Buying Property in Hong Kong: A Guide for Overseas Buyer on Purchase and Mortgage

Being a popular property investment market, the sales processes, payment methods, and mortgage requirements in Hong Kong may be different from other countries. This article highlights key points to note for Mainland and overseas buyers seeking to purchase first-hand properties or arrange a mortgage in Hong Kong.

Further reading: The Home Purchase Journey at a Glance

- You can explore Hong Kong's property market through several channels:

- Access the Sales of First-hand Residential Properties Electronic Platform to learn more about the first-hand properties, including sales brochures, price lists, and sales arrangements.

- Consult local property agencies, and learn more about the latest listings, property price trends, and transaction history via real estate information platforms and property market news websites.

- Once you’ve identified your preferred property, you can submit a registration of intent to the developer through the property agent (if applicable). You will need to provide a cashier order or a cheque for the amount specified by the developer, payable to the designated law firm.

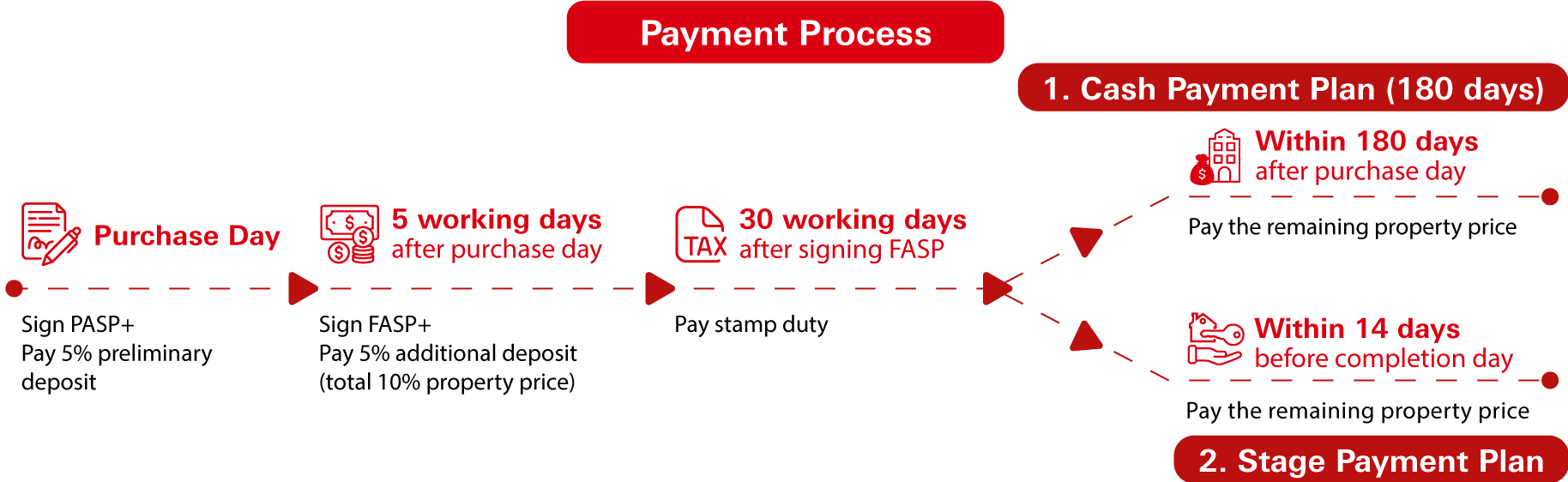

- Developers usually use balloting to determine the order for selecting the residential properties. Once you have selected your preferred unit, you will need to sign a Provisional Agreement for Sales and Purchase (PASP), and pay a 5% provisional deposit of the property price. After signing the PASP, you'll need to sign a Formal Agreement for Sales and Purchase (FASP) within five working days, and pay an additional 5% deposit.

Further reading: New Property: Key factors to note when buying first-hand property

- First-hand properties are usually classified as completed or as under construction. For first-hand properties still under construction, developers will usually have a pre-sale with a choice between two payment plans:

- Cash Payment Plan: Buyers who opt for this payment plan will need to pay the full property price within a designated timeframe before the construction is completed. As developers prefer earlier payments, more discounts and benefits will be given for this plan. If you have sufficient funds and want to enjoy these benefits, cash payment plan would fit you.

- Stage Payment Plan: With this option, buyers pay a down payment after selecting their unit, with the remaining balance to be paid within 14 days after the developer notifies them that the unit ownership can be transferred. This plan provides buyers with sufficient time to arrange financing.

- Please note that you must be in Hong Kong to apply for a mortgage or sign any mortgage documents.

- In general, both local and overseas buyers can apply for a mortgage with a loan-to-value (LTV) ratio up to 70% of the property price. For new arrivals who have obtained a Hong Kong identity card and are purchasing a property for self-occupancy, you can also apply for mortgage insurance with a LTV ratio of up to 90%. However, buyers holding Mainland or overseas passports without a Hong Kong identity card are not eligible for mortgage insurance.

- Typically, individuals from the Mainland and overseas need to provide the following documents when applying for a mortgage from a bank:

- A valid passport or Exit-Entry Permit for Travelling to and from Hong Kong and Macau (please note that a Mainland identity card cannot be used for mortgage applications)

- PASP and its attachments

- Proof of local or non-local incomes1

| Proof of Income requirements (Non-local income source) | ||

|---|---|---|

| Regular salaried payroll customer | Irregular salaried payroll customer | Self-employed customer |

|

|

|

Regarding the proof of local income requirements, please refer to further reading for details.

Further reading: Mortgage application documents checklist

- Investment or rental income can generally be included in personal income calculations; however, calculation methods may vary among different banks. Please contact us for more information.

- Additionally, banks in Hong Kong usually only accept Hong Kong dollars as the repayment currency for mortgages. You can use HSBC's foreign exchange service to convert Hong Kong dollars for mortgage repayments anytime and anywhere through online or mobile banking.

- Please note that the documents required for a mortgage application are not limited to the above. The bank may request supporting documents related to your mortgage loan application.

Note:

- Income proof requirement may vary case by case. For enquiries, please contact our staff.

Mortgage loan approval is subject to the applicant's personal circumstances and the applicable terms and conditions and policies at the time. Approval is subject to credit assessment and the bank reserves the right of final decision.

To borrow or not to borrow? Borrow only if you can repay!

All information is for reference only. All services provided by The Hongkong and Shanghai Banking Corporation Limited ("HSBC") are subject to the prevailing terms and conditions and the applicable terms and conditions shall prevail if there are any inconsistencies or discrepancies with the content. HSBC is not responsible for any liabilities, costs, damages, or any consequences stemming from reliance on the information provided. Content provided should not be treated as any investment or legal advice or professional opinion, and is not solicitation or advice of any products or services. HSBC does not guarantee the accuracy, timeliness or completeness of this information, and information may be subject to change without prior notice.

Issued by The Hongkong and Shanghai Banking Corporation Limited