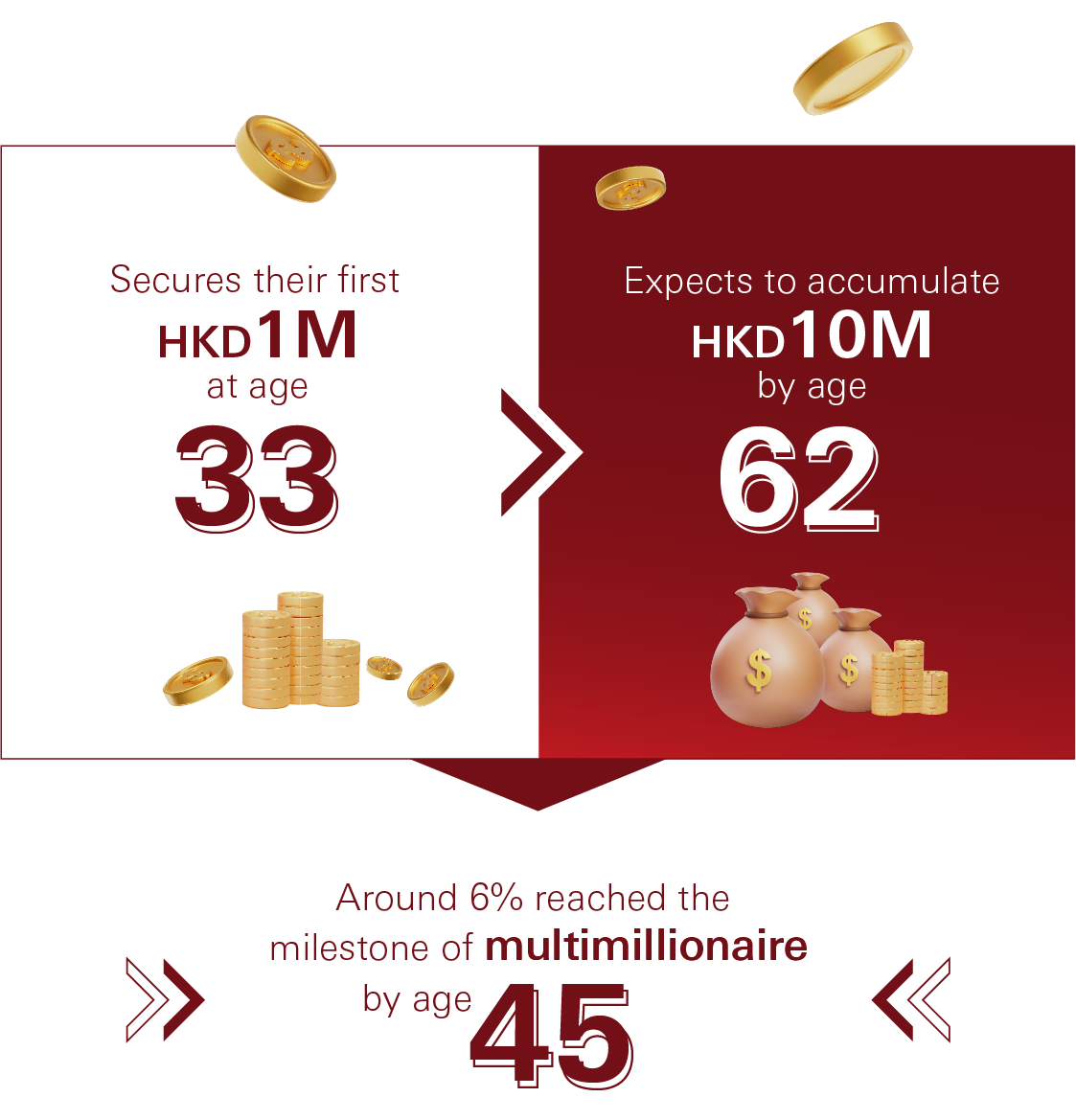

Building on our insights from last year, HSBC Premier has conducted a survey* in Hong Kong to examine the market landscape further. The HSBC Premier 2023 Affluent Survey delves deeper into the evolving financial goals and landscapes of Hong Kong’s affluents. A key finding reveals that a typical middle-class individual:

Influenced by a blend of various factors, both global and local, the affluent has adopted new trends in wealth management.

17% of the next middle-class generation own a property before age 18, with parents preparing 400-sq.-ft homes for post-graduation

Among middle-class parents who intend to purchase a property for their children, 1 in 4 plan to buy it for them at or before the age of 18.

Will wealth span three generations? 54% are factoring in their grandchildren’s financial futures

While the intent for legacy planning is high, only 25% have begun. With 94% wanting to leave assets for their children, 54% also consider their grandchildren, mainly through cash. This reflects a deep-rooted desire to ensure financial stability across generations.

Many believe they need HKD6.66M for retirement, yet more than half underestimate the costs of retiring

Nearly 60%

consider 60 as the ideal retirement age.

HKD6.66M

is estimated to be needed for retirement.

Over half (56%)

find this goal challenging.

