Savour the promise of long-term protection for your family with our life insurance plan

How to grow your assets when the outlook is uncertain?

Navigating global economic cycles is like journeying through life. There will always be unforeseen peaks and valleys. In the face of uncertainty, how can you protect your family by steadily growing your assets?

Protecting your family starts with accumulating your wealth. Ideally, when markets are volatile and interest rates are low, you would also complement long-term growth with life insurance protection. At the same time, many people share the goal of transferring their wealth to their loved ones in flexible and cost-effective ways. Reaching that goal takes careful planning. Pauline’s case below can help give you a better understanding of how legacy planning works.

|

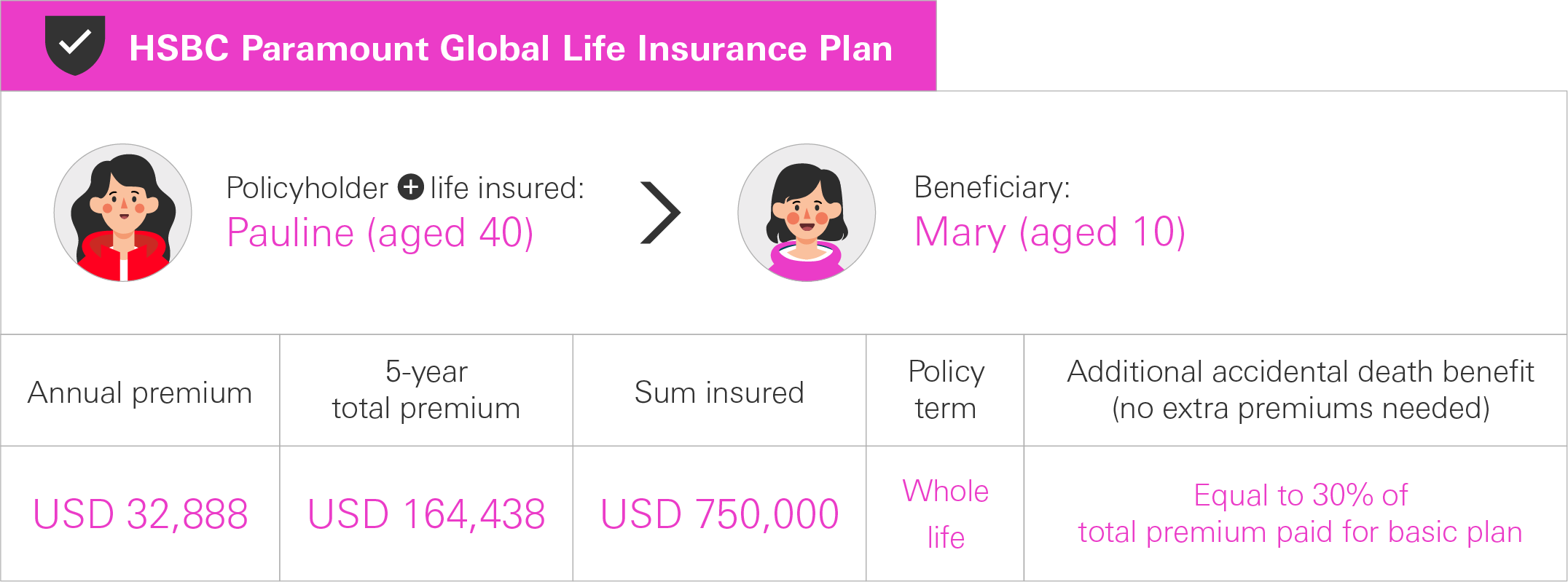

Pauline, aged 40, and her husband just celebrated the 12th anniversary of their wedding. They have a 10-year-old daughter, Mary, who’s an only child. Pauline heads up the customer service department at a big company. Although she excels at balancing the demands of career and family, she understands that the future is often hard to predict. Her goal is to protect her family with life insurance while accumulating enough wealth to meet the requirements of different life stages. Another priority of hers is to acquire flexible legacy planning solutions that would allow her to help Mary meet future challenges. She therefore chooses an insurance plan that offers significant growth potential and long-term protection, with herself as the life insured and Mary as the beneficiary. The premium payment period is 5 years. |

Note: “Age” means age next birthday. No extra premiums are required for the additional accidental death benefit. If the life insured passes away due to an accident before the age of 80, then beneficiary will receive an additional accidental death benefit equal to 30% of the premium paid for the basic plan.

