- Terms and Conditions apply.

- Terms and Conditions apply .

- HSBC Life reserves the right to modify the discount and offer at any time without prior notice.

- The list of HSBC Life Care+ Medical Network providers and specialties are subject to change.

- 3-month Standard Plan free trial includes main member and up to 2 sub-members. The discounted price of HKD333 for 3 months of Premium Plan applies to main member and up to 5 sub-members.

- Includes oral examination, clinical advice, scale and polish, tooth extraction, tooth filling, root canal treatment, crown and bridge.

- This service is only available in Hong Kong. Delivery time will depend on your delivery location and actual traffic conditions. An additional charge of HKD50 for medicine delivery or HKD20 for prescription delivery is applicable per consultation for Premium Plan members. For Standard Plan members, you can purchase video consultation including medicine delivery for HKD250 each.

- Hong Kong taxpayer who is the policyholder of a policy issued under a certified plan of Voluntary Health Insurance Scheme (VHIS) may claim tax deductions for the premiums paid (excluding discount and levy) for yourself and your specified relatives up to HKD8,000 per insured person per assessment year. The amounts are for illustrative purposes only. The actual amounts of tax deductible and/or saving depend on the personal circumstances, and may be different from the amounts illustrated. For details, please visit the website of the Inland Revenue Department (ird.gov.hk) or seek independent tax advice.

The Ultimate Healthcare Combo

Outpatient + Inpatient

Comprehensive protection for your health

HealthPass

VHIS One Plan

Access healthcare the smarter way

Activate and use immediately!

Start your 3-month trial and enjoy up to 20% off3 on doctor visits.

HSBC Life is giving away 160,000 free trials of HealthPass in Hong Kong!

HSBC HealthPass

Enjoy savings on doctor visits and dental care

Save on both money and time with HealthPass!

Save on scaling, filling, extractions, crowns and more!

Case Study02

(regular price: HKD 250 per video consultation)

Affordable, convenient and stress-free health care at your fingertips!

HSBC VHIS One Plan

Comprehensive medical protection giving you peace of mind for your medical expenses

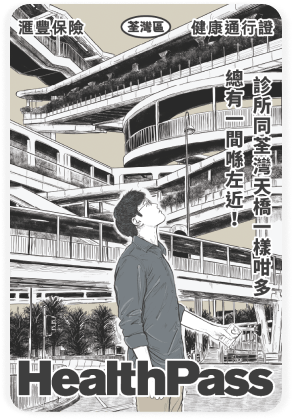

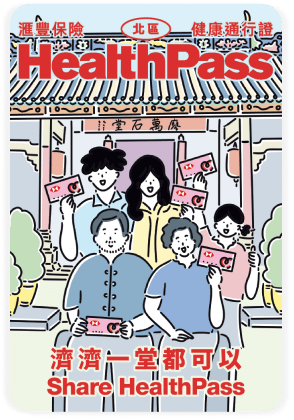

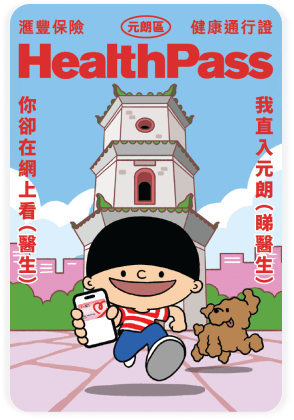

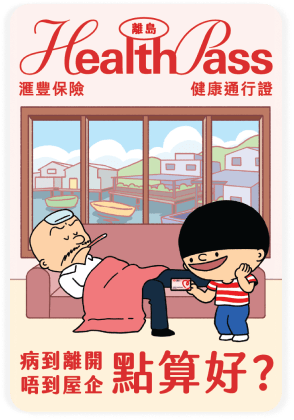

HealthPass Artist Series

HSBC Life

HealthPass Tour

FAQ

More about HealthPass

- HSBC Banking customers who hold an HSBC HK Mobile Banking app digital profile

- 18 years of age and older

Customers holding:

- a valid HKID; or

- a valid passport (where HKID isn’t available)

- Go to Well+ homepage.

- Select HealthPass.

- Select 'Subscription management'

- Select 'Cancel auto-renewal'.

- Medicine delivery fee of HKD50

- Medicine delivery fee of HKD50

More about VHIS One Plan

For VHIS One Plan, immediate coverage should be granted once the policy being effective as per the benefit schedule respective limits.

If an Insured Person undergoes surgical treatment for breast cancer, and Surgeon’s fee is payable for such surgical treatment, benefit item “Specified reconstructive surgery benefit”, shall be payable for eligible expenses for breast reconstruction surgery performed (to restore one or both of the Insured Person’s breasts for beautification or cosmetic purposes) which occurs at the same time or within twelve (12) months from the date of the surgical treatment for breast cancer, subject to the limit as stated in the Benefit Schedule of the respective Plan.

- The policyholder is a personal income taxpayer or his/her spouse;

- The insured person is the policyholder or the policyholder’s “specified relatives” as defined under the Inland Revenue Ordinance (Cap. 112); and

- The insured person is a Hong Kong resident*

(*) Including Hong Kong Identity Card holders, and people aged under 11 who are not Hong Kong Identity Card holders but their parents are Hong Kong Identity Card holders when they were born or adopted. For detailed definitions, please refer to Inland Revenue Ordinance Cap. 112.

- Accept the application

- Decline/ Postpone the application

- Accept the application with premium loading

- Accept the application with case-based exclusion(s)

- Accept the application with premium loading and case-based exclusion(s)

HSBC HealthPass is a health services-based membership scheme sold and managed by HSBC Life (International) Limited, incorporated in Bermuda with limited liability ('HSBC Life'). HSBC HealthPass is a product of HSBC Life, but not The Hongkong and Shanghai Banking Corporation (the 'Bank'). It's part of the overall Well+ Programme co-branded by HSBC Life and the Bank, and is aimed at rewarding those who are proactive in improving their health and general well-being ('you'). HSBC HealthPass gives customers access to affordable healthcare with discounted health, medical, and wellness services and products. HSBC HealthPass is a membership scheme and not an insurance product.

The HSBC VHIS One Plan is a life insurance plan underwritten by HSBC Life which is authorised and regulated by the Insurance Authority ('IA') to carry on long-term insurance business in the Hong Kong SAR. It is not a bank deposit or bank savings plan. Please refer to the product brochure for detailed features and the policy provisions for the detailed terms and conditions.

HSBC Life is incorporated in Bermuda with limited liability, and is one of the HSBC Group's insurance underwriting subsidiaries. The Bank is registered in accordance with the Insurance Ordinance (Cap. 41 of the Laws of Hong Kong) as an agency of HSBC Life for the distribution of life insurance products in the Hong Kong Special Administrative Region. This product is a product of HSBC Life but not the Bank and it is intended only for sale in the Hong Kong SAR. Your benefit is subject to the credit risk of HSBC Life. Your premiums paid will form part of HSBC Life's assets. You do not have any rights or ownership over any of those assets. Your recourse is against HSBC Life only.

In respect of an eligible dispute (as defined in the Terms of Reference for the Financial Dispute Resolution Centre in relation to the Financial Dispute Resolution Scheme) arising between the Bank and you out of the selling process or processing of the related transaction, the Bank is required to enter into a Financial Dispute Resolution Scheme process with you; however, any dispute over the contractual terms of the above insurance product should be resolved between HSBC Life and you directly.