Term Life and Whole Life Insurance – what is the difference?

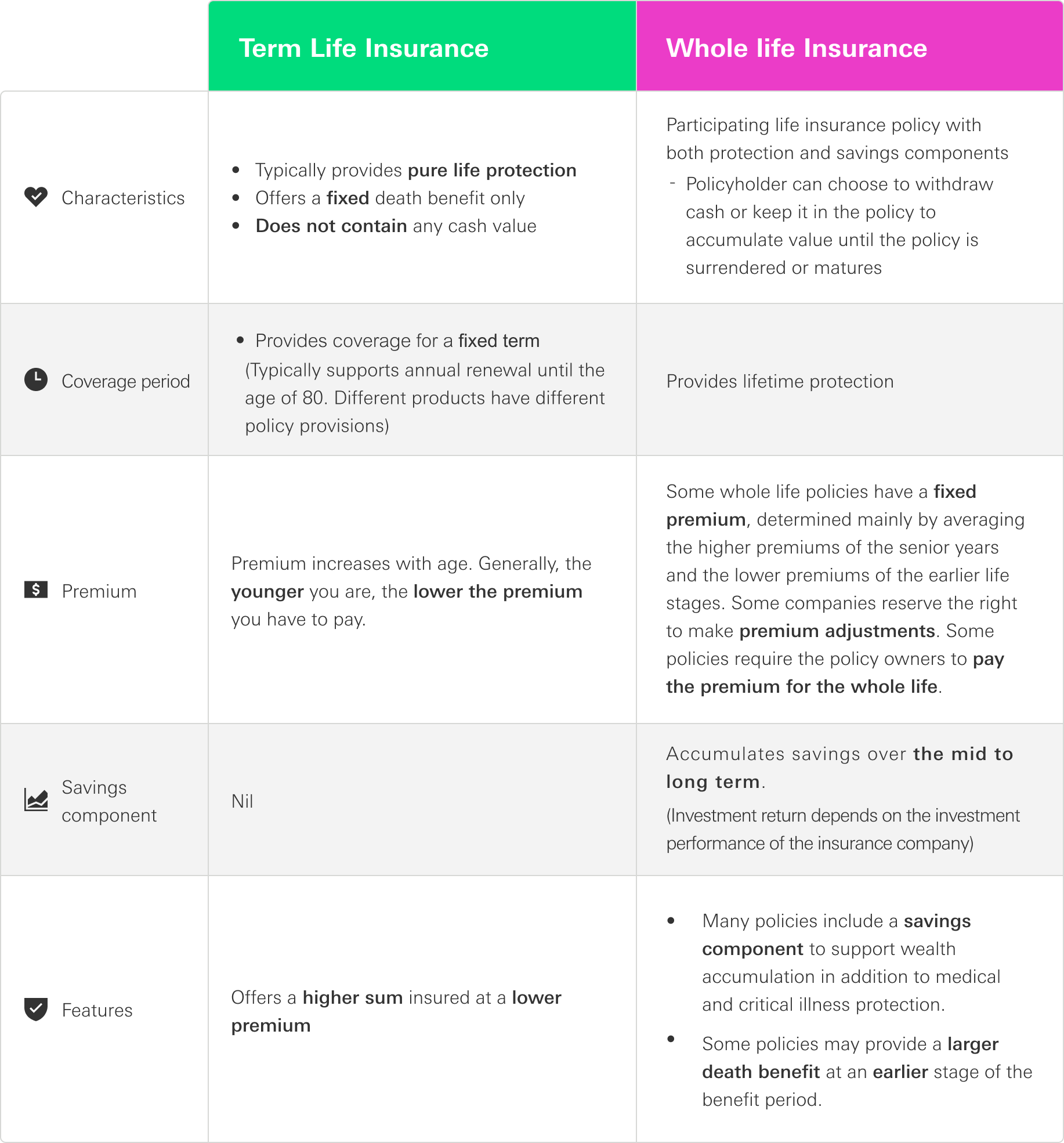

A life insurance policy is one of the most important purchases you could ever make. There is, however, a wide variety of life insurance products on the market. For a start, the two most common types are term life and whole life plans, with very different scopes of coverage. What are the key differences between them? And what factors should you consider when choosing a life policy to ensure the best protection for your current life stage?