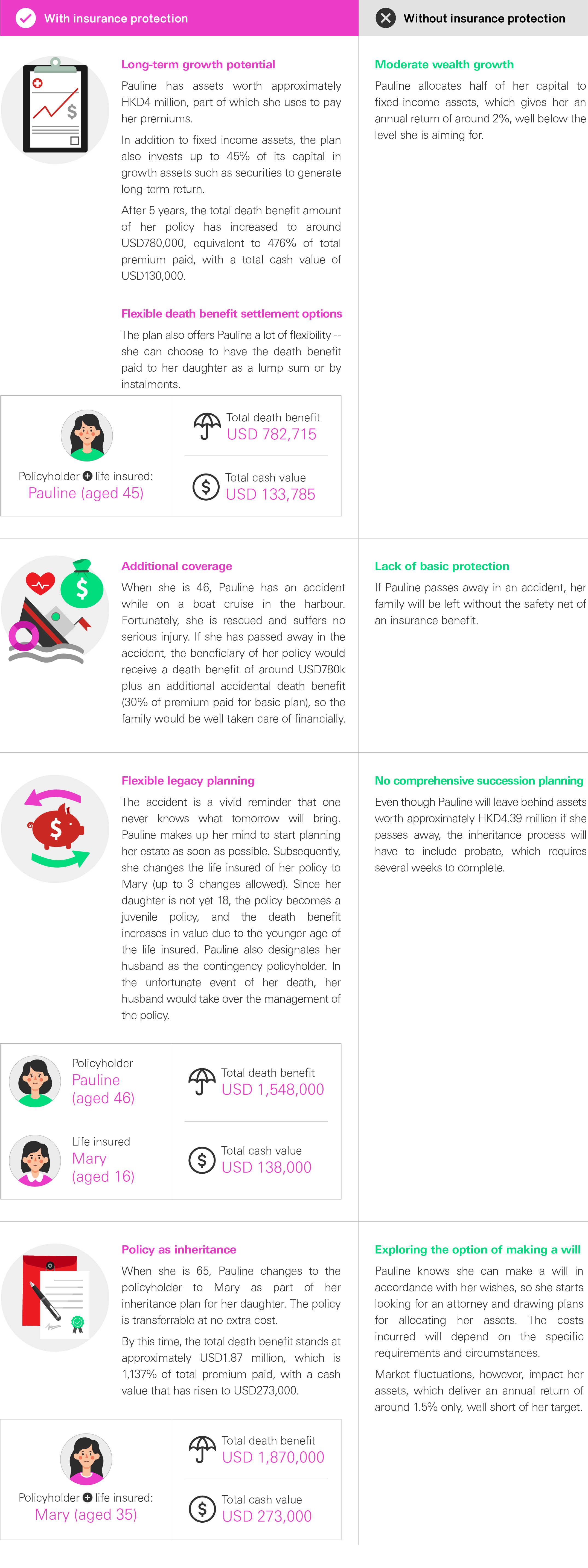

When she is 46, Pauline is involved in an accident. Even though she is safe at the end, the experience drives home the importance of planning one’s legacy in the face of life’s uncertainty. The below 2 hypotheses illustrate the potentially life-changing differences between having and not having insurance protection.

HSBC Paramount Global Life Insurance Plan provides long-term potential return and an increasing total death benefit amount to help Pauline, Mary and her successor accumulate their wealth in the face of uncertain prospects. They can also exercise the Policy Value Management Option to lock in a portion of the policy value. By investing in growth assets, the plan offers them the advantages of tapping into long-term economic growth. It may be the right solution for you too. Visit any HSBC branch or contact an HSBC relationship manager to learn more, so you can take the ups and downs of the road ahead in your stride.

Notes:

- The above examples are hypothetical and for illustrative purposes only. Please refer to Product Brochures and Policy Provisions for detailed terms and conditions as well as exclusions.

- Pauline and Mary are standard non-smokers residing in Hong Kong.

- No partial surrender has been made during the policy term.

- All premiums have been paid in full during the premium payment period.

- There is no outstanding policy loan while this policy is in force.

- The Special Bonus scale and investment returns are assumed to remain unchanged throughout the policy term.

- The underwriting conditions applicable to an actual instance of Change of Life Insured would be assessed on a case-by-case basis at our discretion, taking into consideration multiple factors, including but not limited to, any changes in the underlying mortality risk, revisions made to the policy term and the latest economic outlook.

- HSBC Paramount Global Life Insurance Plan is not a bank deposit or bank savings plan but a whole life insurance plan with a savings element underwritten by HSBC Life (International) Limited ("HSBC Life") which is authorised and regulated by the Insurance Authority ("IA") to carry on long-term insurance business in the Hong Kong SAR. Policyholders are subject to HSBC Life's credit risk and may incur a loss in the event of early surrender.

Special offers

Apply for HSBC Paramount Global Life Insurance Plan II to enjoy up to 20% off first-year premium, plus an additional 1.5% off for selected customers.

Offer ends 31 March 2026. T&Cs apply.

Disclaimer

The information contained in this article is for general reference only and is not intended to constitute a recommendation or advice to any person or to be the basis for any financial decision. No person should act on any information in the article without seeking professional advice. There are certain assumptions that are used in the above scenarios and/or illustrations. Details will need to be considered on a case-by-case basis, subject to the terms of the relevant policy

The information contained in this article does not constitute an offer for the purchase or sale of any banking or insurance products or services. Products and services are subject to individual needs. Contact your financial planner to review your financial needs and risk acceptance level. Under any and all circumstances, HSBC Life and/or HSBC Group shall not be liable for any damages, losses or liabilities, including but not limited to direct or indirect, special, incidental, consequential damages, losses or liabilities, in connection with your or any third party’s use of this article or your reliance on or use of or inability to use the information contained in this article. This article should not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose.

HSBC Life has based this article on information obtained from sources it believes to be reliable, but which it has not independently verified. HSBC Life and HSBC makes no guarantees, representations or warranties and accepts no responsibility or liability as to its accuracy or completeness. Information in this article is subject to change without notice.

HSBC Life is authorised and regulated by the Insurance Authority to carry on long-term insurance business in the Hong Kong SAR. HSBC Life is incorporated in Bermuda with limited liability, and is one of the HSBC Group’s insurance underwriting subsidiaries. Insurance products provided by HSBC Life are only intended for sale through HSBC in the Hong Kong SAR. Policyholders are subject to credit risk of HSBC Life. For monetary disputes arising between HSBC and you out of the selling process or processing of the related transaction, HSBC will enter into a Financial Dispute Resolution Scheme process with you; however any dispute over the contractual terms of the product should be resolved between HSBC Life and you directly. For details and information about HSBC Life products, please visit the insurance-related pages at HSBC’s website or visit our branch.

All the information in the article is updated as of November 2021

Issued by HSBC Life (International) Limited (Incorporated in Bermuda with limited liability)

© Copyright. HSBC Life (International) Limited. All rights reserved.

Date