Our Critical Illness Support Team is here to help you become more knowledgeable in critical illness and protection solutions.

How to determine your critical illness protection level?

A critical illness plan can pay for your treatment when a disease strikes, and cover living expenses for you and your family. But to ensure you’ll have an adequate protection level, learn the basics first.

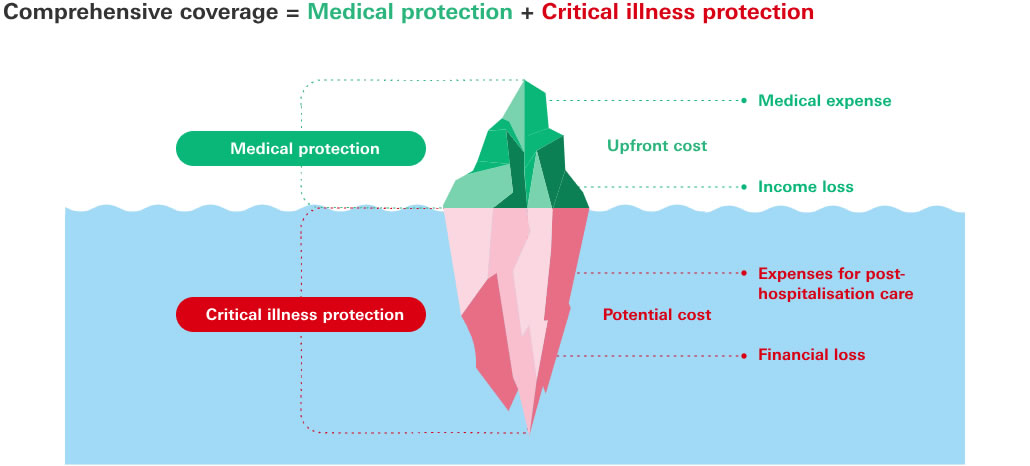

Some people have put forward the notion that the protection level of your critical illness policy should be around 2-3 times your annual salary. But this hypothesises only a partial income loss while you are convalescing because of a serious illness. The lump sum benefit from your critical illness plan is assumed in this scenario to be enough for covering living expenses for you and your family while you are undergoing treatment and working less. The cost of treatment for a critical illness, however, is only the tip of the iceberg. The expenses of a long convalescence plus the financial impact on your family are in fact the biggest worries.

