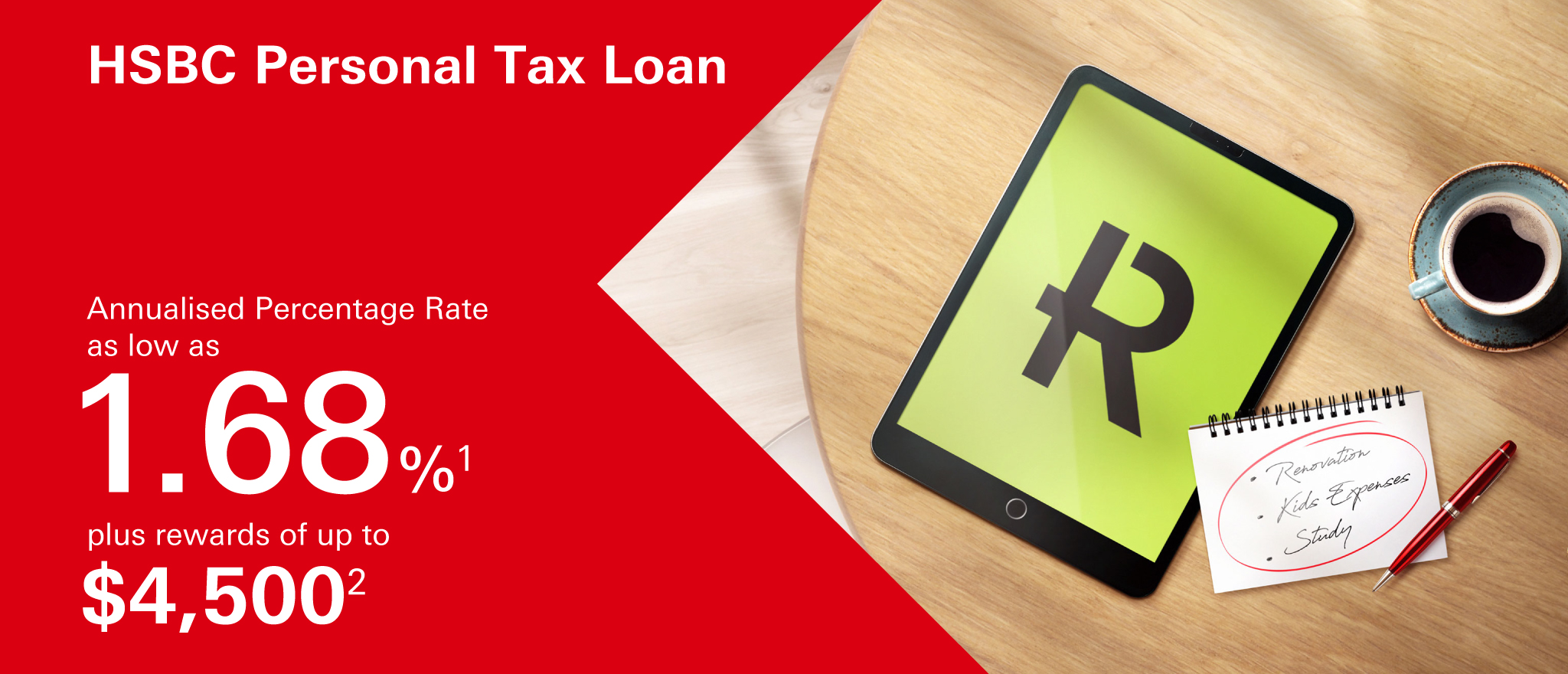

Annualised Percentage Rate as low as 1.68%1 |

Successful application offer of up to $4,500 rewards3 |

Document submission offer of HK$300 cash rebate4 |

Annualised Percentage Rate as low as 1.68%1 |

Successful application offer of up to $4,500 rewards3 |

Document submission offer of HK$300 cash rebate4 |

Additional $288 RewardCash for New-to-Credit Card customers8,10

Additional HK$288 cash rebate for FX customers9,10

Call 2748 8080 (24-hour application hotline)

Visit hsbc.com.hk/loan

Note: The APR of this promotion ranges from 2.08% to 21.70%, with repayment period of 6 to 24 months.

To borrow or not to borrow? Borrow only if you can repay!

Reference number: Y23-U2-LTAX63