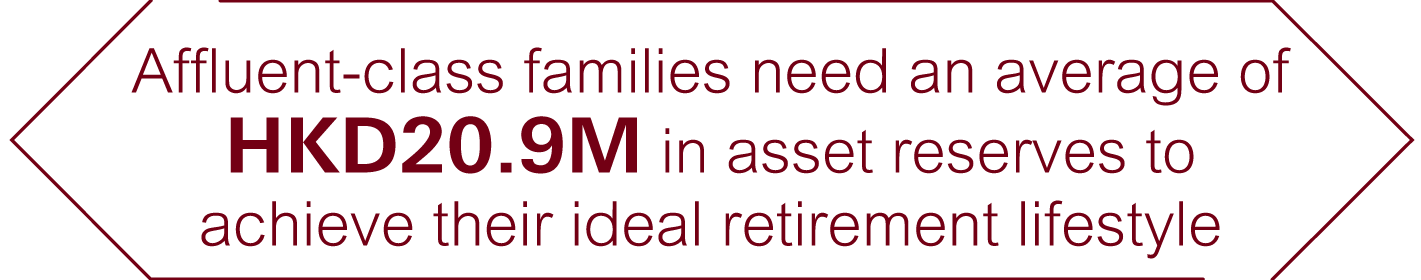

HSBC Premier has conducted a survey in 2024 with 1,057 affluent-class individuals who possess HKD1 million or above in liquid assets to gain insights into their retirement aspirations and planning strategies. The report reveals that the ideal retirement age for the affluent class is 60 years old.

In reality, how can affluent-class individuals truly retire without any worries? Let’s take a closer look!

![]()

The ideal retirement age for the affluent class is 60 years old

On average, retirement planning starts at the age of 45

![]()

75% of affluent-class individuals born in the 80s/90s want to "plan early"

Yet, 45% have NOT taken any proactive steps

80% of respondents need to support

support 3 family members*

*The 3 family members mentioned include the respondent themselves

50% of retired individuals with children

have delayed their retirement planning

Affluent-class parents

retire 7 years

later than affluent-class individuals without children

20% of affluent-class parents among them

still provide financial support to their children

even at the average age of 64

They have put their children’s financial needs into their retirement plans, and

set aside HKD1.4M

for their children’s future

The average life expectancy in Hong Kong continues to rise, retirees may need to fund decades of post-retirement living expenses. The longer the retirement, the more inflation erodes your savings. Additionally, the increase in medical expenses in recent years has been quite significant.

![]()

80% of the affluent class

opt for private hospitals

and spend an average of HKD34,000 annually on regular family healthcare

50% of the affluent class aspire to have

"medical financial freedom" before retirement

An average of

HKD1.1M is earmarked for healthcare expenses

1/4 affluent-class individuals anticipate that they will fall short of their ideal retirement

65% seek diversified investments to better secure their retirement funds in volatile markets

HSBC Premier, it’s more than banking. We are here to meet all your needs, offering comprehensive retirement solutions, from wealth management and investment products, to insurance and healthcare coverage. We also take into consideration your children’s global education plans and strive to elevate your enjoyment in life, giving you the confidence to plan for a secure retirement and embrace the lifestyle you have always envisioned.

Risk Disclaimer

Investment involves risk. This information is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. All products in any financial planning tool are generalized for simulation purpose without taking product suitability and affordability into account. You should carefully consider whether any investment product or service is appropriate for you in view of your personal circumstances. Past performance is no guide to future performance nor do we represent that any movements provided in the simulation tool are likely to occur in the future. There may not be any HSBC product that provide the same outcome as the simulation in the financial planning tool. Investors should refer to the individual product explanatory memorandum or offering document for further details and risks involved. The price of investment products may move up or down. Losses may be incurred as well as profits made as a result of buying and selling investment products. The information is subject to change without notice.