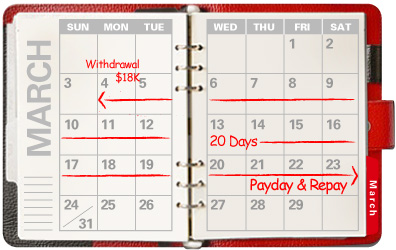

Simply plan ahead and select a loan products that best suits you to better grasp the opportunity! Revolving Credit Facility provides you a standby credit to solve any sudden need you have for funds. There is no fixed repayment period or amounts, and the interest is calculated on a daily basis.

How's the interest calculated?

* Please refer to the interest rate table for respective APRs. Terms and Conditions apply.

^ Based on a first 3-month introductory interest rate of 1.90% p.a., the daily interest is less than HK$1.

Note: The above interest payment calculation and image display are for reference and illustration purposes only.

Apply now from 14 December 2023 to 30 January 2024 to enjoy the below offers:

| Apply 24/7: | |

|

hsbc.com.hk/loan |

|

2748 8080 |

Revolving Credit Facility Terms and Conditions

Notice relating to the Personal Data (Privacy) Ordinance

Reference number: Y23-U2-LRCF611

To borrow or not to borrow? Borrow only if you can repay!