Everyone needs to be protected against life’s uncertainties. If you have a steady income and are financially capable, you might want to choose a whole life policy, which typically has a higher premium but contains a saving component to help you fulfill your long-term wealth goals.

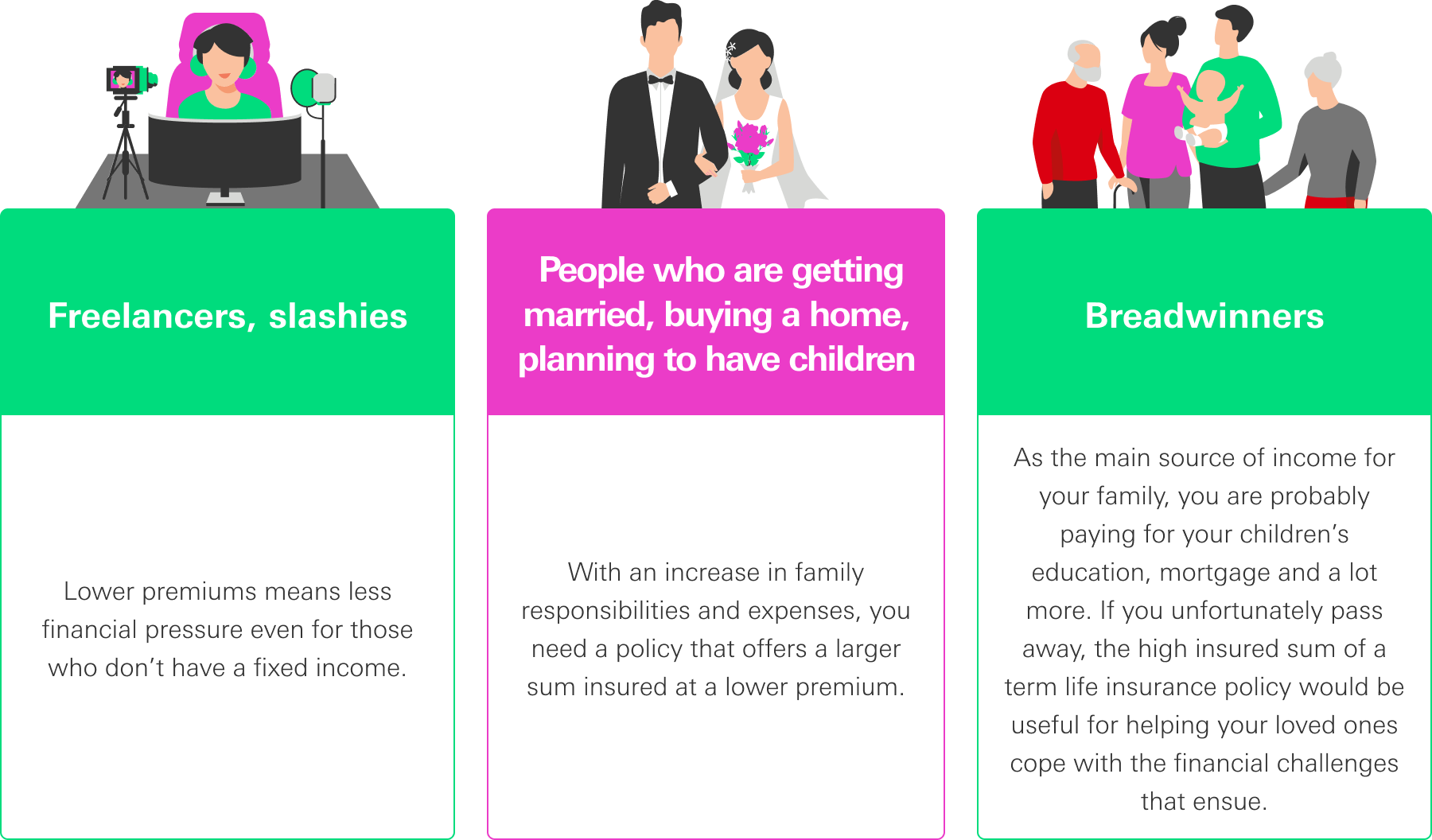

Generally, term life policies tend to be more affordable, thus are more suitable for young people and career starters with lower incomes. However, a term life insurance policy could also be a good protection solution for:

