Many a mickle makes a muckle. With HSBC Wealth Goal Insurance Plan II, your wealth can be built gradually and support your long-term savings goal.

Are there secret weapons to help you save faster?

We all know the benefits of saving money, but it’s often easier said than done when you have different financial obligations to meet! Don’t give up. Here are some tips on developing effective saving habits.

Now that 2020 is over, it’s time to set a new financial goal for the new year. After all, it is by staying committed to growing our wealth that we can enrich our future with more possibilities. Whether you’re planning a secure retirement for yourself or saving for your children’s education, having a good savings habit and effective financial tools can help you reach your goal sooner than you think. Let’s look at Angel’s example:

Angel works in accounting, so she is good at numbers and managing her money. She often shares her insights on how to save money effectively with her friends.

The world is full of temptations: new phones, limited-edition handbags, sumptuous omakase dinners. We always seem to want more than we can afford! That’s why, for many people, it’s easy to overspend. While everyone wants to reward themselves for their hard work once in a while, spending without moderation can stop you from reaching your savings goals or even incur deficits.

Angel set herself a monthly spending limit years ago, and records all her expenses, big or small, in a computer spreadsheet. That way, she’ll know right away whenever she has exceeded her monthly quota. This not only reminds her to review her spending habits regularly but shows her what she’s spending the most on. For instance, she was working long hours at the beginning of the year. The result was quite a bit of shopping therapy. Her record showed that she ended up buying 5 lipsticks and 2 pairs of high heels over a short period. Presented with the evidence of her uncharacteristic indulgence, she reminded herself that she already had enough of those luxuries, and any additional acquisitions would be pointless. She hasn’t added to her lipstick and shoe collections since. The result is, of course, less spent, more saved.

