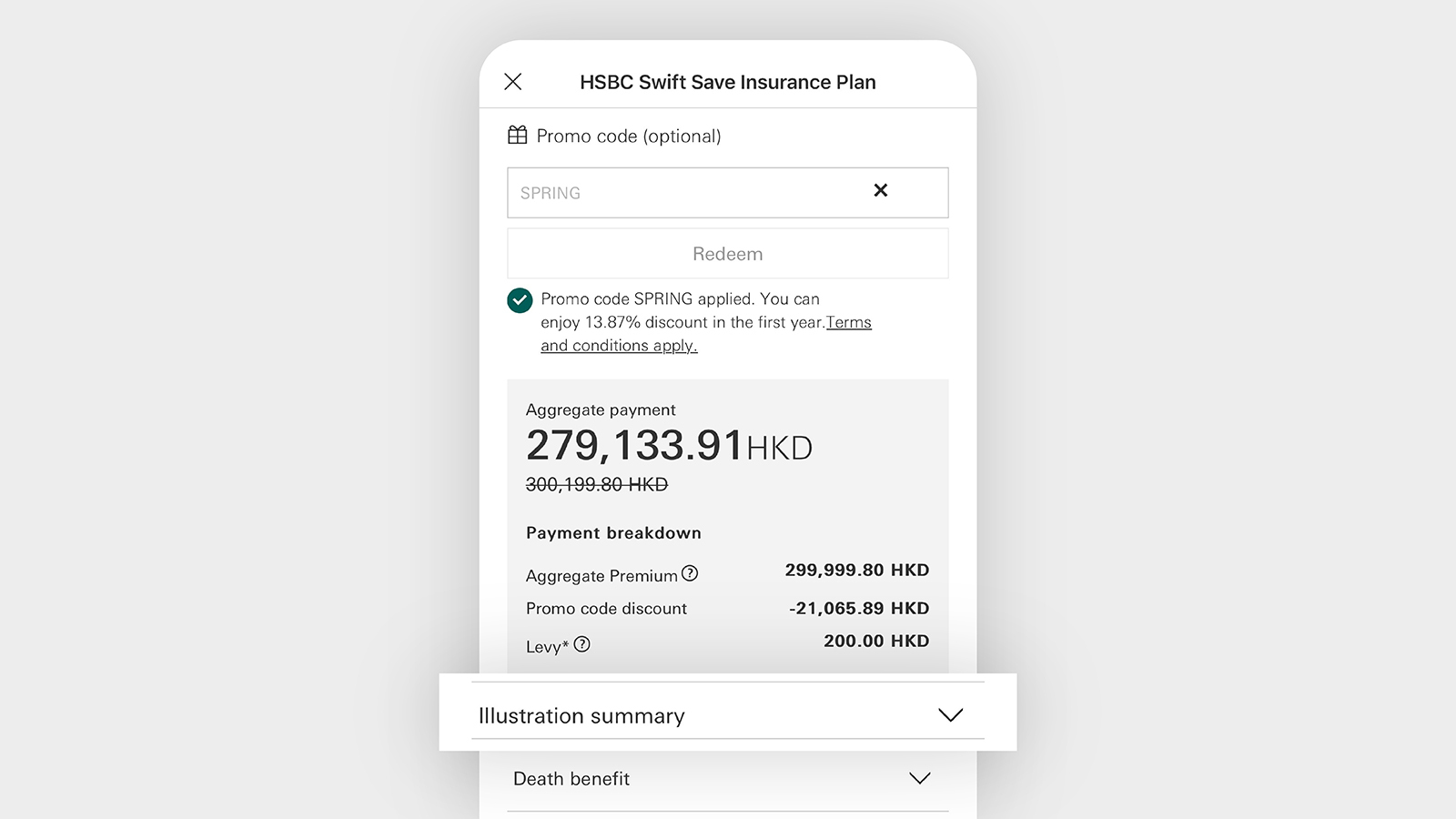

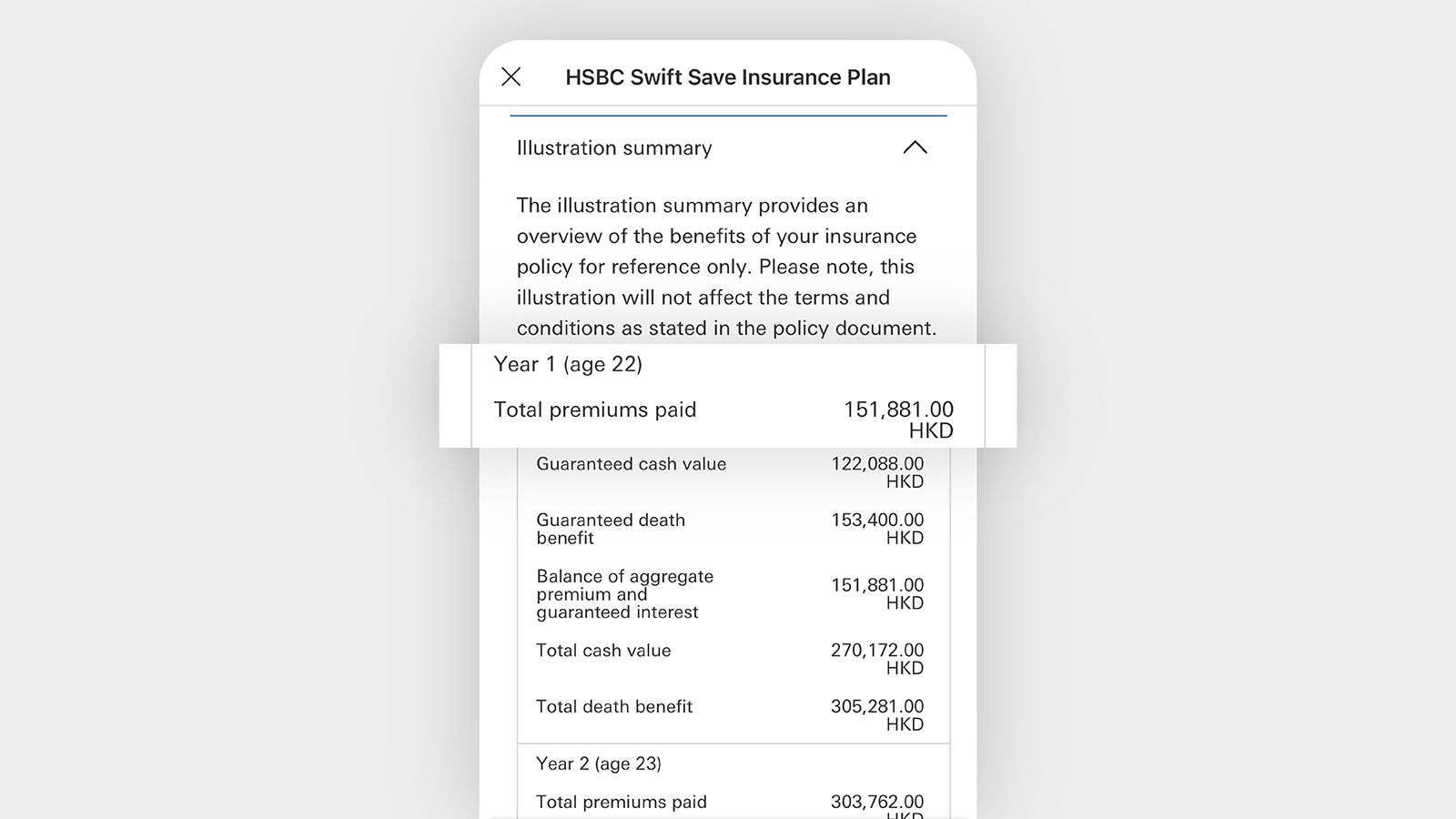

If you use the promo code ‘SPRING’ to take out a 5-year HSBC Swift Save Insurance Plan with a lump sum payment of HKD300,000 (before discount), i.e. ANP of HKD151,8813, you will enjoy:

-

A first-year premium discount of 13.87% which is equivalent to HKD21,065.

That means you will pay an approximate lump sum of just HKD278,935 and get back HKD334,4884 after 5 years (guaranteed HKD return of 3.70% p.a.)!

-

RewardCash premium rebate of $750RC

-

Extra premium rebate

If you join the Well+ Get Insured Online challenge for the first time this year, you’ll also enjoy an extra premium rebate of up to $300RC5! Eligibility requirements and rewards as follows:

| Eligibility |

Premium refund |

- Join Well+ Get Insured Online challenge for the first time this year and apply successfully for an eligible new HSBC insurance plan6

|

|

- New HSBC Life customer7

|

|