Navigating retirement as the sandwich generation

Living in today’s world requires us to face a variety of challenges, is longevity a trouble? Retirement often means financial insecurity, and some might question if they are truly ready for this major transition. The research report aims to give you some insights on better retirement planning.

HSBC Life presents the research study of “Between responsibility and restfulness: Retirement challenges and new horizons for the sandwich generation”. A total of 1,003 respondents from Hong Kong and Macau were interviewed. The research aims to identify their pain points and solutions for retirement, explore the reasons and situations behind the trend of retiring away from home.

“Sandwich generation”: Between family responsibilities and restfulness

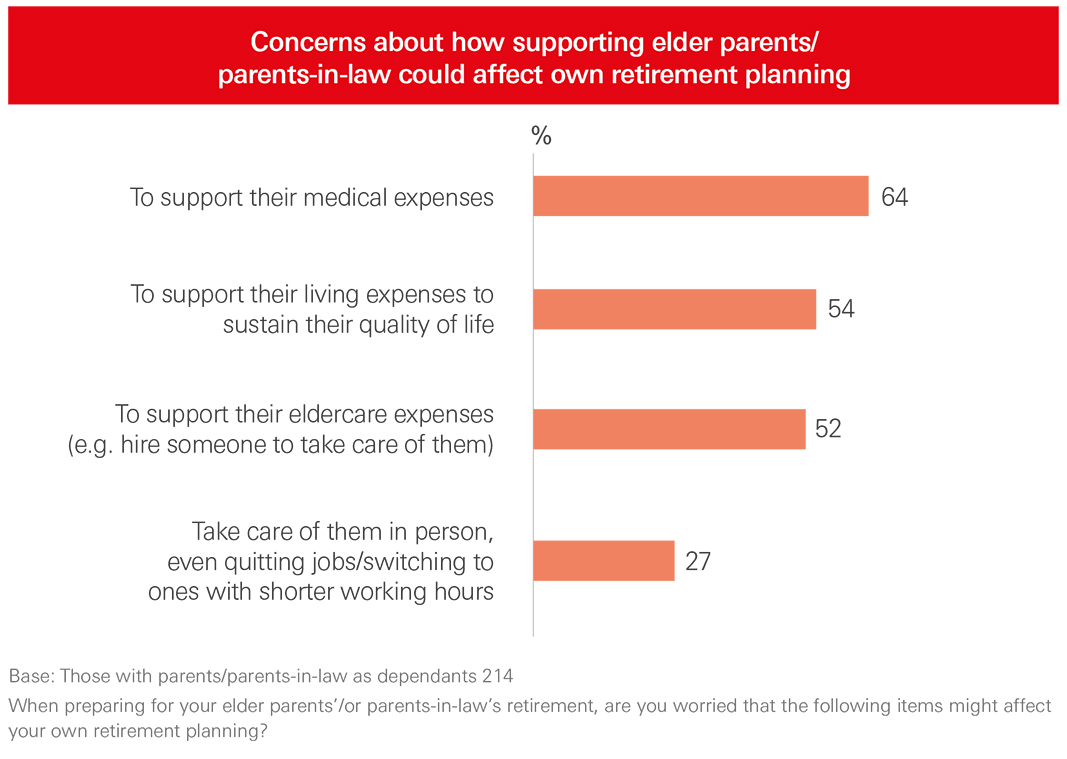

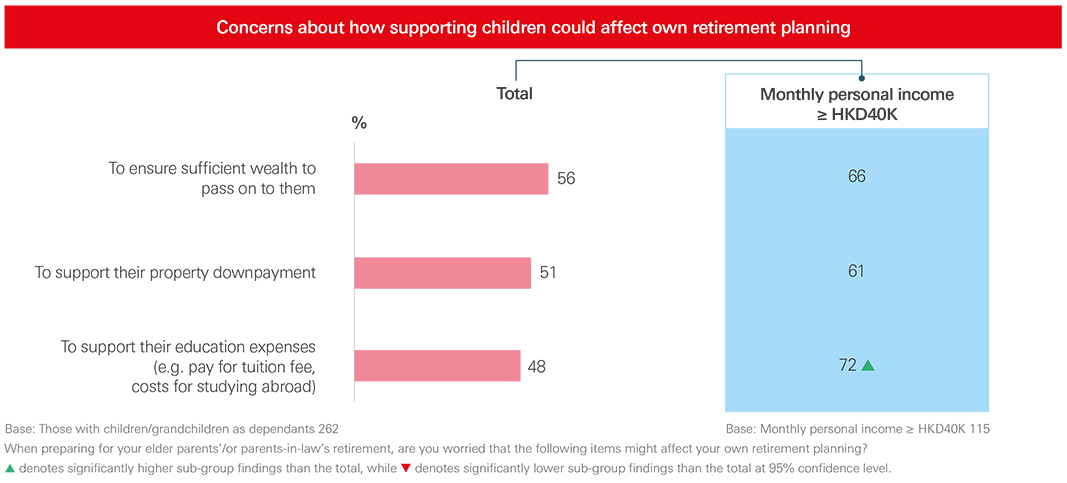

40% of the respondents are the sandwich generation, they expressed the need to bear the financial responsibility of looking after their parents or children after retirement. They allocate over one-third (36%) of their spendings on average to their families. 