VHIS plan – Why pay a deductible?

When you buy medical insurance, you’re buying the peace of mind of knowing that you’re shielded from unexpected medical expenses. But some VHIS plans include a self-paid deductible. What are the benefits?

With some medical insurance plans, you are required to pay a portion of the cost of the insurance yourself, with the balance covered by the insurance company.

You purchase a VHIS plan to reduce your exposure to unexpected medical expenses. By the same token, insurance companies use deductibles to lower the risks to which they are exposed. If you are willing to pay part of the cost of the insurance, the insurance company will be responsible for a lesser amount. Since it’s then less risky for the insurance company to provide you with protection, the premiums you have to pay for that protection will also be lower.

If you have a group medical plan or a basic medical plan, a VHIS plan with a deductible is a better option for you.

A group medical plan may not provide all the protection you need. According to the Hong Kong Federation of Insurers’ Medical Claim Data Survey 2019, group medical plans in Hong Kong cover only 64% to 75%1 of hospitalisation and surgical expenses, which means employees often have to make up the shortfall themselves.

If you maintain a group medical and VHIS combo, most of your expenses in a medical situation would be covered by your group plan while your VHIS plan would take care of the rest. Since a VHIS plan with a deductible has lower premiums, it would allow you to prepare comprehensive protection for yourself with less money.

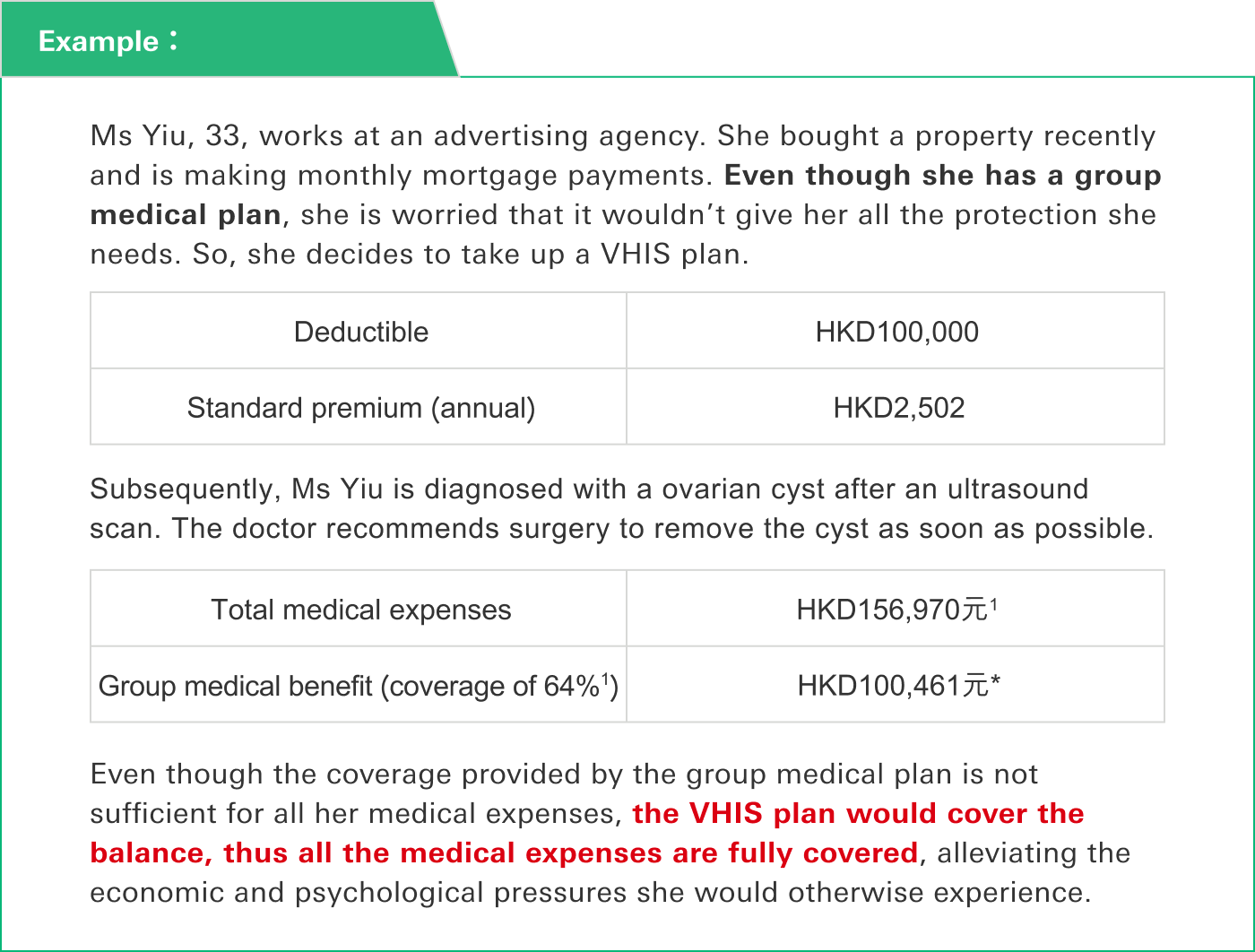

Ms Yiu’s VHIS plan

| Issue age* | Standard premium (annual) | Annual protection limit | Annual deductible |

|---|---|---|---|

| 33 | HKD2,502 | HKD5,000,000 | HKD100,000 |

| With group medical plan only | With group medical plan + HSBC VHIS Flexi Plan |

|

|---|---|---|

| Total cost of surgery for removing ovarian cyst | HKD156,9703 | HKD156,9703 |

| Group medical benefit | HKD100,461* | HKD100,461* |

| VHIS benefit (with HKD100,000 deductible) | No applicable | HKD56,509 (Since the benefit from her group medical plan already exceeds the deductible of HKD100,000, the balance is fully covered2) |

| Amount paid by Ms Yiu | HKD56,509 | HKD0 |

*Figures are rounded off

As we can see, acquiring a VHIS plan with a deductible enables Ms Yiu to fill her protection gap and ensure that any potential medical expenses would be taken care of, leaving her plans and mortgage payments unaffected.