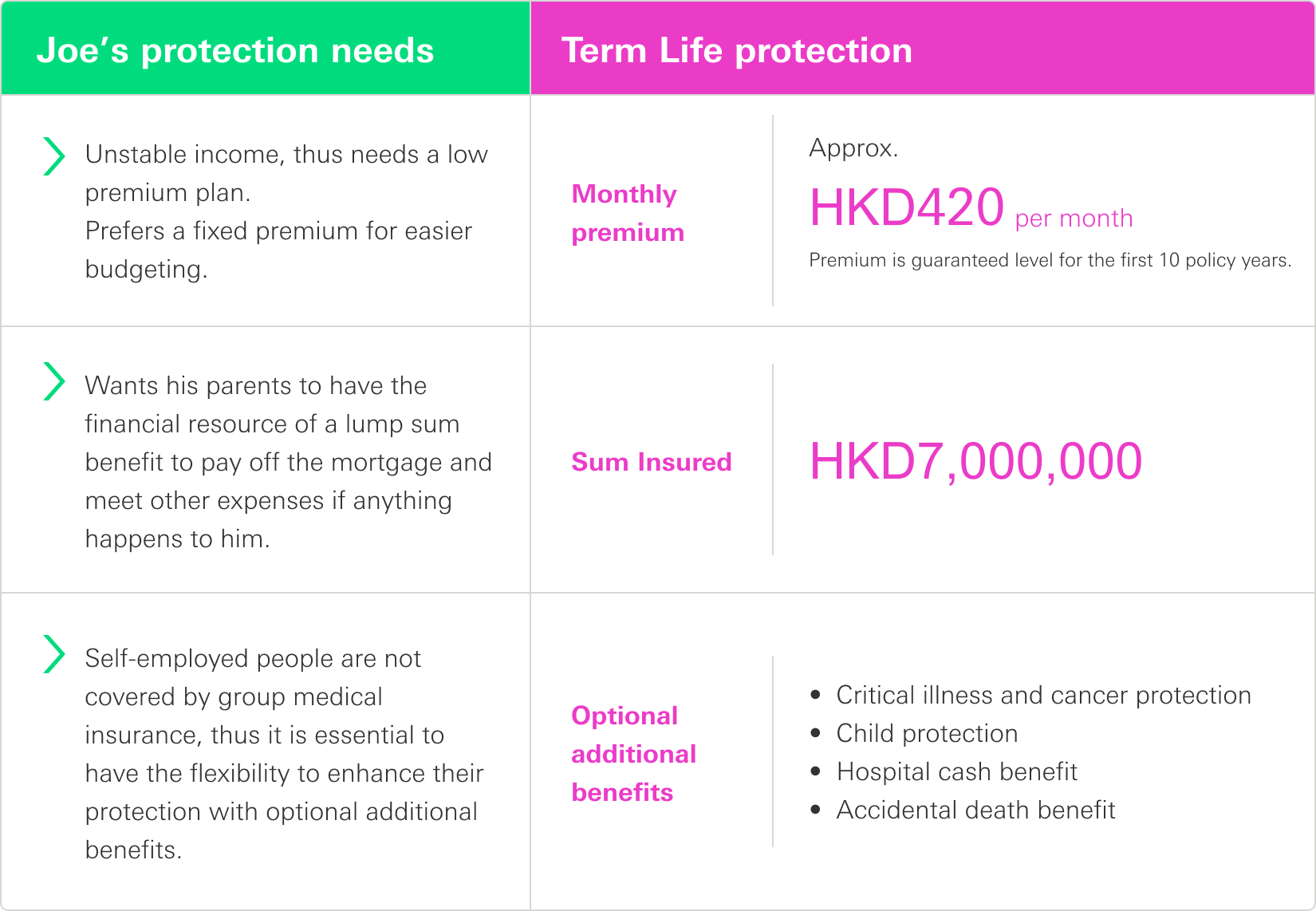

Joe is a 28-year-old fitness coach. As a freelancer, he doesn’t have a stable income. He is the only child of the family and is thus responsible for supporting his parents. He owns a HKD7 million property, for which he is paying mortgage monthly. To acquire protection that meets his limited budget, he opts for a term life insurance plan:

In addition to lower premiums, higher flexibility and larger death benefits, term life insurance policies offer other advantages:

Premium structures are simple, making it easy to compare quotes

Most term life policies do not require applicants to undergo a health examination.

With some term life policies, application can be done online.

quickly and conveniently.

Different life stages bring different needs, and the protection plans we have should be continuously adjusted to reflect these changes. Term life and whole life insurance plans offer different benefits to support different priorities, so choose the protection that best suits your circumstances and financial capability. To learn more, talk to us today.

Special offers

Apply online for HSBC Family Protector with the promo code "SAVE8M" to enjoy 8-month first-year premium waiver (or 67% off).

Sign up for Well+ now and you can enjoy an incremental 1-month first-year premium discount!

Offer ends 30 June 2024. T&Cs apply.

Disclaimer

The above examples are hypothetical and for illustrative purposes only.

The information contained in this article is for general reference only and is not intended to constitute a recommendation or advice to any person or to be the basis for any financial decision. No person should act on any information in the article without seeking professional advice. There are certain assumptions that are used in the above scenarios and/or illustrations. Details will need to be considered on a case-by-case basis, subject to the terms of the relevant policy.

