All-round healthcare coverage tailored to your individual needs

VHIS insights – Tax Season

Filling in your tax return form is not always easy, but if you do it right, you could enjoy tax savings. The annual premium for each VHIS policy is good for up to HKD8,000 in taxable income deduction per person per year. There are just a few things to keep in mind when you’re applying for tax deduction.

Policies for family members are tax-deductible

Unlimited number of life insureds and policies

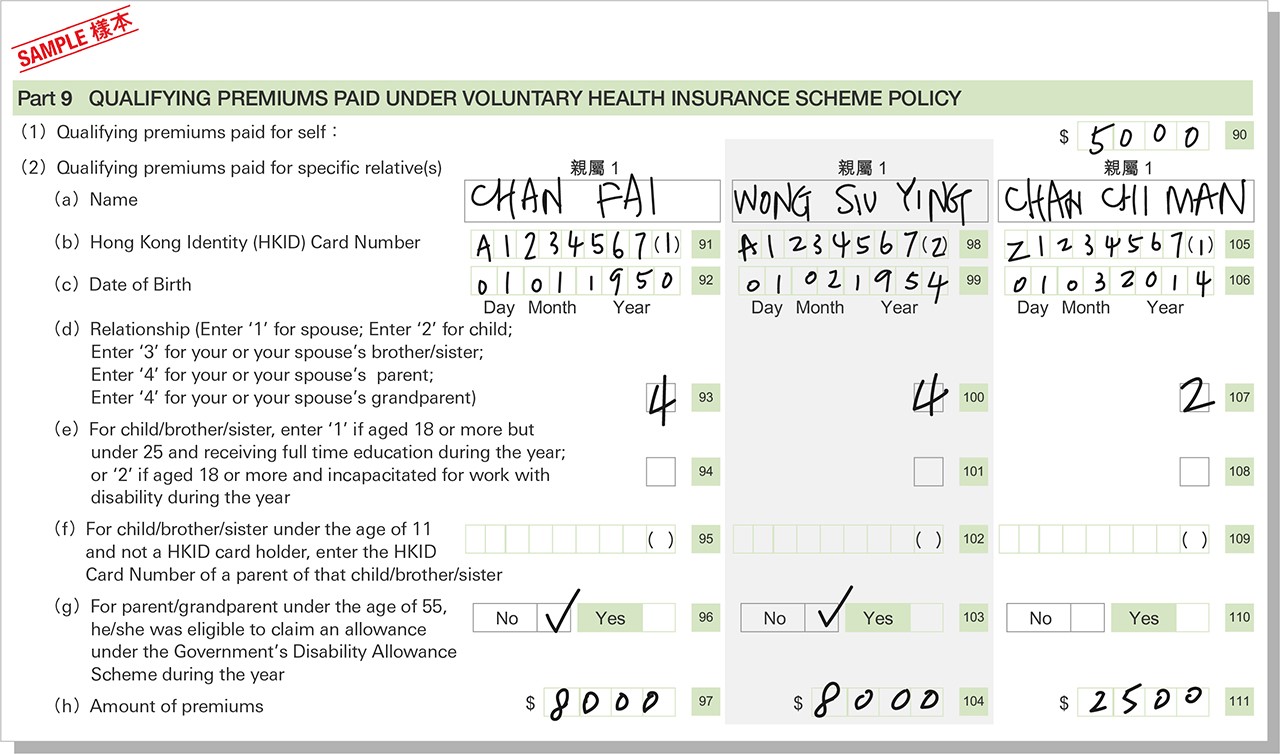

When you’re filling in the VHIS premium amounts in Section 9 of the tax return form, remember that there’s no limit to the number of family members and policies supported by you. The tax-deductible premium amount, however, is subject to a maximum of HKD8,000 per life insured per tax assessment year. Designated family members can include the taxpayer’s spouse and children, and the paternal and maternal grandparents, parents and siblings of the taxpayer and their spouse. A tax deduction quota of up to HKD8,000 applies to each of these family members. So the more eligible family members you purchase VHIS policies for, the more you’ll be able to claim for tax deduction.

A reminder: only the policyholder can claim the tax-deductible amount but not the life insured of the VHIS policy (unless they are the same person). In other words, different taxpayers who have purchased a VHIS policy for the same family member can each apply for a tax deduction of up to HKD8,000. Check out the following examples to see how it works.

