Our Critical Illness Support Team is here to help you become more knowledgeable in critical illness and protection solutions.

Know more, fear less - Be vigilant about critical illness

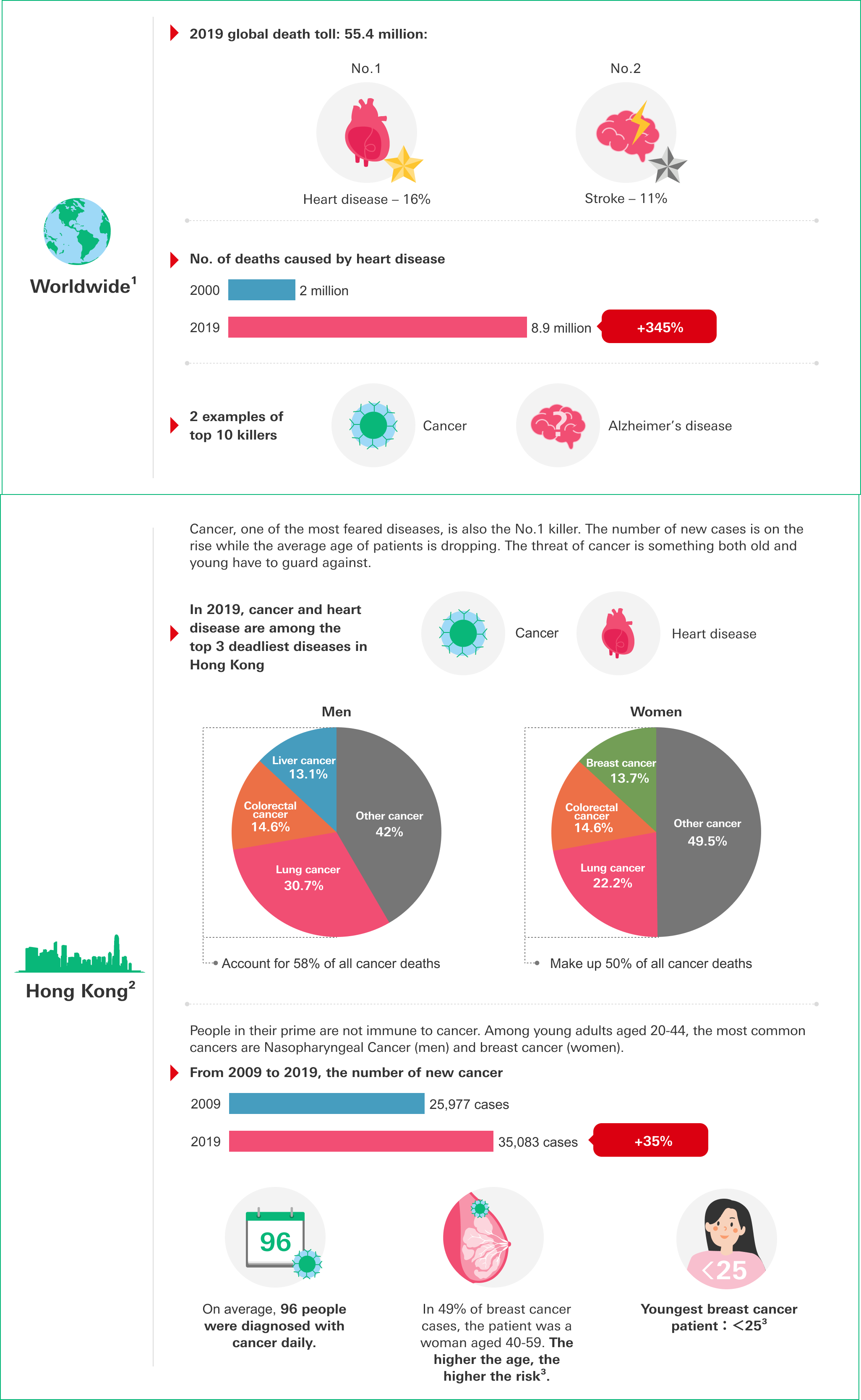

How would a critical illness impact you, your family and your life plans? Trends showing critical illness patients are getting younger. To avoid sudden and overwhelming medical expenses, early planning is a solution.