The information contained in this article does not constitute an offer for the purchase or sale of any banking or insurance products or services. Products and services are subject to individual needs. Contact your financial planner to review your financial needs and risk acceptance level. Under any and all circumstances, HSBC Life and/or HSBC Group shall not be liable for any damages, losses or liabilities, including but not limited to direct or indirect, special, incidental, consequential damages, losses or liabilities, in connection with your or any third party’s use of this article or your reliance on or use of or inability to use the information contained in this article. This article should not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose.

HSBC Life has based this article on information obtained from sources it believes to be reliable, but which it has not independently verified. HSBC Life and HSBC makes no guarantees, representations or warranties and accepts no responsibility or liability as to its accuracy or completeness. Information in this article is subject to change without notice.

HSBC Life is authorised and regulated by the Insurance Authority to carry on long-term insurance business in the Hong Kong SAR. HSBC Life is incorporated in Bermuda with limited liability, and is one of the HSBC Group’s insurance underwriting subsidiaries. Insurance products provided by HSBC Life are only intended for sale through HSBC in the Hong Kong SAR. Policyholders are subject to credit risk of HSBC Life. For monetary disputes arising between HSBC and you out of the selling process or processing of the related transaction, HSBC will enter into a Financial Dispute Resolution Scheme process with you; however any dispute over the contractual terms of the product should be resolved between HSBC Life and you directly. For details and information about HSBC Life products, please visit the insurance-related pages at HSBC’s website or visit our branch.

All the information in the article is updated as of April 2022

Issued by HSBC Life (International) Limited (Incorporated in Bermuda with limited liability)

© Copyright. HSBC Life (International) Limited. All rights reserved.

Date