Gen Z1 isn’t the next wave, they ARE the new wave – bursting with fresh perspectives, unconventional lifestyles, and innovative interpretations of financial management.

HSBC One sees the limitless potential of Gen Z, which is why in 2024, we’re dropping the latest Decoding Gen Z Study.

Together, let us take a deep dive into their behaviours, and explore the world through the Z lens.

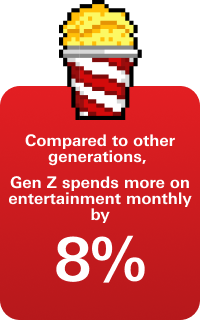

Gen Z1 knows how to live it up. From shopping sprees to movie nights, their monthly expenditure on entertainment exceeds that of any other generation.

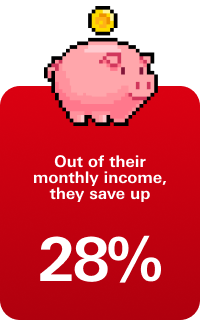

But here’s the kicker – they are surprisingly financial disciplined too and are doing an impressive job of balancing fun and finance.

On average, Gen Z embarks on their investing journey by the age of 20 and saves 28% of their income each month, putting them ahead of all other generations.

It is time to decode their “mindZet”.

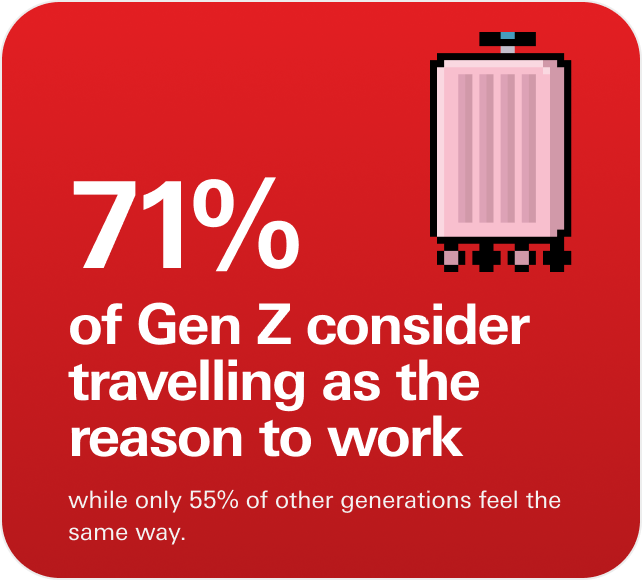

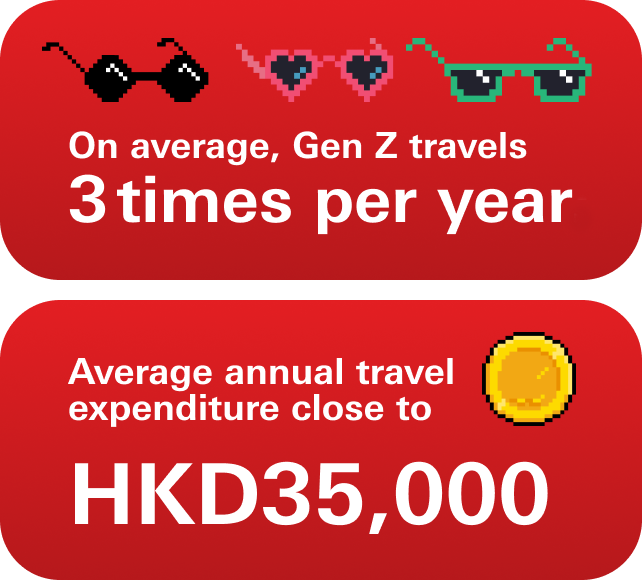

Hustling hard for home-buying has always been a traditional social norm – people simply viewed it as a key milestone in life. Gen Z, however, would much rather travel thousands of miles than spend millions of dollars on a property.

They are either on a trip, or working to save up for the next trip 🏃🏻💨💨.

To Gen Z, even the sky is not the limit. Being the experience enthusiasts they are, Gen Z knows how to put their money into fun use – dining, partying…you name it. They strive to live well, but they do well in saving money too. In fact, Gen Z leads all generations in both spending and saving ratios 🤑🤑🤑.

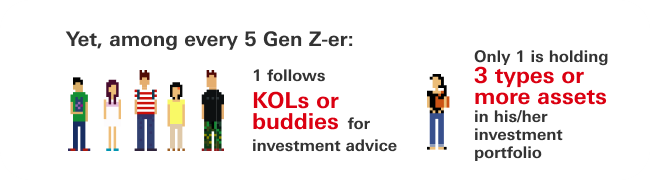

Born in the digital age, Gen Z ventures into investing earlier than any other generation 🔥🔥, but they are also prone to herding behaviours 🕺 and misinformation.

Meanwhile, here are the reasons why some Gen Z-ers have not started investing yet:

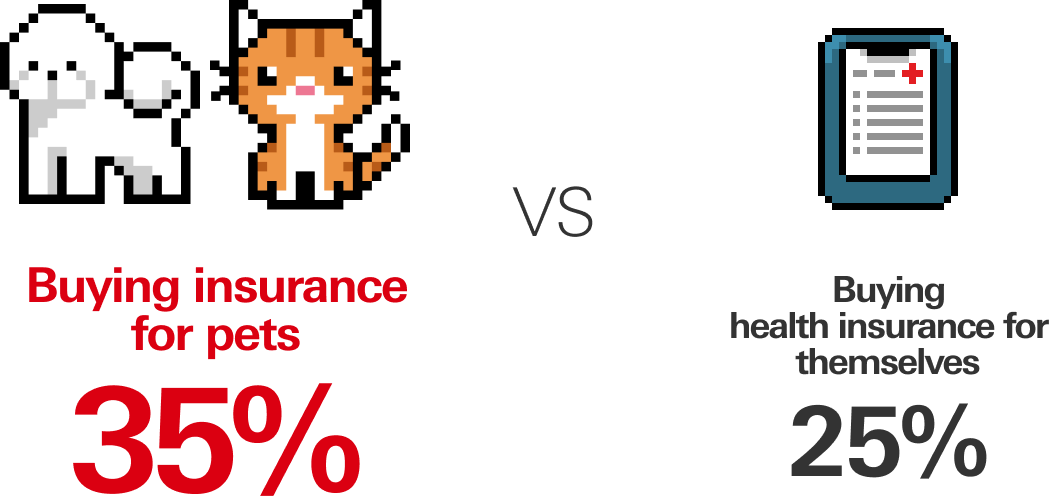

Gen Z sees enjoyment as a priority, but when it comes to health, they are relatively indifferent.

In fact, they would rather buy insurance for their pets than for themselves.

Keeping an eye on your health is just as important.

That’s what it takes to bring your furry friends on even more adventures.

Constantly challenging the status quo, Gen Z never stays in the comfort zone.

To keep pace with Gen Z, HSBC One has been upgraded too.

HSBC One 2.0 - an all-in-one account that offers comprehensive digital banking services with exclusive benefits such as the new Flash Friday✌️ rewards, auto payroll set-up and savings rates offers, strives to elevate your financial and lifestyle experiences.

Learn more

1.Hong Kong residents aged between 18 to 27

*The survey was conducted from June 27 to July 15, 2024, and had interviewed 1,253 residents aged 18 to 34 living in Hong Kong or other cities in the Greater Bay Area in Mainland China.