Term Life and Whole Life Insurance – what is the difference?

A life insurance policy is one of the most important purchases you could ever make. There is, however, a wide variety of life insurance products on the market. For a start, the two most common types are term life and whole life plans, with very different scopes of coverage. What are the key differences between them? And what factors should you consider when choosing a life policy to ensure the best protection for your current life stage?

A life insurance policy is one of the most important purchases you could ever make. For a start, the two most common types are term life and whole life plans, with very different scopes of coverage. What factors should you consider when choosing a life policy to ensure the best protection for your current life stage?

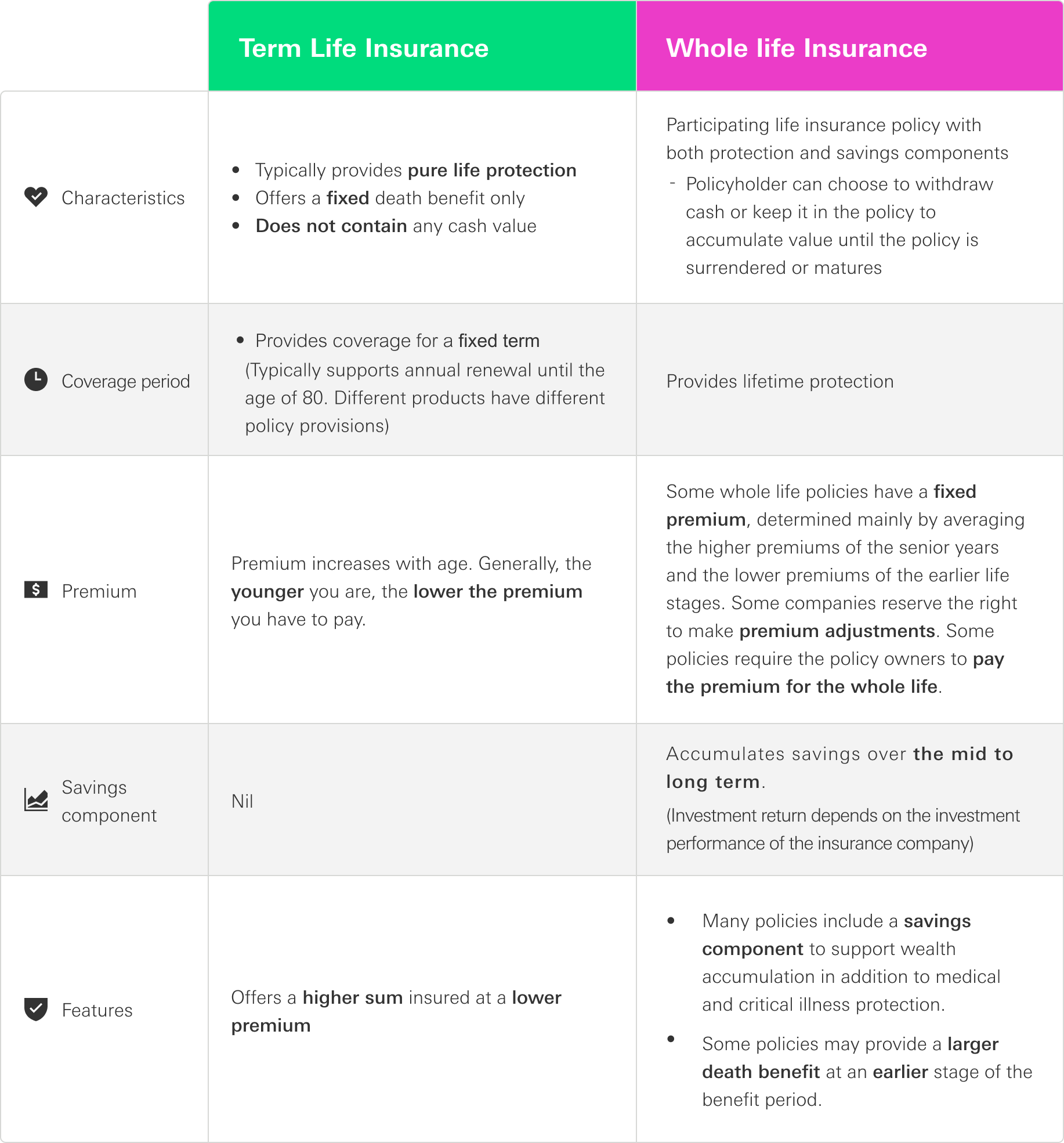

Term Life vs. Whole Life Insurance: differences at a glance

Who is term life insurance for?

