For your peace of mind, be sure to designate a beneficiary

Life insurance can help protect their loved ones. But there are several things that are easily overlooked during the application process. Who can be a beneficiary? Why is it important to assign one? Read on to find out.

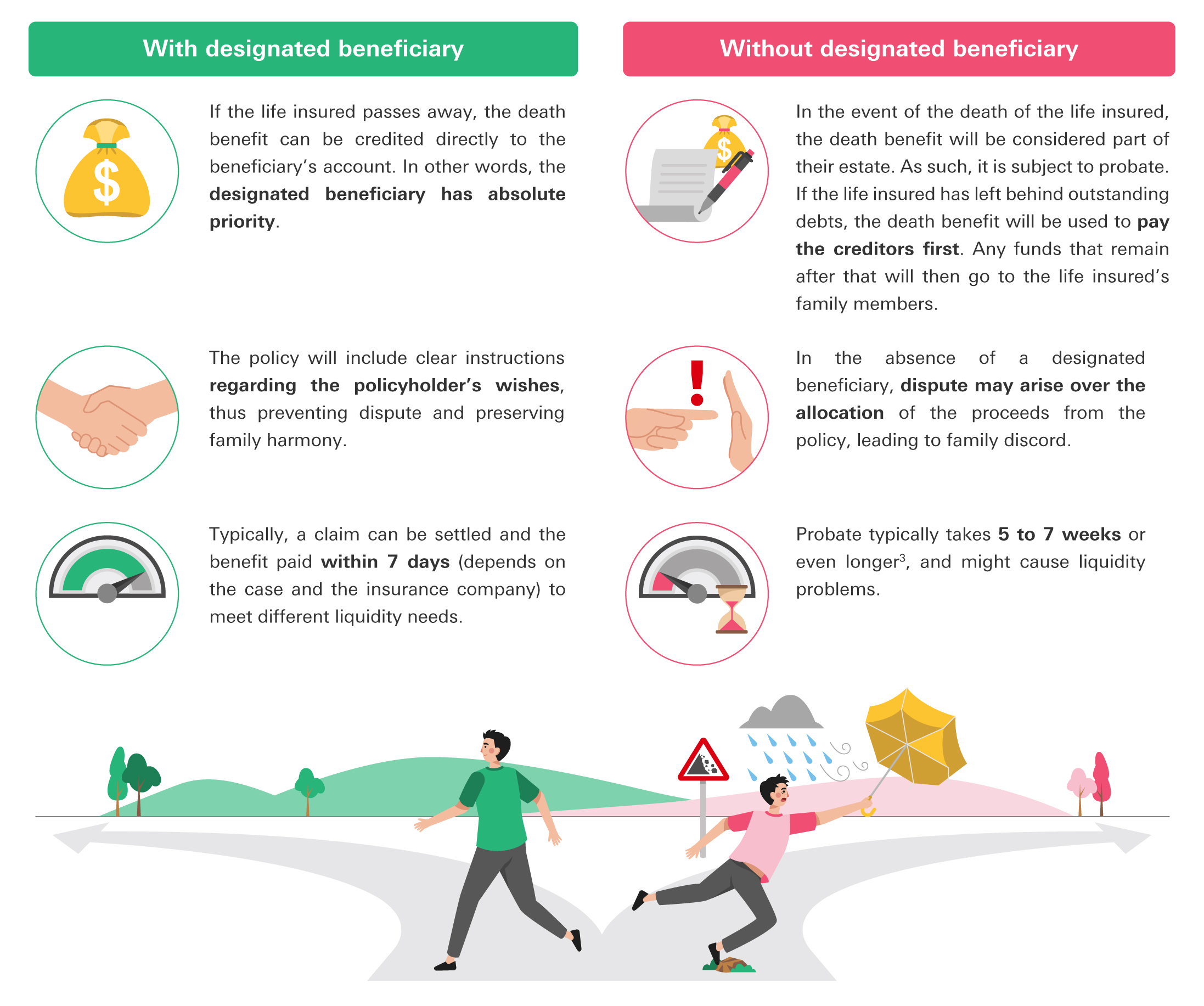

The beneficiary is the individual who receives the insurance benefit when an insured event happens, for instance, if the life insured passes away. The policyholder can assign a beneficiary while applying for an insurance policy or at any time after the policy has been issued, as a way to protect a loved one against financial pressure at critical times.

At the time of application, an insurable interest has to exist between the beneficiary and the life insured, that is, if anything happens to the life insured, the beneficiary will likely suffer a financial loss or other hardships. With that in mind, you can consider designating any of the following persons and entities as a beneficiary 1,2:

If the beneficiary is below the age of 18, a trustee can be appointed to manage the proceeds from the death benefit on their behalf until they reach the age of 18. Once the policy has been issued, the policyholder can nominate any person or legal entity as the beneficiary, such as an accredited charitable organisation as a way to help others and give back to society.