1. Which age group are you in?

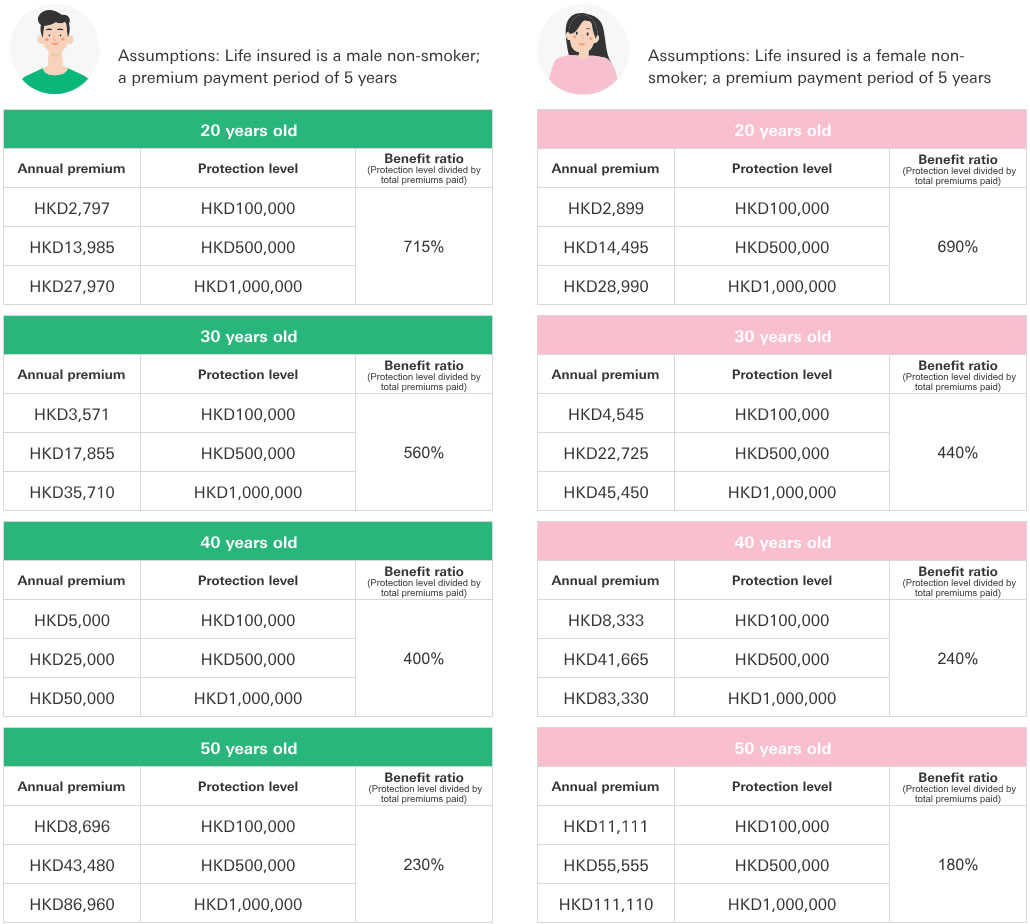

People have different protection needs. For young people, the key consideration may be the possibility of a premium return if they stay healthy. In addition, the majority would hope to make good use of their money, paying only a few of premiums and still enjoying a larger protection level. The table below shows the typical protection level and rate of return for different age groups.

A typical medical insurance policy can serve as the basis of your health protection If you already have a Voluntary Health Insurance Plan or a Group Medical Plan that reimburses you for actual medical expenses, you may have adequate medical coverage. The lower the medical cost you need to pay, the lower the protection level for your critical illness plan needs to be.

3. What is your financial burden?

Critical illnesses, such as cancer, require long recovery times, usually up to 2-3 years. During this period, there is a significant chance that you will be unable to work and yet you will need to handle your living expense at the same time that you manage your medical costs. Therefore, you should consider the following points:

- Critical illness treatment costs

- Caregiver cost

- Daily living expenses

- Children’s school fees and related financial burdens

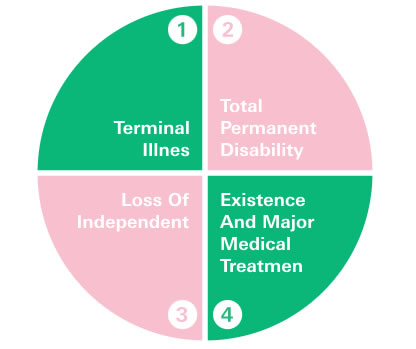

Even though more items covered doesn’t necessarily mean higher premiums, we still need to be mindful of whether the scope of coverage is broad enough. There are critical illness insurance plans on the market that cover:

Common critical illnesses + extended coverage for conditions that result beyond the causes of critical illnesses,

eg, terminal illness, total permanent disability, loss of independent existence and major medical treatment = safety net against undiscovered new diseases and physical injuries.

Now that you have a better understanding of the threat of critical illness, take a look at the below example for more clarity when you’re working out the protection amount you need.

Ian's story

Age 30 (Non-smoker, male)

Engineer

Main source of income

Reason for purchasing insurance:

- To ensure adequate financial protection for her family if he ever become critically ill

- To ensure annual premiums will remain level to facilitate his wealth management planning

- He hopes that, if he stays healthy, he would receive a refund of total premiums paid at the end of the protection period, which would give him an extra financial resource

Chosen plan: A critical illness plan that fits his budget and offers a high benefit ratio

Critical illness protection plan

| Premium payment period: | 5 years |

| Protection level: | HKD300,000 |

| Annual premiums: | HKD10,713 |

| Total premiums paid: | HKD53,565 |

| Refund of 101% of total premiums paid: | HKD54,101 |

| Policy term: | 10 years |

Scenario 1

lan is diagnosed with stage 3 lung cancer in the 3rd policy year and receives a lump sum benefit of HKD300,000 with 933% benefit ratio (protection level divided by total premiums paid: HKD300,000/HKD10,713 x years) to pay for his treatment and family expenses, which greatly stabilises his financial position.