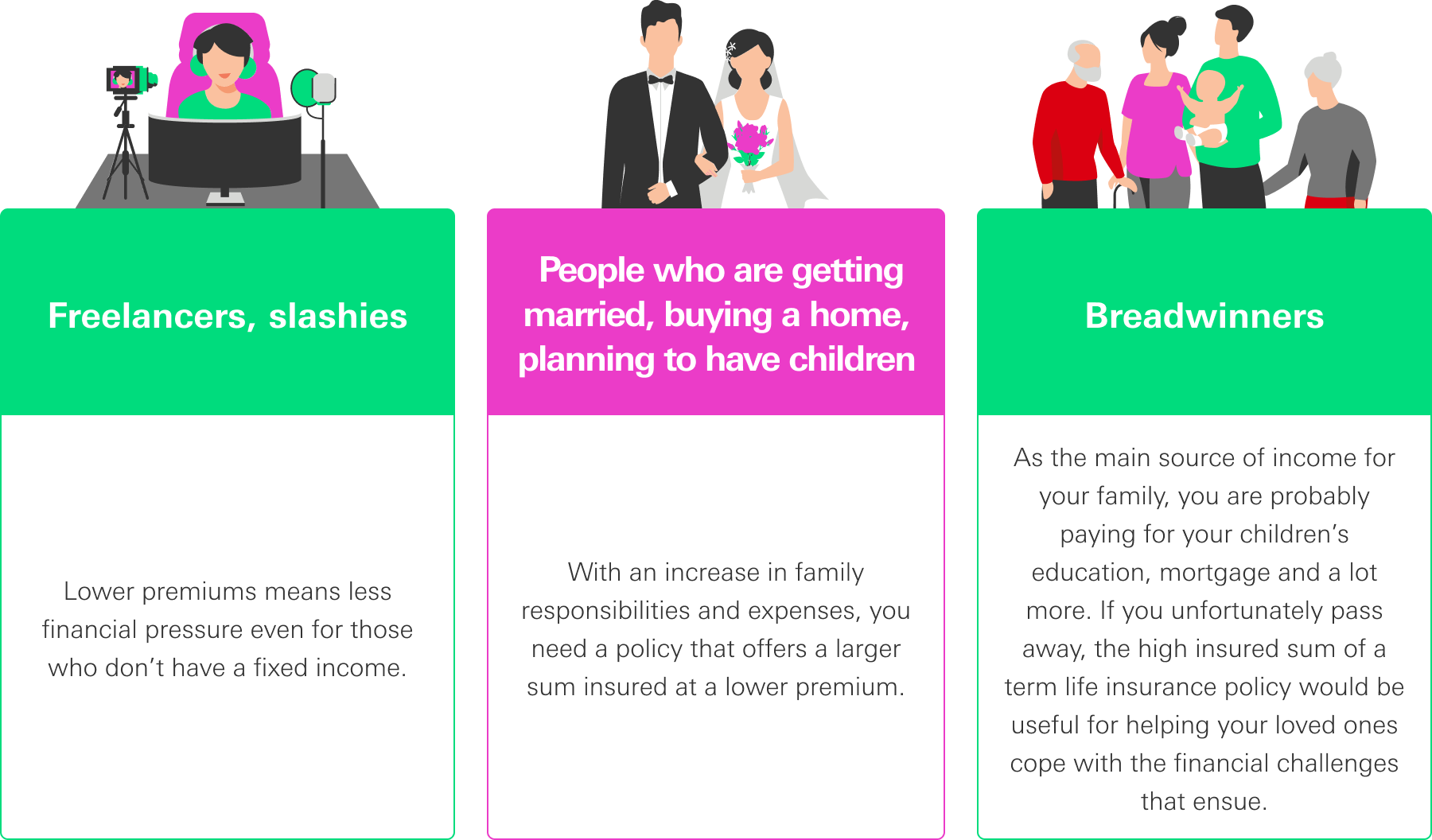

Everyone needs to be protected against life’s uncertainties. If you have a steady income and are financially capable, you might want to choose a whole life policy, which typically has a higher premium but contains a saving component to help you fulfill your long-term wealth goals.