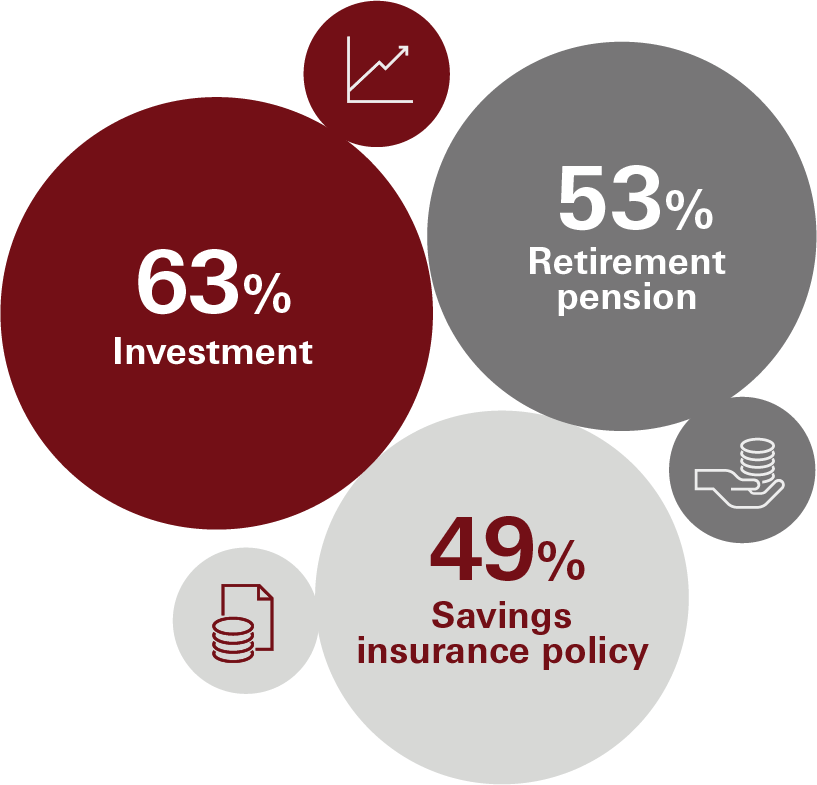

Amid interest rate uncertainties, investments pave the way for passive retirement income

Investments lead as the preferred post-retirement income source. 55% are amplifying investments and time deposits due to economic trends.

The perceived affluent benchmark has grown by 8% from last year, significantly exceeding the actual average and revealing a marked disparity.

Increased caution towards wealth management in 2023

This year, 49% of respondents have adopted a more cautious approach, reflecting an 8% increase from the previous year.

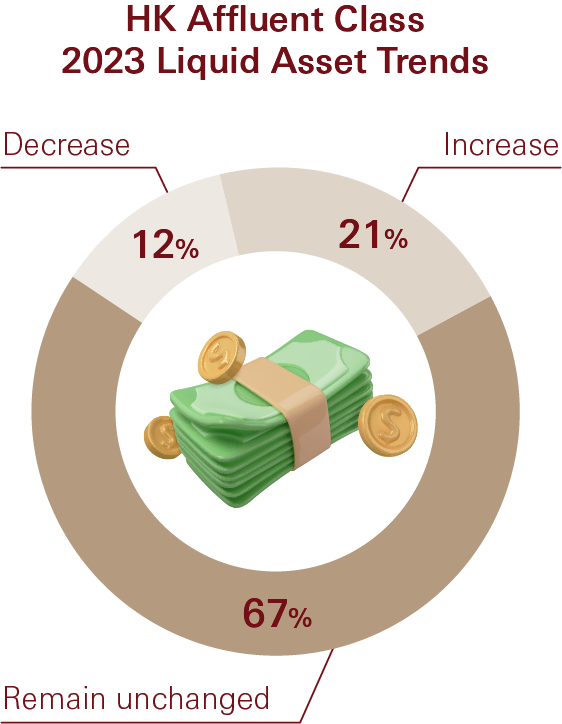

Despite post-pandemic challenges, affluent wealth defied decline and outperformed the Hang Seng Index

With 21% witnessing a noteworthy 14% increase in their liquid assets, the affluent demonstrated their financial resilience in light of global adversities.

Faced with property market volatility and rising interest rates, 59% have shifted their investment gaze elsewhere

Faith in property value preservation has dropped from 76% in 2022 to 53% in 2023

68% anticipate and are concerned about rising interest rates. This indicates that property acquisition is losing priority, signalling a shift in investment focus.

Unlock your wealth potential with HSBC Premier's comprehensive solutions.

As global landscapes evolve, so do your wealth goals. HSBC Premier is steadfast in supporting your journey to intergenerational wealth sustainability. We offer you tailored services like our Wealth Goal Insurance Plan II, which enables policy coverage transfer to your loved ones, ensuring your financial aspirations are met at every life stage. If you are preparing for your children's overseas education, we provide specialised support services, including our Voluntary Health Insurance Scheme (VHIS), to address every facet of your planning needs. Our comprehensive approach ensures that, regardless of future shifts in landscapes, you and your families can confidently pursue your wealth and life aspirations.

*There are 1098 respondents in the HSBC Premier 2023 Affluent Survey

Risk Disclaimer

Investment involves risk. This information is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. All products in any financial planning tool are generalized for simulation purpose without taking product suitability and affordability into account. You should carefully consider whether any investment product or service is appropriate for you in view of your personal circumstances. Past performance is no guide to future performance nor do we represent that any movements provided in the simulation tool are likely to occur in the future. There may not be any HSBC product that provide the same outcome as the simulation in the financial planning tool. Investors should refer to the individual product explanatory memorandum or offering document for further details and risks involved. The price of investment products may move up or down. Losses may be incurred as well as profits made as a result of buying and selling investment products. The information is subject to change without notice.