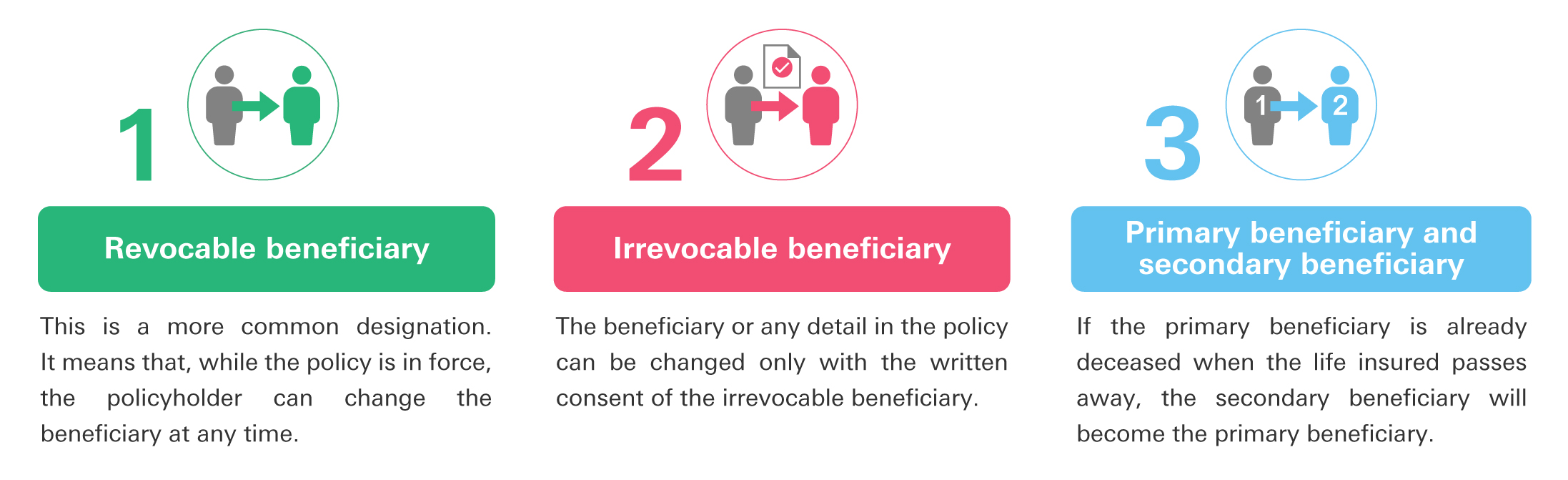

All you need to do to nominate a beneficiary is complete the relevant change of beneficiary form and return it to the insurance company (if an irrevocable beneficiary is being nominated, the form should be accompanied by a signed copy of the beneficiary’s identity document). Actual requirements may vary; please contact HSBC Life or your Relationship Manager for details. For added convenience, you can also submit the application online, for example by logging on to the HSBC website or mobile banking app.

There are many variables along your life journey. That’s why it’s important to start planning for the future as early as possible. Nothing can replace the long-term protection you give your loved ones in the form of a life insurance policy. When applying for a policy, be sure to designate a beneficiary and make other necessary arrangements. It will give you a lot of peace of mind. One more thing. Remember to review your existing policy regularly and change the beneficiary if necessary whenever there’s an important life event (e.g. wedding, divorce or the death of a family member) to ensure suitable protection for your loved ones.

Talk with us

Want to know more how our products can help you? Get personalised support from our Insurance Specialists. Book a face-to-face appointment or meet with us over video.

Notes:

- Proof of relationship may be required for some cases.

- Proof of relationship and declaration may be required for some cases.

- High Court, Probate Registry Guide to Court Services (May 2020).

Disclaimer:

The information contained in this article is for general reference only and is not intended to constitute a recommendation or advice to any person or to be the basis for any financial decision. No person should act on any information in the article without seeking professional advice.

All information is provided for reference only. You should not make any decision based on this article alone. If you are in doubt about any content in this article, you should seek independent professional advice. HSBC Life does not undertake any obligation to make available to you any further information or update the contents of this article, and such contents are subject to change at any time without notice. All information is provided for general information purposes only and does not constitute any tax, insurance and/or other advice or recommendation. Under any and all circumstances, HSBC Life and/or HSBC Group shall not be liable for any damages, losses or liabilities, including but not limited to direct or indirect, special, incidental, consequential damages, losses or liabilities, in connection with your or any third party’s use of this article or your reliance on or use of or inability to use the information contained in this article. This article should not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose.

HSBC Life has based this article on information obtained from sources it believes to be reliable, but which it has not independently verified. HSBC Life and HSBC makes no guarantees, representations or warranties and accepts no responsibility or liability as to its accuracy or completeness. Information in this article is subject to change without notice.

HSBC Life is authorised and regulated by the Insurance Authority to carry on long-term insurance business in the Hong Kong SAR. HSBC Life is incorporated in Bermuda with limited liability, and is one of the HSBC Group’s insurance underwriting subsidiaries. Insurance products provided by HSBC Life are only intended for sale through HSBC in the Hong Kong SAR. Policyholders are subject to credit risk of HSBC Life. For monetary disputes arising between HSBC and you out of the selling process or processing of the related transaction, HSBC will enter into a Financial Dispute Resolution Scheme process with you; however any dispute over the contractual terms of the product should be resolved between HSBC Life and you directly. For details and information about HSBC Life products, please visit the insurance-related pages at HSBC’s website or visit our branch.

The article is issued in September 2023

Issued by HSBC Life (International) Limited (Incorporated in Bermuda with limited liability)

© Copyright. HSBC Life (International) Limited. All rights reserved.

Date