Cyber security is more critical than ever with the increasing sophistication of scams.

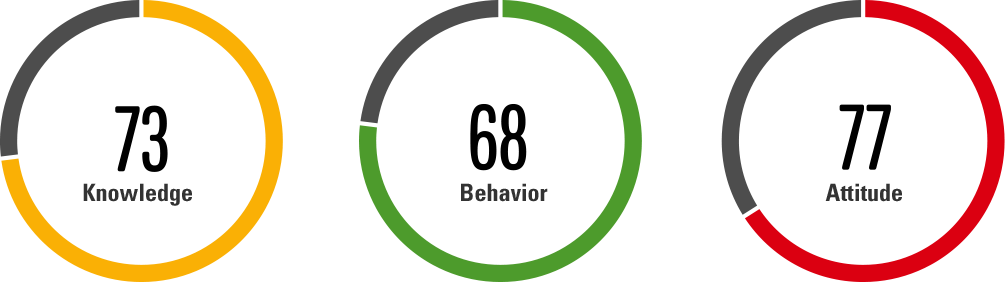

HSBC surveyed 1,005 Hong Kongers between 18-55 years old in Feb 2020, where we developed a Cyber Security Index (ranging from 0-100) comprising three key pillars: knowledge, behavior and attitude.

Here’s some insightful findings:

With an average score of 73 in cyber security knowledge, the behavior score was just 68.

66% of respondents use the same passwords on several platforms, which is very risky.

Gen Z (Age 18-24) has the highest scores in knowledge and attitude, but lowest in behavior, indicating they’re not translating their knowledge into the right behavior.

The tendency for risky behaviors is also high among Gen Z. For example, they grant permission without checking T&C, sharing personal information in messenger/ cloud-based conversations, using public wifi to access online banking, and ignoring suspicious log-on alerts etc.

Have you done similar risky behavior?

Only 8.5% of respondents are considered as “Cyber Smart”, scoring 80+ in all three pillars.

With a long history in Hong Kong, HSBC cares to protect our customers, particularly around cyber security.

HSBC users score higher than average in Cyber Security Index where 44% of respondents are aware of our cyber security educational information. According to the survey, HSBC is the most trusted bank in Hong Kong market.*

For more security tips, please visit HSBC Cyber Security Hub.

Hong Kongers concern about data privacy. Half of the respondents are willing to connect their bank accounts to smart devices, yet only 7% are comfortable to link that to a third party app. Only 38% of respondents trust virtual banks and are willing to try. Virtual banking still has a long way to go.

Here’s a simple guide to be “Cyber Smart”, brought to you by HSBC.

*Statistics from HSBC cyber security survey 2020