Generally, term life policies tend to be more affordable, thus are more suitable for young people and career starters with lower incomes. However, a term life insurance policy could also be a good protection solution for:

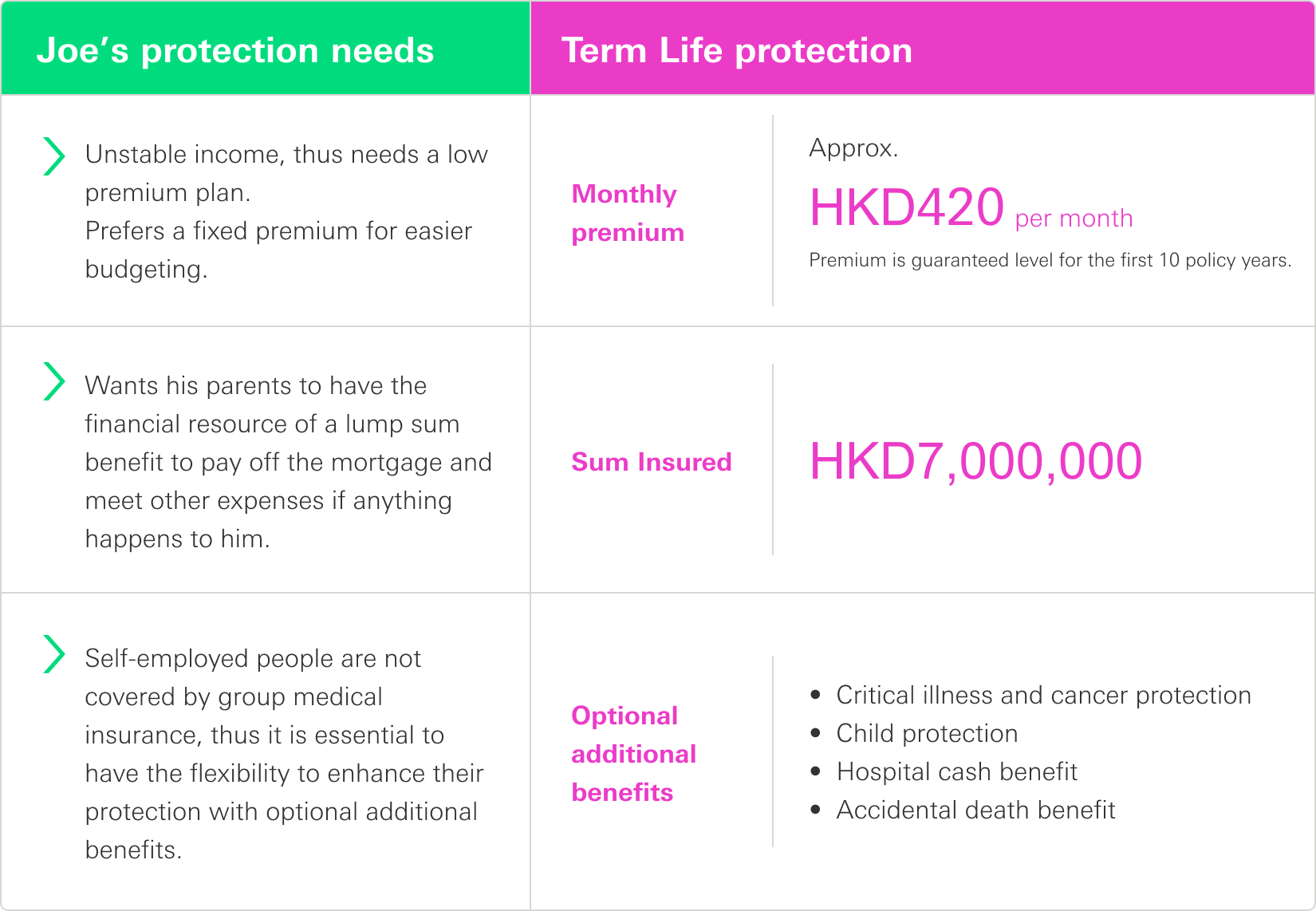

Joe’s story – Paying lower premiums for more protection and flexibility

|

Joe is a 28-year-old fitness coach. As a freelancer, he doesn’t have a stable income. He is the only child of the family and is thus responsible for supporting his parents. He owns a HKD7 million property, for which he is paying mortgage monthly. To acquire protection that meets his limited budget, he opts for a term life insurance plan:  |