Example 1: Single man

Jasper holds a VHIS policy, for which he pays an annual premium of HKD12,000. Since this exceeds the upper limit, the tax-deductible amount he is eligible to claim HKD8,000.

|

Annual premium paid: HKD12,000 |

Exceeds upper limit of HKD8,000 |

Total tax deduction claimable: HKD8,000 |

Example 2: Married woman, supporting her parents-in-law and a son

Lenny is the policyholder of 4 VHIS policies, with herself, her father-in-law, mother-in-law and son as the life insured respectively. The annual premiums she pays are HKD5,000, HKD16,000, HKD12,000 and HKD2,500 respectively. That means the premiums for two of her policies exceed the HKD8,000 limit.

|

Annual premium paid:

HKD5,000  |

Does not exceed the limit of HKD8,000 |

Tax deduction claimable: HKD5,000 |

|

Annual premium paid:

HKD16,000  |

Exceeds the limit of HKD8,000 |

Tax deduction claimable: HKD8,000 |

|

|

Annual premium paid:

HKD12,000  |

Tax deduction claimable: HKD8,000 |

||

|

Annual premium paid:

HKD2,500  |

Does not exceed the limit of HKD8,000 |

Tax deduction claimable: HKD2,500 |

The total tax-deductible amount Lenny can claim is thus: HKD5,000 + HKD8,000 + HKD8,000 + HKD2,500 = HKD23,500

Below is a sample tax return form for your reference

*Reference: Section 9 of Tax Return - Individuals

Example 3: Each sibling purchasing VHIS policies for their mother

Cammy has bought 2 VHIS policies for her mother, for which she pays annual premiums of HKD4,000 and HKD6,000 respectively. Since the total has gone over the limit, she can only claim a tax deductible amount of HKD8,000.

|

Annual premium paid:

HKD10,000  |

Exceeds the limit of HKD8,000 |

Tax deduction claimable: HKD8,000 |

At the same time, her brother Joseph has also bought a VHIS policy for his mother, paying an annual premium of HKD6,000. Since this premium amount is below the limit, Joseph can claim the full HKD6,000 tax-deductible amount.

|

Annual premium paid:

HKD6,000  |

Does not exceed the limit of HKD8,000 |

Tax deduction claimable: HKD6,000 |

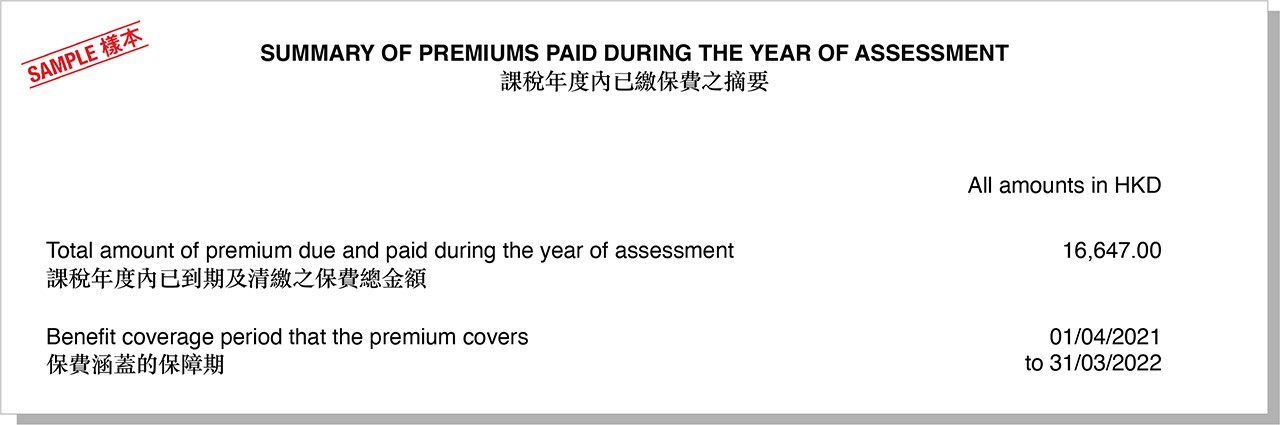

You’ll find what you need to complete your tax return form in the Summary of Premiums Paid for the Current Tax Assessment Year or other related documents. Keep this information at hand when you’re doing your tax return to save yourself the trouble of doing all that adding and subtracting.

Even though you don’t have to include your annual VHIS summary with your completed tax return form, it is advisable to keep it for 6 years for possible selected reviews by the Inland Revenue Department.

