: Mortgage loan approval is subject to the applicant's personal circumstances and the applicable terms and conditions and policies at the time. Approval is subject to credit assessment and the bank reserves the right of final decision.

To borrow or not to borrow? Borrow only if you can repay!

All information is for reference only. All services provided by The Hongkong and Shanghai Banking Corporation Limited ("HSBC") are subject to the prevailing terms and conditions and the applicable terms and conditions shall prevail if there are any inconsistencies or discrepancies with the content. HSBC is not responsible for any liabilities, costs, damages, or any consequences stemming from reliance on the information provided. Content provided should not be treated as any investment or legal advice or professional opinion, and is not solicitation or advice of any products or services. HSBC does not guarantee the accuracy, timeliness or completeness of this information, and information may be subject to change without prior notice.

Issued by The Hongkong and Shanghai Banking Corporation Limited