93% of them are worried that family responsibilities would affect their own retirement planning. For those with elderly parents, they cited medical expenses, daily living expenses and eldercare needs as the top three concerns. For those with children, their top concerns include passing down sufficient wealth, assisting with property down payments, and covering education expenses.

Retire and relocate: Exploring the options away from home

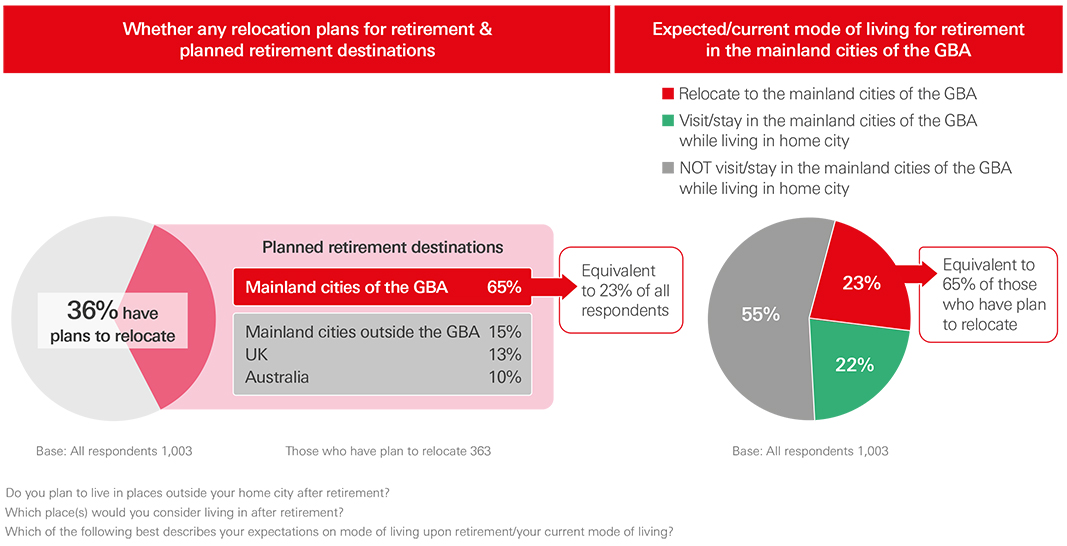

36% respondents are planning to retire to a different location than Hong Kong and Macau to look for an alternative retirement solution. Among this group, 65% have chosen the mainland cities of the GBA, distantly followed by the mainland cities outside the GBA (15%), UK (13%) and Australia (10%). Additionally, another 22% of the total respondents are planning to treat mainland cities of the GBA as their second home, spending a quarter of their retirement time there while maintaining ties with their home city.