The Hong Kong SAR government introduced a trio of tax-saving schemes. In addition to eligible VHIS policies, certified Qualifying Deferred Annuity Plans and Tax-deductible Voluntary Contributions plans will also allow you to avail yourself of potential tax benefits.

Sources:

- VHIS tax deduction: https://www.vhis.gov.hk/en/consumer_corner/tax-deduction.html

- Tax Deduction for Qualifying Premiums Paid under the Voluntary Health Insurance Scheme (VHIS) Policy: https://www.gov.hk/en/residents/taxes/salaries/allowances/deductions/vhis.htm

- How much tax can you save with VHIS? https://www.ifec.org.hk/web/en/financial-products/insurance/product-types/vhis/tax-savings-vhis.page

- Completion and Filing of Tax Return - Individuals: https://www.ird.gov.hk/eng/tax/ind_ctr.htm

- [Tax return 2021] Handy guide to tax return and tax deduction https://wealth.hket.com/article/2960206/【報稅2021】報稅、扣稅攻略懶人包

Special offers

Apply online for HSBC VHIS Flexi Plan with the promo code "MEDI30" to enjoy 30% off first-year premium discount.

And an extra 10% off when you apply with your family members.

Sign up for Well+ now and you can enjoy a first-year premium discount up to 60%!

Offer ends 31 March 2026. T&Cs apply.

Disclaimer

Before claiming any tax deductions, you must meet all eligibility requirements set out in the provisions under the Inland Revenue Ordinance, while following the guidance issued by the Inland Revenue Department (“IRD”) of the Hong Kong SAR. This general information about tax is for reference only and should not be the basis for any tax related decision. Please note that the actual tax benefits of these policies would depend on your personal tax position and there might not be tax deductions benefits if you are not subject to salaries tax and personal assessment in the relevant year of assessment. Should you have any enquiries, please contact independent profession tax advisor. Please note that the tax law, regulations and / or interpretations are subject to changes and may affect any related tax benefits including but not limited to the eligibility criteria for a tax deduction. HSBC Life (International) Limited (“HSBC Life”) or The Hongkong and Shanghai Banking Corporation Limited (“HSBC”) are not responsible for informing you about any changes in laws, regulations or interpretations, and how those may affect you. This article shall not constitute any tax advice. HSBC Life shall not be liable for any loss, costs or damages which may be incurred (directly or indirectly) due to or relating to the contents herein.

Tax deduction eligibility is only applicable to policyholders or his/her spouse who are Hong Kong taxpayers. Tax deduction for the qualifying premiums paid under a VHIS policy (not including levy) will be based on the premiums paid after deducting the premium discount (if any). For more information, please refer to www.ird.gov.hk or seek independent tax advice.

The information contained in this article is for general reference only and is not intended to constitute a recommendation or advice to any person or to be the basis for any financial decision. No person should act on any information in the article without seeking professional advice.

HSBC Life does not intend to give any tax advice to any person, and will not give any tax advice. This document shall not constitute any tax advice. Please seek independent advice on tax from your own independent advisor when necessary.

The information contained in this article does not constitute an offer for the purchase or sale of any banking or insurance products or services. Products and services are subject to individual needs. Contact your financial planner to review your financial needs and risk acceptance level. This article should not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose.

HSBC Life has based this article on information obtained from sources it believes to be reliable, but which it has not independently verified. HSBC Life and HSBC makes no guarantees, representations or warranties and accepts no responsibility or liability as to its accuracy or completeness. Information in this article is subject to change without notice.

HSBC Life is authorised and regulated by the Insurance Authority to carry on long-term insurance business in the Hong Kong SAR. HSBC Life is incorporated in Bermuda with limited liability, and is one of the HSBC Group’s insurance underwriting subsidiaries. Insurance products provided by HSBC Life are only intended for sale through HSBC in the Hong Kong SAR. Policyholders are subject to credit risk of HSBC Life. For monetary disputes arising between HSBC and you out of the selling process or processing of the related transaction, HSBC will enter into a Financial Dispute Resolution Scheme process with you; however any dispute over the contractual terms of the product should be resolved between HSBC Life and you directly. For details and information about HSBC Life products, please visit the insurance-related pages at HSBC’s website or visit our branch. HSBC Life is a registered VHIS provider (Registration no.: 00042, effective date: 29 May 2020)

All the information in the article is updated as of June 2021

Issued by HSBC Life (International) Limited (Incorporated in Bermuda with limited liability)

© Copyright. HSBC Life (International) Limited. All rights reserved.

Date