The definition of “middle class” has long been a subject of debate. In May 2022, HSBC Premier conducted a survey of 1,000 people in Hong Kong for fresh insights into middle class aspirations and financial needs. A key finding: a middle class person is widely thought to be someone with an average of HKD5.9 million in liquid assets. And, due to a combination of social and other factors, the ways in which the middle class prefers to manage and preserve its wealth is evolving into new trends.

Educating the next generation remains a top priority

Investing in their children’s success

Middle class parents put aside at least

HKD

3.85 million

for their children’s overseas education in countries like the UK, Canada, Australia.

Paving the way to an overseas education

35%

of middle class parents plan to send their children overseas to continue their education, citing key reasons such as better education arrangement, the stressful curriculum in Hong Kong, and lower exchange rates.

A homely gift for the gifted graduate

Two-thirds of middle class parents have earmarked approx.

HKD

1.4 million

mainly for helping their children buy a property after graduation.

Financial opportunities and challenges are constantly evolving for middle class families in Hong Kong. We need to understand what matters most to these customers in order to curate the right products and services.

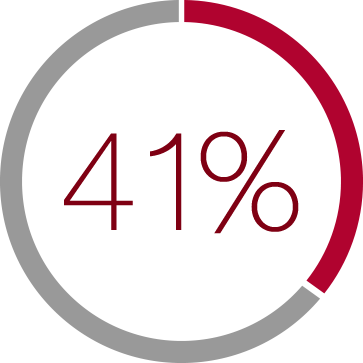

of respondents take a cautious/very cautious approach to wealth management, an increase of 11% since the start of the pandemic. Many of them have also switched to the more conservative strategies below:

of middle class responents are holding more cash than before the pandemic.

76% of respondents consider making property investments a viable option for preserving their wealth; 2/3 of them own an average of 1.4 properties.

Earlier retirement planned, but savings are not growing fast enough.

7 out of 10 young middle class people plan to retire early at the age of 56 so they can start doing what they love.

But 47% of respondents say they have fallen behind on their savings because of the impact of the pandemic. To make up for lost time, they are cutting expenses, adding part-time work to their primary jobs or running their own businesses in order to supplement their incomes and stay on track for early retirement.

Our middle class customers have complex wealth ambitions, which requires comprehensive wealth planning to achieve their short, medium and long term goals.

We understand that, as the world and market conditions change, so too will your wealth goals. HSBC is committed to embracing change to help you do the same. We provide our HSBC Premier clients with the dedicated Future Planner and Wealth Portfolio Intelligence Service to support their financial ambitions across different life stages. Our tailored wealth solutions combine cutting-edge technology and a human touch to help you move up the wealth ladder. And if your children will be studying abroad, exclusive support services including overseas education advisory, Multi-currency Supplementary Debit Card, overseas study insurance and more are available to meet all your planning needs. All of which means that, no matter how different the future is shaping up to be, you and your children can always pursue your wealth and life goals with confidence.

Risk Disclaimer

Investment involves risk. This information is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. All products in any financial planning tool are generalized for simulation purpose without taking product suitability and affordability into account. You should carefully consider whether any investment product or service is appropriate for you in view of your personal circumstances. Past performance is no guide to future performance nor do we represent that any movements provided in the simulation tool are likely to occur in the future. There may not be any HSBC product that provide the same outcome as the simulation in the financial planning tool. Investors should refer to the individual product explanatory memorandum or offering document for further details and risks involved. The price of investment products may move up or down. Losses may be incurred as well as profits made as a result of buying and selling investment products. The information is subject to change without notice.