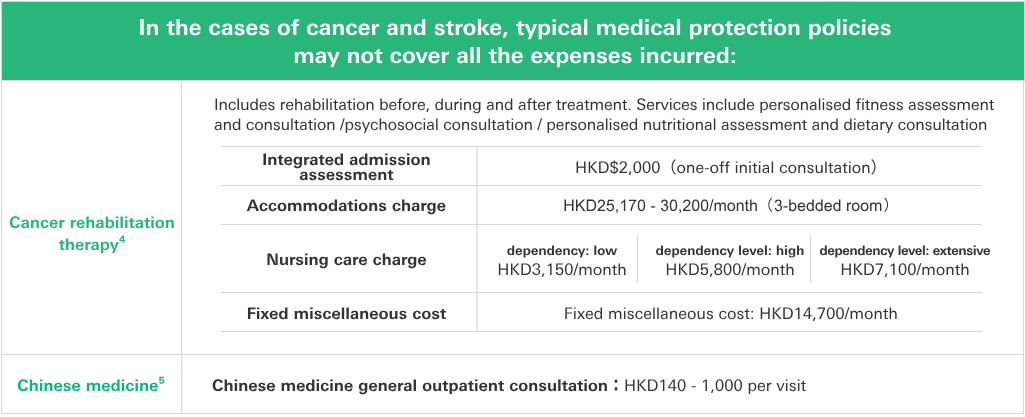

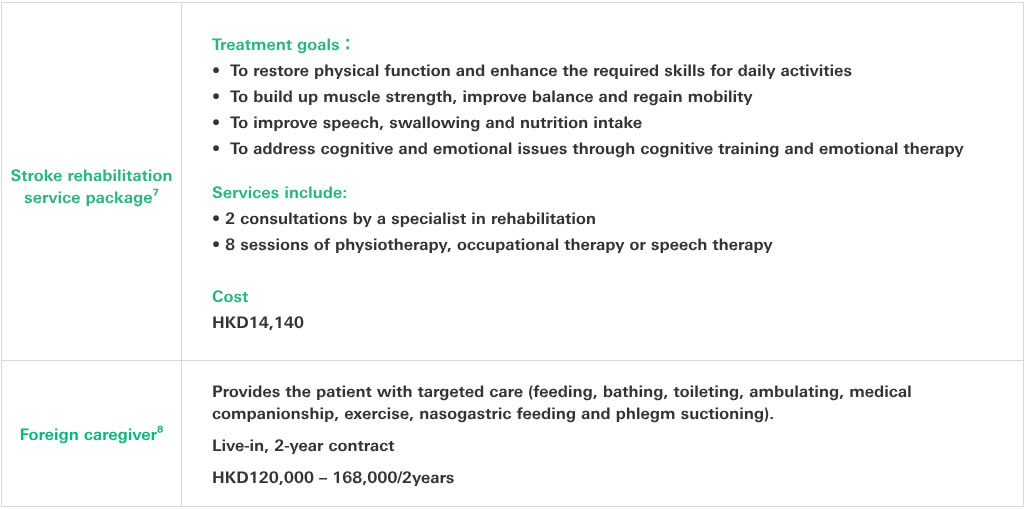

Many people have the impression that one medical insurance policy is enough for all future medical expenses. But not only are critical illness treatments expensive, the post-treatment rehabilitation process can also be very long and costly.

Around 90% of stroke patients suffer from hemiplegia, or paralysis on one side of the body. At the same time, the severity of a stroke directly affects the amount of time needed to restore neurological functions: 2 months for a mild stroke, and 5 months for a moderate stroke. Patients who have suffered a severe stroke would even require at least 18-month rehabilitation6. And a patient with mobility issues will need not only physiotherapy but professional home care service.

The impact of a critical illness is not only physical and financial. In the case of a patient of moderate financial means, even their family’s quality of life and prospects can suffer.

Just because you’re healthy now doesn’t mean you don’t have to be alert to the possibility of an unexpected critical illness. Make sure you won’t be caught off guard and have a check in advance to see if you have sufficient medical and critical illness protection. A critical illness policy can give you the crucial support of a lump sum benefit during the costly treatment and rehabilitation journey. More importantly, the larger your reserve, the more financial resources you would have to fund different medical options. If you don’t make any claims during the term of the policy, you could even receive a full refund of the premium paid. With the right protection, you are backed up in health and in sickness.

Sources:

- World Health Organisation

- Hospital Authority: Overview of HK Cancer Statistics 2019.

- Hong Kong Cancer Registry: Top 10 Female Cancers in Hong Kong (2019)

- Jockey Club Institute of Cancer Care Survivorship Clinic

- Integrative Medical Centre, The Chinese University of Hong Kong

- Lotung Pohai Hospital: Securing treatment during golden period helps stroke patients resume normal life

- Hong Kong Sanatorium & Hospital: Stroke Rehabilitation Service Package

- Active Global Specialised Caregivers

Special offers

Apply online for HSBC Swift Guard Critical Illness Plan with the promo code "SAVE15" to enjoy 15% off first-year premium discount.

Sign up for Well+ now and you can enjoy a first-year premium discount up to 50%!

Offer ends 30 June 2024. T&Cs apply.

Disclaimer:

The above information was gathered from publicly accessible sources, and does not represent the opinion of HSBC Life (International) Limited or The Hongkong and Shanghai Banking Corporation Limited (collectively referred as “HSBC” or “We”). We shall not be liable for any potential health issues or loss that may be caused by or relating to any of the above information. All information and recommendations provided are for reference only. You should not make any decision based solely on such information. We are under no obligation to update this information for you, and assume no responsibility for its reliability or accuracy. All content is subject to change without prior notice. If necessary, please consult medical professionals.

The information contained in this article is current as of June 2022.

Issued by HSBC Life (International) Limited (Incorporated in Bermuda with limited liability)

© Copyright. HSBC Life (International) Limited. All rights reserved.

Date