Moreover, taxpayers with VHIS plans qualify for tax deductions. If they purchase VHIS plans for themselves and their family members, each plan will entitle them to an annual tax deduction of up to HKD8,000. There is no limit to the number of plans they can get.

If you want to buy medical insurance to avoid having to shoulder substantial medical expenses and you can afford a small payment of HKD10,000 to HKD20,000, you may want a VHIS plan with a deductible of less than HKD20,000.

If your existing medical coverage can offset medical expenses of approximately HKD100,000, then a plan with a HKD100,000 deductible is worth considering. These plans are more affordable, allowing you to enjoy extra protection at lower premiums.

The VHIS plans currently on the market come with different deductibles. With HSBC VHIS Flexi Plans, for example, you can choose from three deductible amounts - HKD16,000, HKD50,000 and HKD100,000 – to suit your needs and budget.

Generally, the higher the deductible, the lower the premium. Conversely, a lower deductible means a higher premium. But that also depends on the type of plan you have and the scope of coverage.

Many people think that, with group medical plans and VHIS plans, it’s an either/or proposition. You only need one. Otherwise, you’d be overlapping resources. In fact, the two kinds of plans complement each other. Below is a list of common medical problems and how HSBC VHIS Flexi Plan can help you cope with them.

| Scenario | Typical group medical plan | HSBC VHIS Flexi Plan |

|---|---|---|

| Hospitalisation or surgery required | Itemised sub-limits | In the event of a serious illness, all medical expenses are fully covered2 after deductible is paid |

| A cancer diagnosis requiring complicated surgery and long-term treatment | Group medical plans may offer only limited protection and are subiect to provisions. | Covers surgical and non-surgical cancer treatments |

| Looking for better hospital accommodations for treating a serious illness | Junior staff only enjoy basic group medical coverage | HSBC VHIS flexi plans are available in 3 levels - Gold, Silver and Bronze - for your selection based on your needs and financial circumstances; plans with deductibles have lower premiums |

| Changing jobs | Even if you find a new job within a short time, group medical protection usually only starts after probation | No waiting period; life insured enjoys immediate and uninterrupted protection |

Deductibles are an effective way to manage the risk of incurring major medical expenses. As long as you know what you need, you can reduce the cost of your insurance protection by taking up a plan with a deductible.

- Hong Kong Federation of Insurers, Medical Claim Data Survey 2019.

- Full coverage shall mean the actual amount of eligible expenses and other expenses charged and payable in accordance to the terms and benefits of HSBC VHIS Flexi Plan.

- Union Hospital website: Fees for common surgical procedures, July 2021 – December 2021.

Special offers

Apply online for HSBC VHIS Flexi Plan with the promo code "SAVE20" to enjoy 20% off first-year premium discount.

And an extra 10% off when you apply with your family members.

Sign up for Well+ now and you can enjoy a first-year premium discount up to 60%!

Offer ends 30 September 2025. T&Cs apply.

Disclaimer

The above examples are hypothetical and for illustrative purposes only.

The information contained in this article is for general reference only and is not intended to constitute a recommendation or advice to any person or to be the basis for any financial decision. No person should act on any information in the article without seeking professional advice. There are certain assumptions that are used in the above scenarios and/or illustrations. Details will need to be considered on a case-by-case basis, subject to the terms of the relevant policy.

The information contained in this article does not constitute an offer for the purchase or sale of any banking or insurance products or services. Products and services are subject to individual needs. Contact your financial planner to review your financial needs and risk acceptance level. Under any and all circumstances, HSBC Life and/or HSBC Group shall not be liable for any damages, losses or liabilities, including but not limited to direct or indirect, special, incidental, consequential damages, losses or liabilities, in connection with your or any third party’s use of this article or your reliance on or use of or inability to use the information contained in this article. This article should not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose.

HSBC Life has based this article on information obtained from sources it believes to be reliable, but which it has not independently verified. HSBC Life and HSBC make no guarantees, representations or warranties and accept no responsibility or liability as to its accuracy or completeness. Information in this article is subject to change without notice.

HSBC Life is authorised and regulated by the Insurance Authority to carry on long-term insurance business in the Hong Kong SAR. HSBC Life is incorporated in Bermuda with limited liability, and is one of the HSBC Group’s insurance underwriting subsidiaries. Insurance products provided by HSBC Life are only intended for sale through HSBC in the Hong Kong SAR. Policyholders are subject to credit risk of HSBC Life. For monetary disputes arising between HSBC and you out of the selling process or processing of the related transaction, HSBC will enter into a Financial Dispute Resolution Scheme process with you; however, any dispute over the contractual terms of the product should be resolved between HSBC Life and you directly. For details and information about HSBC Life products, please visit the insurance-related pages at HSBC’s website or visit our branch.

All the information in the article is updated as of May 2022

Issued by HSBC Life (International) Limited (Incorporated in Bermuda with limited liability)

© Copyright. HSBC Life (International) Limited. All rights reserved.

Date