Scenario 2

lan remains healthy over the next 10 years. Since he has not made any claim and reduced the protection level, he receives a refund of 101% of total premiums paid, which works out to HKD54,101. This additional financial resource can then be used to help achieve his goal of starting an online business.

Assumptions:

This ratio is subject to age / gender / smoking status / payment mode / payment terms and conditions, etc.

Different life stages call for different protections. That is especially true of critical illness insurance. That’s why there are critical illness plans on the market with a 10-year policy term, with protection level ranges from HKD100,000 to HKD2,500,000, and those that may return 101% of the total premiums paid to give different customers more flexibility in meeting their wealth management needs. If you are thinking about buying an insurance policy, make sure it’s the right one for you. That will let you get the most out of it. Finally, some critical illness plans currently on the market only need to go through simplified underwriting. All you need is to answer 5 simple health questions and no medical examination is required. Application is simple and easy.

Special offers

Apply online for HSBC Swift Guard Critical IlIness Plan with the promo code "10CARE" to enjoy 10% off first- year premium discount.

Sign up for Well+ now and you can enjoy a first-year premium discount up to 20%!

Offer ends 31 March 2026. T&Cs apply.

Disclaimer

The above examples and scenarios are hypothetical and for illustrative purposes only.

The figures shown above are based on the calculation from HSBC life according to its own reference sources. These figures are indicative for reference only which may be changed from time to time, and are subject to the latest information released by insurance companies. The premiums above do not include the Insurance Authority’s premium levy.

The information contained in this article is for general reference only and is not intended to constitute a recommendation or advice to any person or to be the basis for any financial decision. No person should act on any information in the article without seeking professional advice. There are certain assumptions that are used in the above scenarios and/or illustrations. Details will need to be considered on a case-by-case basis, subject to the terms of the relevant policy.

The information contained in this article does not constitute an offer for the purchase or sale of any banking or insurance products or services. Products and services are subject to individual needs. Contact your financial planner to review your financial needs and risk acceptance level. Under any and all circumstances, HSBC Life and/or HSBC Group shall not be liable for any damages, losses or liabilities, including but not limited to direct or indirect, special, incidental, consequential damages, losses or liabilities, in connection with your or any third party’s use of this article or your reliance on or use of or inability to use the information contained in this article. This article should not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose.

HSBC Life has based this article on information obtained from sources it believes to be reliable, but which it has not independently verified. HSBC Life and HSBC makes no guarantees, representations or warranties and accepts no responsibility or liability as to its accuracy or completeness. Information in this article is subject to change without notice.

HSBC Life is authorised and regulated by the Insurance Authority to carry on long-term insurance business in the Hong Kong SAR. HSBC Life is incorporated in Bermuda with limited liability, and is one of the HSBC Group’s insurance underwriting subsidiaries. Insurance products provided by HSBC Life are only intended for sale through HSBC in the Hong Kong SAR. Policyholders are subject to credit risk of HSBC Life. For monetary disputes arising between HSBC and you out of the selling process or processing of the related transaction, HSBC will enter into a Financial Dispute Resolution Scheme process with you; however any dispute over the contractual terms of the product should be resolved between HSBC Life and you directly. For details and information about HSBC Life products, please visit the insurance-related pages at HSBC’s website or visit our branch.

All the information in the article is updated as of June 2022

Issued by HSBC Life (International) Limited (Incorporated in Bermuda with limited liability)

© Copyright. HSBC Life (International) Limited. All rights reserved.

Date