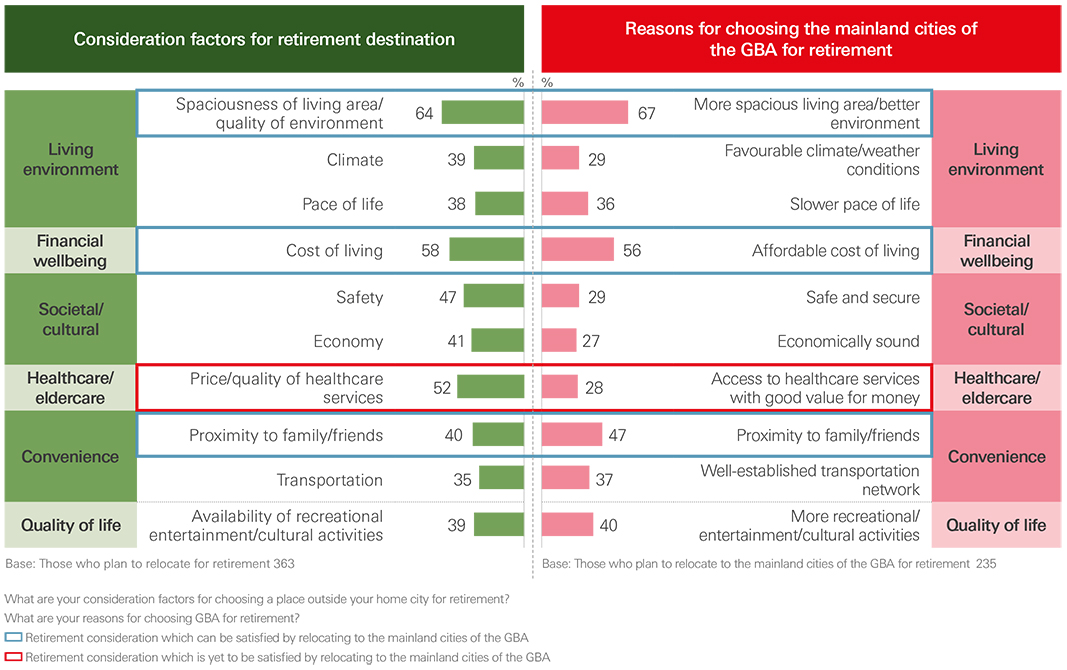

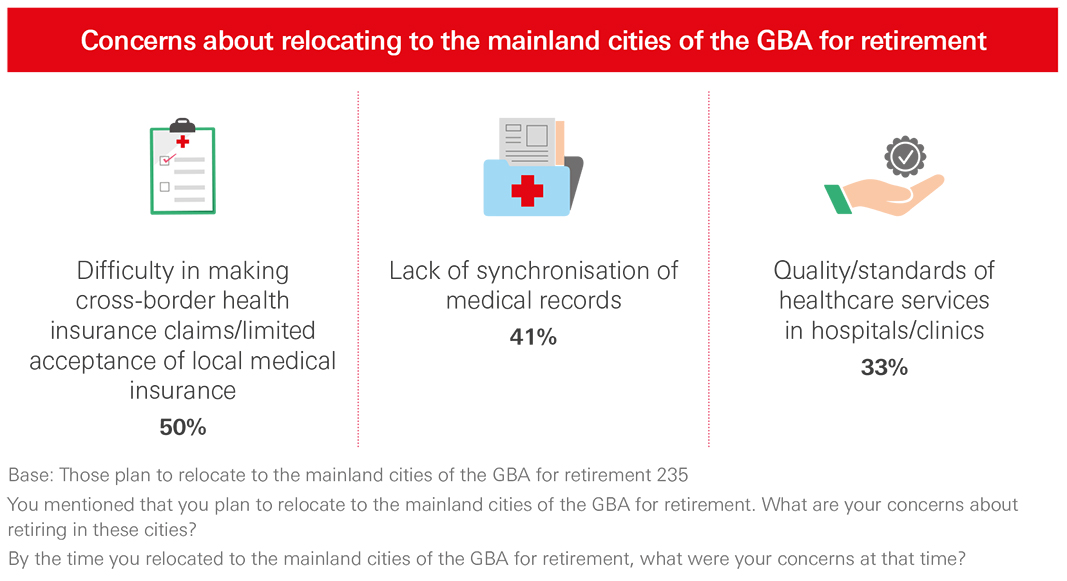

For people choosing where to retire, spaciousness/quality of living environment, cost of living and price/quality of healthcare services are the key criteria. Half of them have the perception that making cross-border health insurance claims is difficult, or that expenses incurred in the mainland cities of the GBA are not claimable at all under their insurance policies in Hong Kong. 41% also expressed concern about the lack of synchronization of their medical records across different locations.