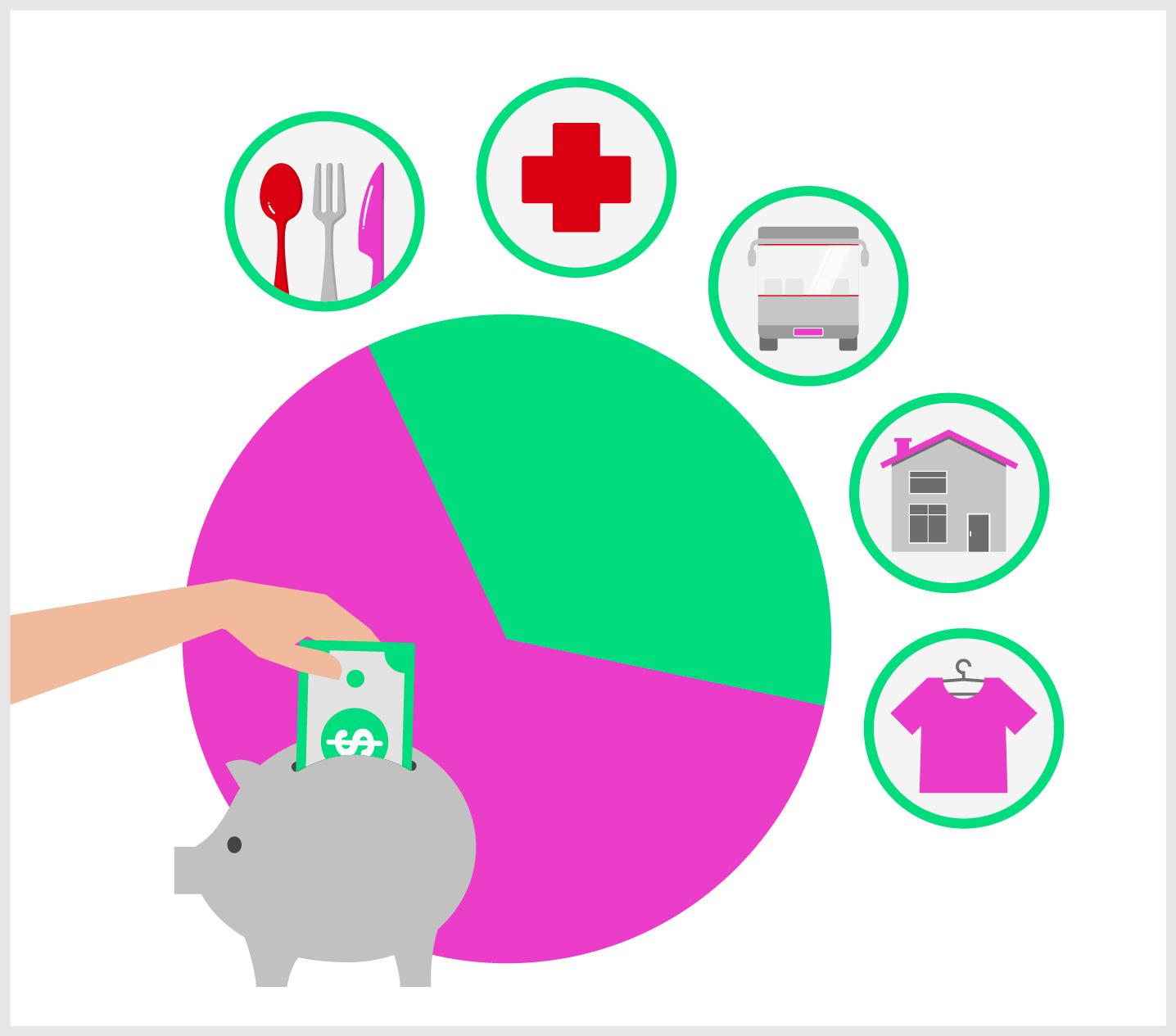

Make good use of savings and transaction accounts

Angel is very organised and separates her expenses and savings into different accounts. After each month’s payday, she would put a portion of her salary in the savings account to keep it out of reach. As for the rest, she deposits it into the transaction account to cover her expenses. If there is money left over in the transaction account at the end of a month, she’d transfer it to the savings account to boost her reserve.

Set a savings goal

Having a goal keeps you going in the right direction. Angel is 35 and she hopes that, by the time she is 65 and ready to open a carefree new chapter in her life, she will have a substantial reserve in place to turn that into reality.

Choose the savings tools that are right for you

Angel understands a carefree retirement requires a major investment. She spent some time looking for a savings tool on the market which would help her reach her goal sooner. In the end, she chose a life insurance plan which offered opportunities for long-term wealth growth. She was drawn to these features in particular:

Life is a long and exciting journey. Raising a family, pursuing further education, starting your own business, buying a property, enjoying your well-deserved retirement, all these need to be backed up with considerable financial resources. Plan for the future and find the right savings tools to help you get the most out of your capital, and you can also start planning the celebrations you would have as you reach each new milestone.

* The above example assumes (i) the life insured is a 35-year-old female, non-smoker; (ii) monthly premium is USD729.2 and a premium payment period of 3 years.

^ You are subject to exchange rate risks. If your insurance policy is denominated in a currency other than the local currency, or if you choose to pay premiums or receive benefits in a currency other than the policy currency, the actual amount paid or received by you will be subject to change according to the prevailing exchange rate between the policy currency and the local / payment currency to be determined by HSBC Life (International) Limited from time to time. Exchange rate fluctuations may have an impact on payment amounts, including but not limited to premium payments, levy payments and benefit payments.

Special offers

Apply for HSBC Wealth Goal Insurance Plan III to enjoy up to 20% off first-year premium, plus an additional 1.5% off for selected customers.

Offer ends 31 March 2026. T&Cs apply.

Disclaimer

The insurance plan mentioned in this article is is a long-term participating life insurance product with a savings element underwritten by HSBC Life (International) Limited (“HSBC Life” or “the Company”). It is not equivalent or similar to any kind of deposit.

You are subject to the credit risk of HSBC Life. Your premiums paid will form part of the Company's assets. You do not have any rights or ownership over any of those assets. Your recourse is against the Company only. If the policyholder discontinues and / or surrenders the insurance plan in the early policy years, the amount of the benefit he / she will get back may be considerably less than the amount of the premium he / she has paid.

HSBC Life (International) Limited (incorporated in Bermuda with limited liability) is authorised and regulated by the Insurance Authority of the Hong Kong SAR to carry on long-term insurance business in the Hong Kong SAR. If you want to learn more about the product details, please refer to the terms and conditions of relevant brochures. HSBC Life will be responsible for providing your insurance coverage and handling claims under your life insurance policy. The Hongkong and Shanghai Banking Corporation Limited is registered in accordance with the Insurance Ordinance (Cap. 41 of the Laws of Hong Kong) as an insurance agent of HSBC Life for the distribution of life insurance products in the Hong Kong SAR. The life insurance plans are underwritten by HSBC Life and are only intended for sale through HSBC in the Hong Kong SAR. For product details and related charges, please refer to the relevant brochures and policy provisions or contact HSBC’s branch staff.

The above examples are hypothetical cases for reference only, they do not constitute sales recommendation or product offer. You should not make any decisions based on the examples and information provided herein. If you are in doubt about the examples or any of the above contents, you should seek independent professional advice or undertake financial analysis to assess your needs before considering insurance plans. The information contained in this article does not constitute an offer for the purchase or sale of any banking or insurance products or services.

The information contained in this article is current as of January 2021.

Issued by HSBC Life (International) Limited (Incorporated in Bermuda with limited liability)

© Copyright. HSBC Life (International) Limited. All rights reserved.

Date