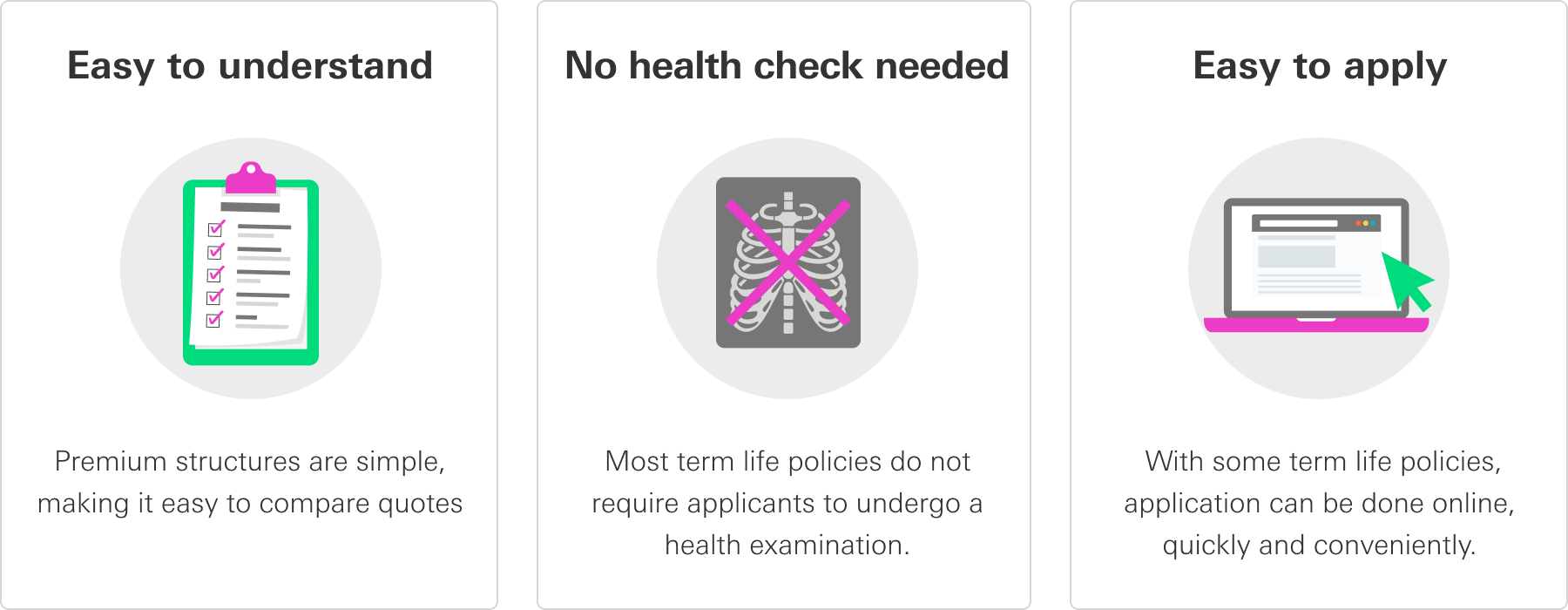

Other term life insurance benefits

In addition to lower premiums, higher flexibility and larger death benefits, term life insurance policies offer other advantages:

Different life stages bring different needs, and the protection plans we have should be continuously adjusted to reflect these changes. Term life and whole life insurance plans offer different benefits to support different priorities, so choose the protection that best suits your circumstances and financial capability. To learn more, talk to us today.