Growing appeal of retirement communities in the mainland cities of the GBA

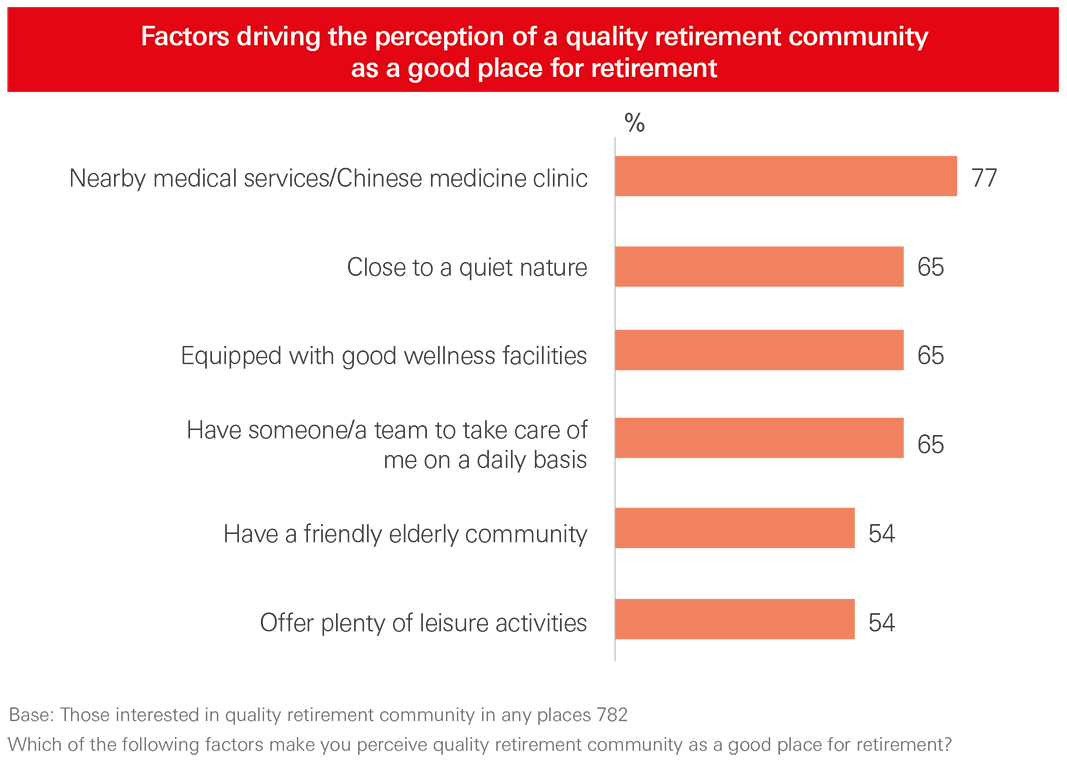

78% of all respondents expressed interest in refiring in a quality senior living community. Sandwich generation who are keen to refire in the mainland cities of the GBA shows a strong interest to a quality senior living community with access to specialized Chinese medical clinic, professional care support and wellness facilities.

Experts suggests a thorough understanding of a suitable retirement plan

Retirement is not just about you. A majority of pre-retirees and retirees are actively seeking ways to effectively care for their dependants without compromising their pursuit of fulfillment in their golden years. It is therefore crucial that we develop a thorough understanding of what our suitable retirement lifestyle entails – financially, geographically, socially – as well as the alternatives that might interest us. After all, retirement is most rewarding to those who started planning for it years, even decades, in advance. With the growing trend of retiring in the GBA , HSBC Life is actively working on creating a robust and comprehensive GBA retirement ecosystem.

To read the full research study, please visit the research study of “Between responsibility and restfulness: Retirement challenges and new horizons for sandwich generation”